March 2021

Portfolio protection – one size fits none

Suny Park, CFA, CPA

Suny Park, CFA, CPA

Head of Institutional Client Strategy, North America Alistair Sayer

Alistair Sayer

Client Portfolio Manager

Key takeaways

- Portfolio ‘Protection’ strategies are valuable, not just because they seek to protect existing plan assets during stress periods but also because they enable investors to avoid forced selling to meet ongoing spending needs, especially in sharp market falls.

- Despite its cost, a systematic put option strategy that provides ‘always on’, non-timed, long convexity exposure that captures substantial positive alpha in severe left-tail sell-offs could play an important role in Protection portfolios.

- Do plan sponsors choose explicit Protection that is expensive (but effective), or implicit Protection that is less expensive but less reliable? Why not consider Protection portfolios that combine options that address different types of crises?

The pandemic-induced sell-off in March 2020 renewed investors’ interest in ‘Protection’ strategies, despite plenty of research papers advising investors that the approach may be too expensive. We believe this argument to be wrong. The notion that portfolio diversification is the only ‘free lunch’ in investing is flawed: yes, it imparts benefits when markets are functioning normally but fails miserably at times of market stress.

Keep in mind the adage: ‘In times of stress correlations go to one’. We believe there is a strong argument for explicit Protection within a diversifying strategy, and at an overall plan level. Protection is valuable, not just because it protects existing plan assets during stress periods, but also because it enables plan sponsors to avoid forced selling to meet ongoing spending needs, especially when markets are in free fall.

Is Protection ‘too expensive’?

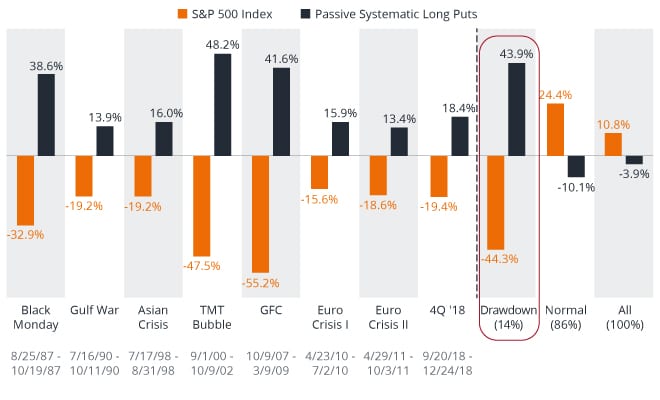

When investors remark that Protection is too expensive, what they often mean is that passive systematic buying of put options (ie. ‘explicit Protection’) to hedge against equity losses is too expensive. That statement is uncontroversial. Campbell Harvey et al. estimated the cost to performance of maintaining a passive at-the-money long put program at 3.9% per year (Exhibit 1). That is a meaningful drag on performance, especially when, during the same period, the S&P 500® Index returned an annualised 10.8%.

Source: Harvey, Campbell R., Edward Hoyler, Sandy Rattray, Matthew Sargaison, Dan Taylor and Otto Van Hemert. “The Best of Strategies for the Worst of Times: Can Portfolios be Crisis Proofed?” 17 May 2019.

Despite its cost, a systematic long put strategy has demonstrated a compelling track record in protecting against large equity losses during repeated crisis periods (highlighted in Exhibit 1). However, from an optics standpoint, it is extremely difficult for investment committees to always maintain exposure to a Protection strategy that may report negative returns in normal environments.

