Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Nick Maroutsos believes that capital preservation and attractive risk-adjusted returns are not mutually exclusive despite zero-interest rate policy across much of the developed world.

While the global economy appears to have absorbed the worst of the blows thrown by the COVID-19 pandemic, entire segments of the economy have likely been permanently upended. Despite last year’s rebound, some pockets of financial markets will likely continue to nurse wounds for quite some time.

Acutely affected is the bond market. This was by design as fixed income securities were the primary mechanism global central banks relied upon in executing their strategy of hyper-accommodative monetary policy. The result has been a distortion that has compromised the two central tenets of bond investing: capital preservation and a consistent income stream.

Perhaps nowhere is this more apparent than in shorter-dated bonds. Investors tend to approach an allocation to these securities with either savings in mind or as a source of liquidity, recognizing that it means compromising returns for capital preservation. Compromise, however, is different from sacrifice, which is largely what markets are commanding at present.

Many savings-focused investors opt for bank certificates of deposit (CD) as an alternative to T-bills. Yet, in the current era, this has proven to be no panacea. While rates are locked in for periods such as 12 months, in an era of declining – or already rock-bottom – Treasury yields, rates on CDs tend to eventually converge toward those on T-bills, forcing one to reinvest at the prevailing lower rate.

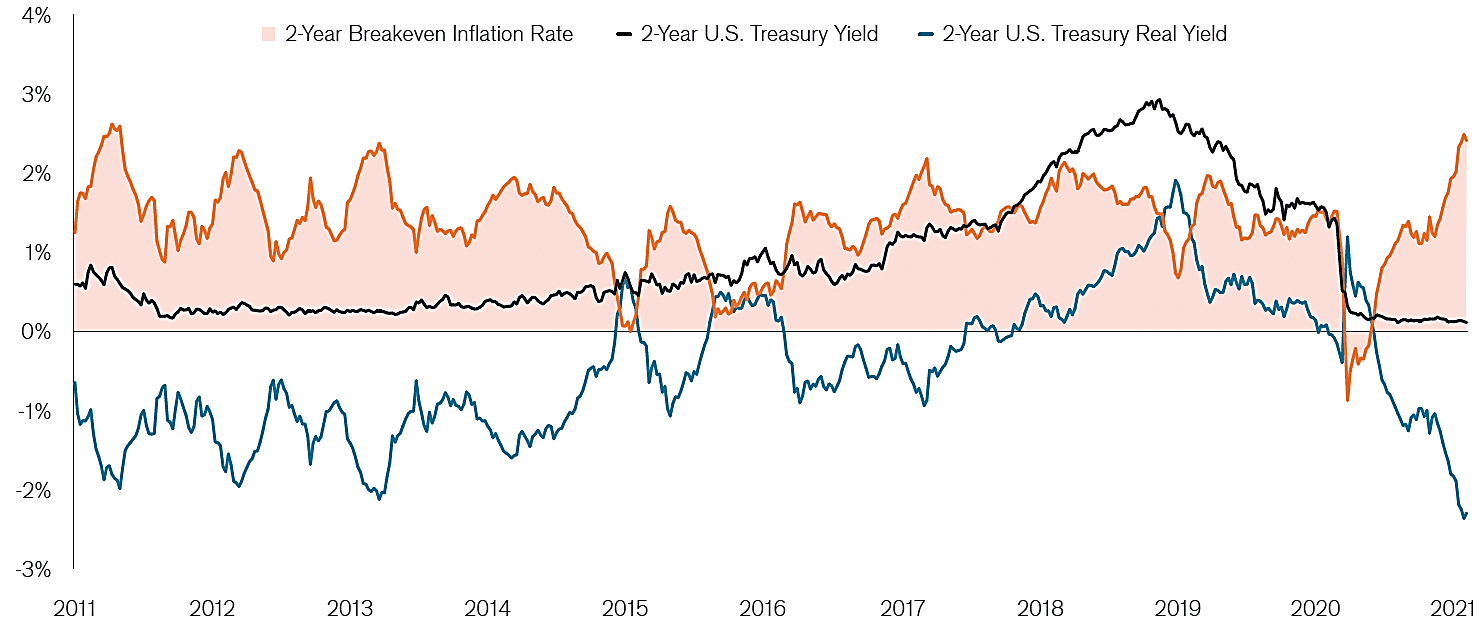

Shorter-dated instruments tend to have low credit risk. Consequently, investors need only to capture a yield higher than the rate of inflation to lock in a positive real yield. Here is where it becomes evident just how punishing the past decade has been to savers: With inflation averaging 1.61% annually (as measured by the Federal Reserve’s (Fed) preferred gauge, the core Personal Consumption Expenditure Price Index) real yields on shorter-dated Treasuries have been deep in negative territory for much of the post-Global Financial Crisis era.

[caption id=”attachment_357818″ align=”alignnone” width=”1479″] Source: Bloomberg, as of 31 December 2020.[/caption]

Source: Bloomberg, as of 31 December 2020.[/caption]

If investors are hoping for a return to positive real yields on shorter-dated Treasuries, they are likely in for a long wait.

Fed officials have stated they have no plans to raise their overnight policy rate – the one that guides short-term interest rates – at least well into 2023, and we doubt economic developments will provide any impetus to change course. The outlook for the global economy is far from certain, and once society eventually does exit from this crisis, we may find “normal” looks considerably different. Travel, tourism and retail – all major sources of employment – will continue to face headwinds for the foreseeable future.

When looking at miniscule-to-negative short-term rates in the U.S., Europe and Japan, all may seem lost to investors in these jurisdictions who believe liquidity and capital preservation are prudent at this time. That, however, is not the case.

To be sure, yields are low across the world. Yet many high-quality fixed income securities are available that still offer attractive yields without having to take on unwelcome levels of interest rate or credit risk. Identifying these involves expanding one’s investment universe to include developed countries with higher growth trajectories and commensurately higher policy rates.

We don’t believe the guiding hand of central banks should be the deciding factor in portfolio allocation. By geographically expanding one’s universe of high-quality, short duration securities, bond investors can favor capital preservation without sacrificing positive real returns. While the solution may not be as basic as purchasing a CD from the local bank, the inclusion of global issuance can help a portfolio replicate the traditional fixed income characteristics of capital preservation and income generation.

For a more in-depth look at this topic, read the full version, Short-Duration Fixed Income: Save Should Not Mean Sacrifice.