Subscribe

Sign up for timely perspectives delivered to your inbox.

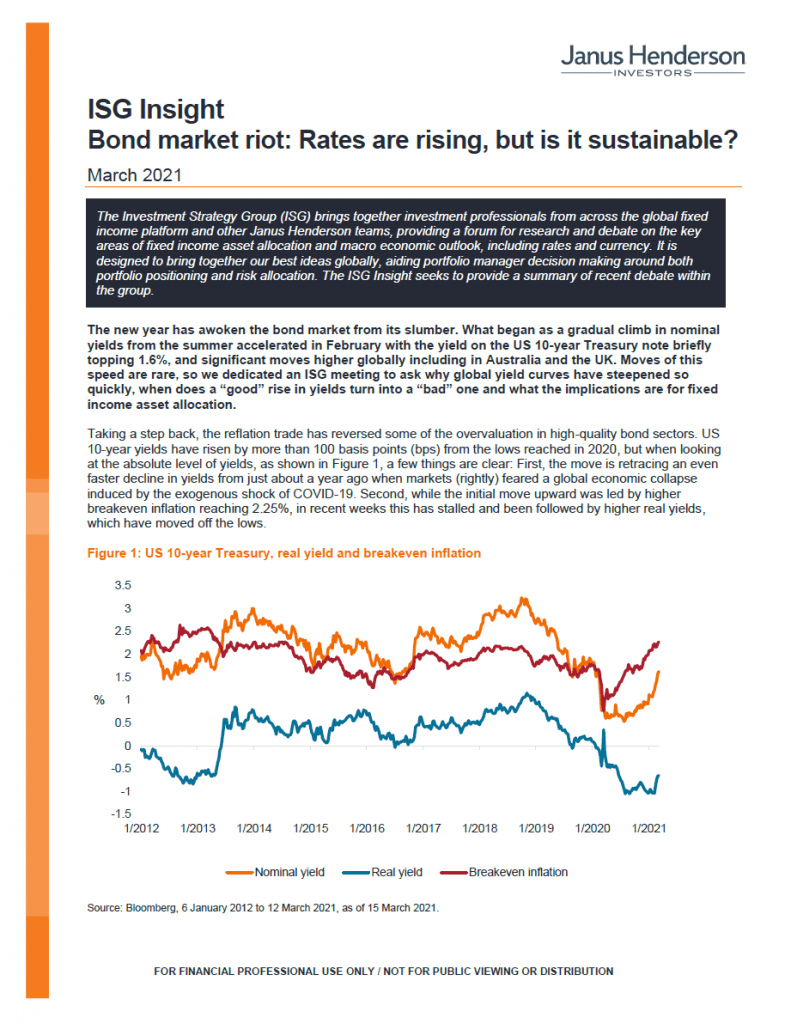

The new year has awoken the bond market from its slumber. What began as a gradual climb in nominal yields from the summer accelerated in February with the yield on the US 10-year Treasury note briefly topping 1.6%, and significant moves higher globally including in Australia and the UK. Moves of this speed are rare, so we dedicated an ISG meeting to ask why global yield curves have steepened so quickly, when does a “good” rise in yields turn into a “bad” one and what the implications are for fixed income asset allocation.

Download

The Janus Henderson Investment Strategy Group (ISG) brings together investment professionals from across the global fixed income platform and other Janus Henderson teams, providing a forum for research and debate on the key areas of fixed income asset allocation and macro-economic outlook, including rates and currency. It is designed to bring together our best ideas globally, aiding portfolio manager decision making around both portfolio positioning and risk allocation. The ISG Insight seeks to provide a summary of recent debate within the group.