Subscribe

Sign up for timely perspectives delivered to your inbox.

The COVID-19 pandemic has helped accelerate the shift from fossil fuels to renewable energy – but that doesn’t mean oil and gas are done for good. Noah Barrett, Lead Equity Analyst on the Energy & Utilities Sector Research Team, explains why the industry could be on the cusp of one more upcycle.

As the transition from fossil fuels to renewable energy gains momentum, the investment case for oil and natural gas is being called into question. Last year, the economic slowdown weighed on energy demand globally. But consumption of renewables increased (albeit modestly) while demand for oil and gas declined by more than 8% and 3%, respectively, according to estimates by the International Energy Agency (IEA). In addition, capital investment in oil and gas declined by one-third from the year prior – the largest drop since 2004 – while government policy and investor interest helped speed the adoption of renewables, particularly in the electric grid.

But as the IEA has noted, although the global pandemic and shifting sentiment are prompting change, the energy transition is unlikely to follow a straightforward path. The prevalence and practicality of oil and gas will make it difficult to phase out conventional energy resources quickly. In fact, demand is expected to tick upward in the near term. Consider:

Markets have already started to price in a demand recovery. As of Feb. 26, Brent crude, a measure of non-U.S. oil prices, traded at $66 per barrel, up from a low of $20 last year. WTI, a benchmark for U.S.-sourced oil, traded at $61 per barrel – a sharp contrast to when the benchmark plunged into negative territory in April 2020.5 Energy stocks have also rebounded, with the S&P 500 Energy Sector returning 26% year to date, compared with a gain of 1.5% for the S&P 500® Index.6

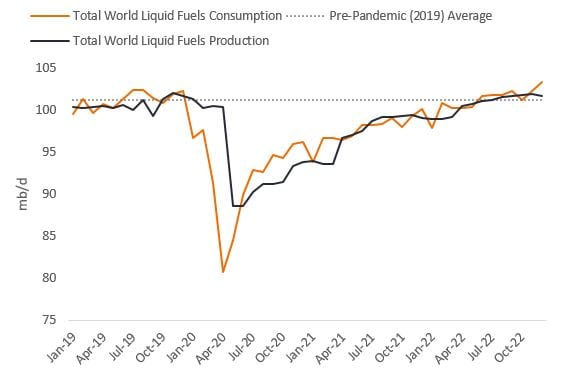

Source: U.S. Energy Information Administration. Forecast is as of 24 February 2021. Data are monthly from January 2019 through December 2022.[/caption]

Source: U.S. Energy Information Administration. Forecast is as of 24 February 2021. Data are monthly from January 2019 through December 2022.[/caption]As demand recovers, supply could be slower to return – even in the freewheeling U.S. shale market, where capital discipline has often been lacking. Punished by the pandemic, U.S. exploration and production (E&P) companies are now expected to reduce reinvestment from 100% (or more) of operating cash flow to 70%-80%, with the remainder used to deleverage balance sheets and return capital to shareholders via dividends and share repurchases. In turn, operators that previously had planned on long-term production growth rates in the mid- to high-teens are now guiding to rates of just 5%-10%.

OPEC+ has helped to keep global supplies in check, cutting output by roughly 7 mb/d by the end of 2020. Mindful of last year’s volatility in oil prices – brought on, in part, by a price war between Russia and Saudi Arabia – we believe the cartel will be reluctant to open the taps too quickly, too soon. Even with a significant amount of spare capacity, we think OPEC+ members will only bring supply back into the market if they see a supportive demand environment. Finally, non-U.S./non-OPEC+ supply is expected to be structurally lower moving forward as production from these countries tends to be more capital intensive with long lead times. With a lack of investment and exploration in recent years, we see little opportunity for significant growth.

In our view, this new environment – one of structurally low production combined with a rebound in demand – could be the start of a new upcycle for the oil and gas industry, all while equity valuations in the sector trade well below historic averages.

Still, in light of the long-term headwinds confronting oil and gas, we think investors need to sharpen their approach to the sector. As renewables increasingly take market share, oil and gas could be even more susceptible to changes in supply/demand, increasing volatility. As such, we believe the market will prioritize firms that prove to be prudent stewards of capital, consistently generating free cash flow and returning capital to shareholders rather than prioritizing production growth. Companies that can adapt existing assets to take advantage of growth in renewable energies could also be attractive.

To that end, we think investors should focus on the following three areas where these attributes have become increasingly evident:

U.S. E&P: We believe last year’s market volatility humbled the industry and could finally drive companies to deliver on promises of capital discipline. Many firms are now targeting structurally lower reinvestment rates, with excess cash flow going to the balance sheet or back to shareholders. As a result, U.S. supply is less likely to increase even if we see higher oil prices, which should help maintain tight global supply/demand balances. Firms best positioned may be those that find cost synergies through mergers and acquisitions or that can remain profitable even if oil prices stay rangebound (WTI at $40-$60 per barrel).

Refiners: Roughly a decade ago, refiners began running assets for cash and returning that cash to shareholders. As the oil market recovers – and with operations already running lean – we think the industry could deliver average free-cash-flow yields in excess of 10% in the coming years. Moderate investments in renewable fuels could also provide refiners with an opportunity to participate in the energy transition, alleviating some concerns around the terminal value of their assets.

Midstream Operators: Midstream operators, whose activities include the storage, processing, and transportation of petroleum products, benefit from fixed-fee contracts. These companies could also see the value of their assets (e.g., pipelines) increase as appetite for crude, petrochemicals and refined products improves and regulatory and cost constraints limit the expansion of oil and gas infrastructure. Although growth in midstream infrastructure may not be needed for several years, many operators generate a significant amount of free cash flow and offer an attractive value proposition in terms of total shareholder return. Similar to refiners, some midstream companies may find ways to repurpose their assets for alternative energy sources, such as hydrogen.

1U.S. Energy Information Administration, as of 23 February 2021.