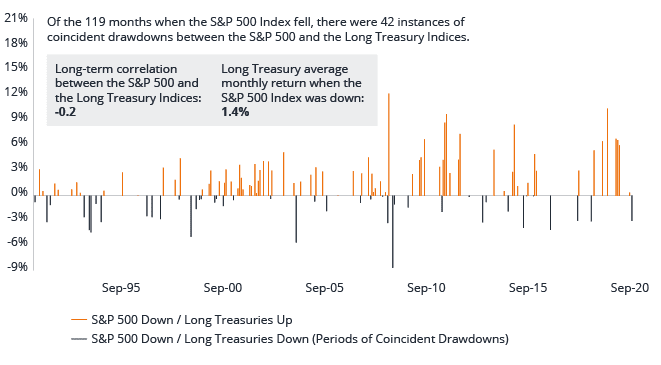

This has led many in the investment community to choose implicit Protection strategies over explicit Protection strategies, or assets perceived to be more cost-effective than systematic long put option strategies. These include Long Treasuries (see Exhibit 2), Gold and Trend-Following (or Time Series) Momentum strategies (to name a few).

View All Perspectives

Source: Bloomberg, Janus Henderson Investors, October 1990 to September 2020.

Note: The lines show the monthly return of the Bloomberg Barclays US Treasury Long Index when the S&P 500 Index had a negative monthly return.

As proxied by the Bloomberg Barclays US Treasury Long Index, Long Treasuries have generated an average monthly return of 1.4% in all months when the S&P 500 Index registered a negative return. But this statement comes with caveats. If equities fall due to unexpected inflation or rising interest rates, then long Treasuries may not provide the necessary protection. And given that the yield on 30-year US Treasuries was 1.65% at the end of 2020, there is limited room for yields to fall, especially if the US Federal Reserve maintains a zero lower-bound target on policy rates.

Alternative ‘Protection’ strategies

There are adjustments which can be made to both explicit and implicit Protection strategies to improve their carry cost while still enabling them to be effective hedges in times of markets stress. Looking at explicit Protection, the passive systematic buying of put options provides negative exposure to markets, but it also provides positive exposure to market volatility. Much of the cost associated with the carry of this type of Protection strategy is the negative exposure to rising markets. If this negative market exposure is neutralised, the remaining long volatility exposure has proven effective at delivering positive returns in times of market stress – as markets tend to trend up but gap down – but with a more attractive carry profile. There are additional modifications to further improve the “carry to payoff” ratio which were explored in a previous article: Portfolio Hedging with a Low-Cost, Long Volatility Strategy.

Looking at implicit Protection strategies, Trend-Following can arguably help to guard against persistent, trending sell-off environments. However, during periods of market rotation, when trends change, such a strategy can be negatively positioned. One adjustment for this is to use shorter-term trends. Trend-Following strategies typically use six-month, 12- month and three-year signals, which is ideal for picking up long-term trends. However, for a more effective Protection strategy, Trend-Followings signals derived from 1- month, 3- month and 12- month periods can be more effective at reacting to changing market dynamics.

Additionally, volatility targeting can also reduce exposure for a strategy around points of market rotation, when volatility tends to rise coincident with potentially negative periods of performance. Furthermore, it is possible to create a ‘one-sided’ Trend-Following strategy, which in normal markets has no exposure and therefore no cost, but when signals indicate market stress, acts to initiate long exposure to implicit Protection assets such as gold and Treasuries.

The importance of Protection for plans with ongoing spending needs

Most research papers advocating for implicit, as opposed to explicit, Protection make a simplifying assumption regarding spending needs of institutional investors. Put more bluntly, they assume no spending by hypothetical institutional investors. This one simplifying assumption can have grave consequences – especially for mature defined benefit (‘DB’) plans that make regular and relatively constant benefit payments throughout normal and crisis environments.

