Subscribe

Sign up for timely perspectives delivered to your inbox.

Senior Portfolio Strategist Lara Reinhard explains why navigating an increasingly difficult fixed income environment may require a more selective approach.

Global interest rates remain extremely low and support from the Federal Reserve (Fed) appears likely to continue for the foreseeable future. Against this backdrop, we expect the search for yield will continue to make “diversifying” fixed income – securities such as corporate bonds and other higher-yielding (but higher-risk) credits – an attractive place in 2021. Still, even in this space, rates have fallen over the past year. As such, investors will need more tools besides the passive exposure strategies that have helped their portfolios since March 2020, when markets sold off and corporate bond rates spiked.

One direction to turn is outside the U.S. In our view, investors would be wise to consider globally diversifying their high-yield exposure for three key reasons:

Source: Bloomberg, as of 31 December 2020.[/caption]

Source: Bloomberg, as of 31 December 2020.[/caption]In the U.S., we’ve seen an impressive rally across broader high-yield and investment-grade bonds, so investors are now forced to be pickier with their security selection and look for opportunities outside of traditional corporate credit. While credit has largely recovered thanks to support from the Fed, there are areas of the market that were left behind and could provide opportunity for greater tightening in the coming months. The commercial mortgage-backed market securities market (CMBS) is one example where a lack of investment has left spreads much wider than the broader high-yield market.

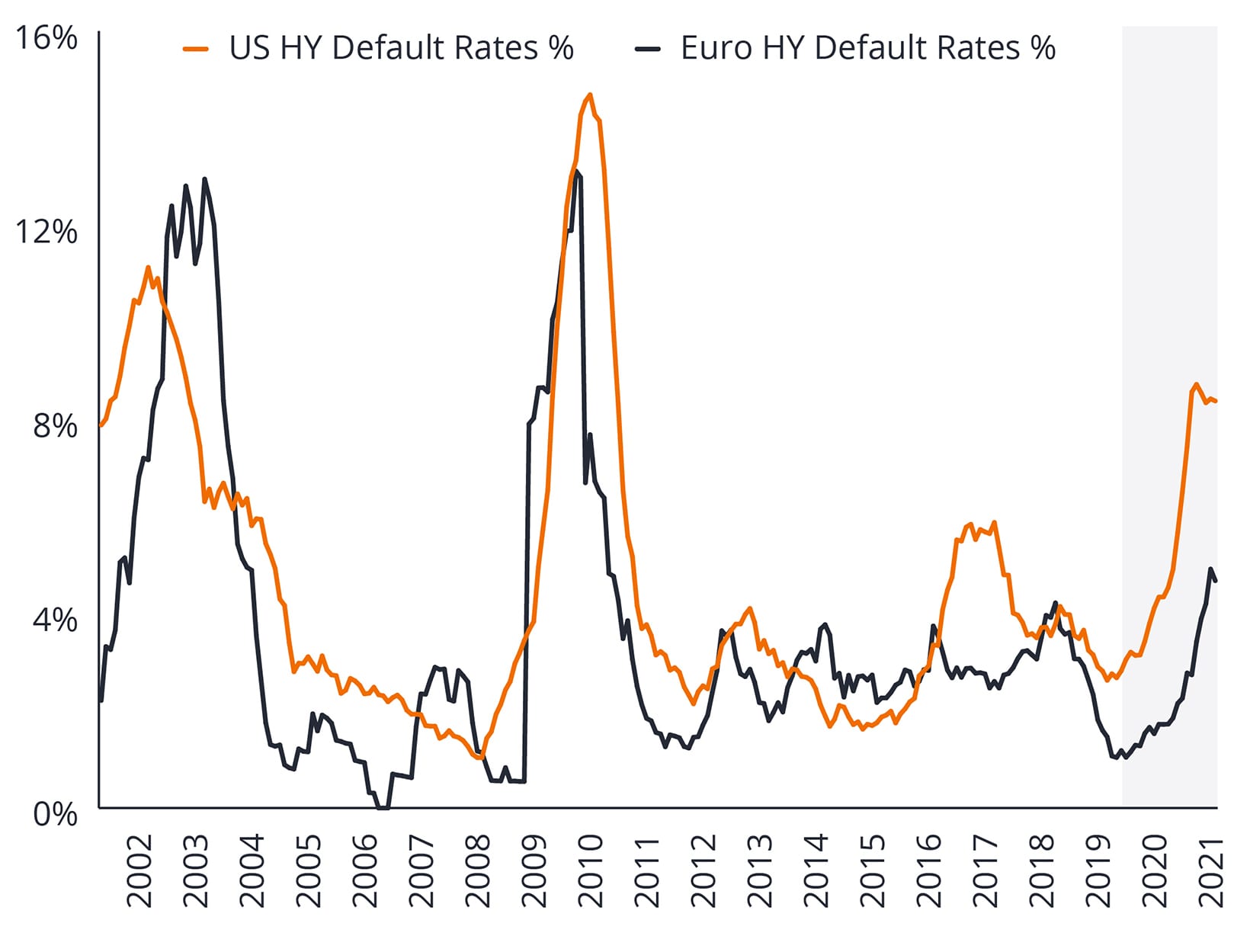

Navigating an increasingly difficult fixed income environment will continue to be a challenge for investors in the year ahead. The widening between corporate bond rates and Treasury yields that we witnessed in March 2020 created a scenario in which timing was paramount and security selection was secondary. Although these “spreads” have tightened, defaults could continue, and we believe it’s important to take an active approach and pass the baton from broad credit exposure to security selection-driven alpha (risk-adjusted performance).