Subscribe

Sign up for timely perspectives delivered to your inbox.

Senior Portfolio Strategist Devin Velnoskey discusses why investors may need to reexamine their equity allocations as the economy reopens and market returns broaden in 2021.

The S&P 500® Index once again outperformed its international counterpart, the MSCI EAFE Index, in 2020, marking the ninth year out of the past 11 in which U.S. equities have outperformed international peers. A handful of large-cap stocks, specifically tech, now dominate many indices and have driven a significant portion of recent equity gains.

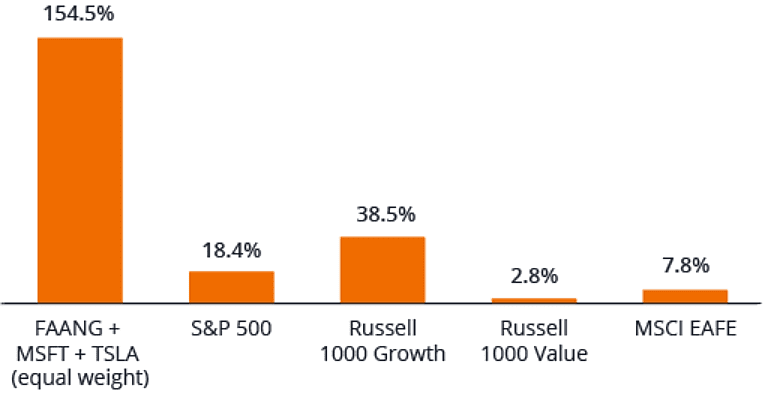

Narrow market leadership is not a new phenomenon, but we are now navigating a historical divergence between winners and losers. Giants like Facebook, Amazon, Apple, Netflix and Google (FAANG), Microsoft (MSFT) and Tesla (TSLA) represent almost 40% of the Russell 1000® Growth Index and 24% of the S&P 500.1 In 2020, returns from just this basket of stocks dwarfed the return generated by traditional equity investment options.

[caption id=”attachment_358701″ align=”alignnone” width=”783″] Source: Morningstar, as of 31 December 2020.[/caption]

Source: Morningstar, as of 31 December 2020.[/caption]

Meanwhile, the historic run of outperformance for growth relative to value over the past two decades has only widened, with large-cap growth stocks outperforming by over 100% cumulatively in the last five years. Even the slightest reversion to the mean could catch investors flat-footed based on the implicit overweight to growth in the S&P 500.

The current concentration among equity indices suppresses investors’ ability to assess their overall portfolio diversification. The situation also creates consternation when considering underweighting or not owning these major names, as such a decision can significantly impact performance.

The narrowness of market leadership has largely been based on the trend toward digitization, which has accelerated due to the pandemic. As the economy reopens, market returns should broaden, and market leadership should transition from COVID-crisis beneficiaries to real economy stocks. Furthermore, the health of consumer balance sheets, supported by a robust housing market and the swift market recovery from the lows of the first quarter of 2020, could unleash pent-up demand in hard-hit industries such as dining, entertainment and travel.

Given this outlook, investors need to be cognizant of the potential dangers of their implicit (or explicit) overweight to U.S. growth equities. Prudent forward-looking investors will need to reexamine their equity allocations by looking at other cap sizes and across global marketplaces for opportunities and differentiated cash flows.

As we transition from the old “growth versus value” paradigm into the post-disruption economy, investors may want to consider strategies that seek to add alpha through stock selection in misunderstood and underappreciated areas of the market.

To learn more about these strategies, read the Portfolio Construction and Strategy Team’s 2021 outlook: Recover Wisely: Be Global, Be Picky.

1Source: Morningstar, as of 31 December 2020.