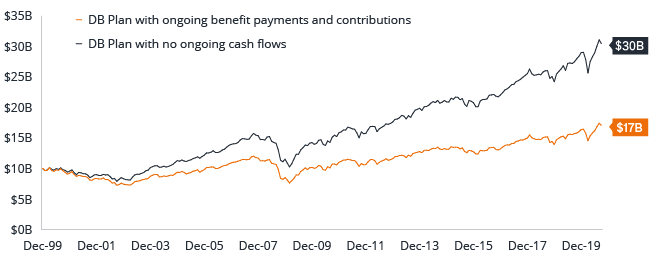

Consider a mature DB plan where the cost of annual benefit payments to retirees and contributions represent 8.0% and 5.0%, respectively, of the starting plan assets on 1 January 2000. This hypothetical Plan makes equal quarterly benefit payments to its retirees and receives contributions semi-annually. In Exhibit 3, one can appreciate the material impact that ongoing benefit payments can have on the terminal value of the Plan assets.

Source: Bloomberg, Janus Henderson Investors, as at 30 September 2020.

Note: Terminal value is calculated assuming at 60%/40% mix between the MSCI ACWI and Bloomberg Barclays US Aggregate Bond Index, annual benefit payments representing 8% of the 1 January 2000 plan assets, occurring at the end of each quarter (quarterly installments); and contributions of 5% occurring bi-annually. Plan assets are rebalanced quarterly.

At the end of September 2020, roughly 20 years from the beginning of the period, the (more realistic) Plan with ongoing net benefit payments lagged a Plan with no ongoing benefit payments by US$13.4bn in terminal value. Importantly, asset reconciliation shows that US$6.35bn of this difference is due to cumulative net distributions and US$7.03bn due to a sacrifice of returns associated with those distributions. This hypothetical DB Plan made cumulative net benefit payments of US$1.47bn following the burst of the TMT Bubble, during the 2008 Global Financial Crisis and during the COVID-19 crisis. Returns sacrificed as a result of the sale of plan assets when equities were down approximated US$3.17bn, as at 30 September 2020.

Retirees expect benefit payments whether the stock market is going up or going down; therefore, plan sponsors do not have the luxury of pausing benefit payments when markets are down. In a prolonged crisis many plans are forced to sell assets to meet their benefit obligations even when equities are down 20%, 30% or 40% from their peak. During such periods, benefit payments can far exceed contributions to defined benefit pension plans. As a result, many plan sponsors have historically sacrificed future returns on assets sold to meet benefit obligations to their retirees.

Protection is valuable, not just because it protects existing plan assets when financial markets are in a free fall, but also because it may provide necessary funds for benefit payments when plan sponsors can least afford to divest assets. It allows plan sponsors to remain invested in the market over the short term (when markets may be down) to capture any future positive long-term returns.

Overcoming the issue of optics

It is almost impossible, in our view, to anticipate a rapid liquidity-induced sell-off such as Black Monday in October 1987 or the most recent pandemic-related sell-off in March 2020. Despite the negative perception of cost, we believe that a systematic put option strategy that provides ‘always on’, non-timed, long convexity exposure has a prominent role to play in Protection portfolios. While systematic put option hedging strategies may provide this type of exposure, our research indicates there is room for a discretionary macro strategy that owns Protection when it is needed but minimises Protection when it is not. Such a strategy would buy, but not sell, convexity; hence, when volatility is identified to be cheap on a forward basis and in relation to the risk environment, it would opportunistically add long-volatility exposure.

From an optics standpoint, it may be difficult for investment committees to maintain exposure to a Protection strategy that reports negative returns in normal environments. For this reason, Protection strategies (especially explicit Protection) should not be viewed in isolation. Rather, they should be combined with other uncorrelated alpha-generating strategies such as complex risk premia or a long-short quality strategy so that, at the aggregate level, they offer the potential to generate positive returns during normal market environments while providing Protection during periods of market stress.

Each crisis is unique, and the effectiveness of various Protection strategies will vary from one crisis to the next. While trend-following CTAs and low-volatility equities were highly effective following the TMT Bubble and during the Global Financial Crisis, both performed poorly as Protection strategies in the most recent COVID-19 crisis. A Protection portfolio should arguably combine both explicit and implicit Protection strategies, or assets that offer characteristics that address different types of crises. When it comes to Protection, one size fits none.