Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio managers Tim Gibson and Xin Yan Low review what has been a tumultuous year for listed property and discuss the risks and opportunities in the year ahead.

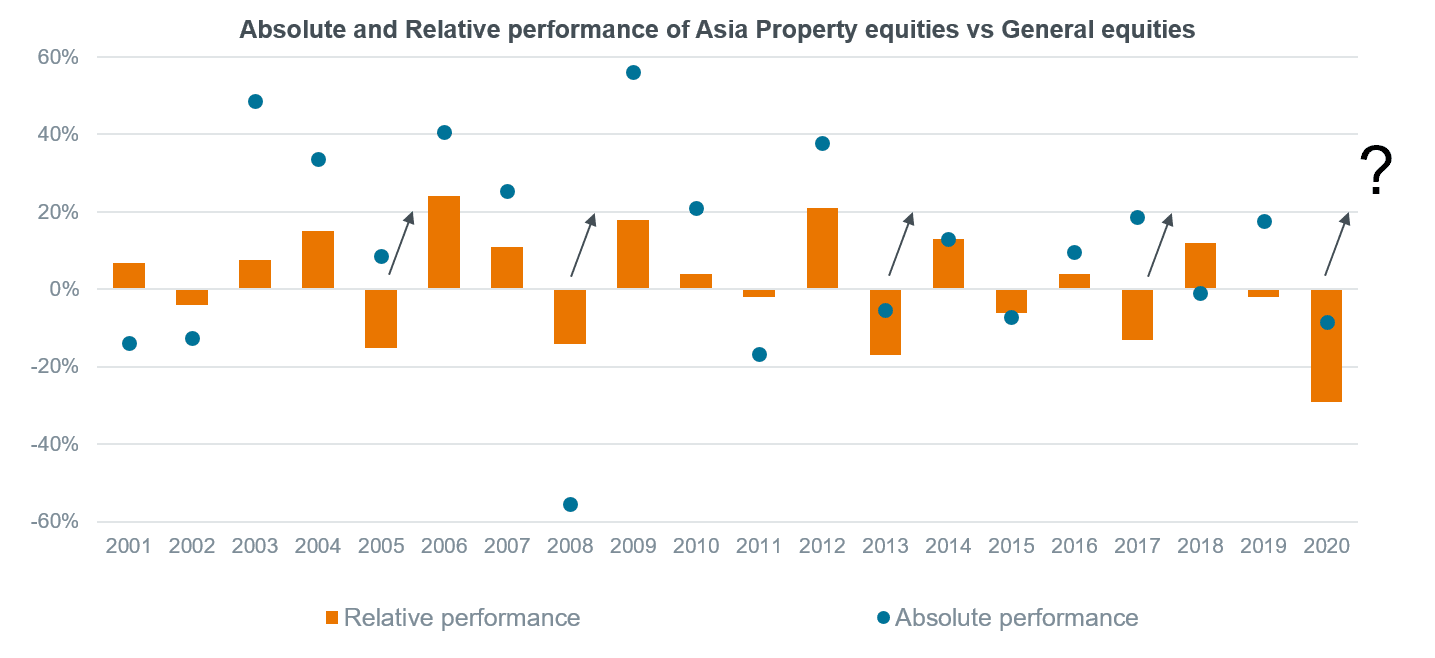

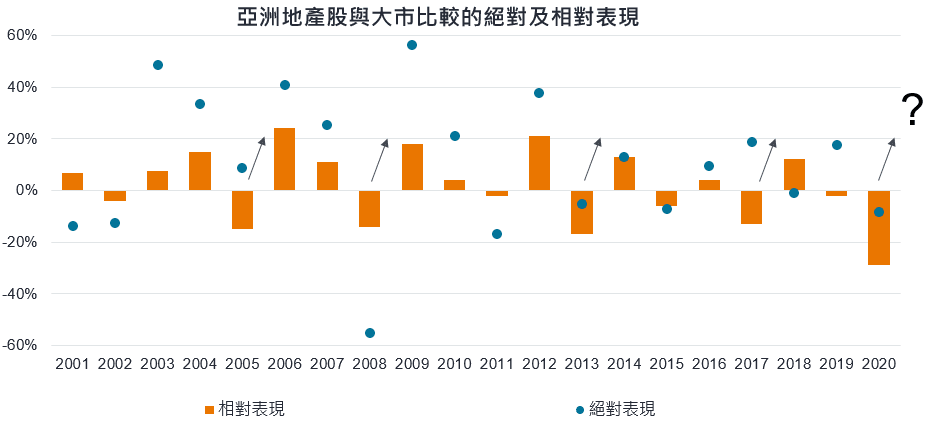

Asian listed real estate was hit harder than most as COVID-19 and investor misperceptions cast a pall over the asset class in 2020. In USD terms, the sector ended the year down 8.9% to clock its worst relative performance (-29%) against general equities (MSCI Asia Pacific Net Total Return Index) in two decades1.

Scratch beyond the surface, however, and more astute investors will likely find resilient cash flows and high quality income streams stemming from long-term contractual leases for many properties. As a result, global real estate stocks currently look undervalued versus other major asset classes such as general equities and bonds.

In Asia, real estate has demonstrated a resiliency that has been a hallmark of the asset class. There have been multiple instances since 2000 when the sector underperformed the general equities market. While past performance should not be used to infer future performance, historical data shows the sector has typically rebounded and outperformed the subsequent year. The chart below not only indicates recovery, but highlights pronounced rebounds following particularly challenging periods. Given the significant underperformance in 2020, could we see a sharp sector recovery in 2021? In all, Asia Pacific property equities has delivered a respectable total return of 7% per annum in USD terms over the past two decades1.

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2020.

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2020.

Note: FTSE EPRA Nareit Developed Asia Dividend Total Return Index (Asia property equities). Relative performance against MSCI Asia Pacific Total Return Index (general equities). Past performance is not a guide to future performance.

Our 2021 outlook for Asia Pacific property equities is favourable for several reasons. With the recent availability and eventual widespread distribution of several COVID vaccines, life could begin returning to normal this year. Investor perceptions of listed real estate could improve, particularly as investors begin to recognise that cash flows via rent collection has remained steady for many sectors. This would likely provide support for valuations of property equities to normalise.

We believe longer-term trends in demographics, technology disruption and rising debt are likely to keep interest rates low. With only around 28% of global debt offering yields of more than 1%2, Asia Pacific property presents an attractive option for investors looking for reliable, higher yielding income streams.

Another point worth highlighting is the balance between the strong rebound in economic growth and the rise in US treasury yields. Recent excitement about a steepening yield curve reflects a pick-up in inflation expectations. This currently appears to be caused by rising input costs due to supply chain disruptions and increasing commodity prices. These conditions are likely to lead to a spike in core inflation, however it is more cyclical than structural in nature.

It is also noteworthy that the US 10-year Treasury yield (at the time of writing), remains around 70bps3 lower than it was a year ago even after the recent increase, making the relative spread in performance, as mentioned at the beginning of the article, of the wider equity markets versus the real estate sector seem somewhat outsized. Indeed, Asian property is currently offering a 12-month forward estimated net dividend yield of 3.9%4 and we aim to deliver a higher yield than the index.

Another consideration when navigating the investment landscape in 2021 is the impact on capital markets should the US Federal Reserve decide to tighten their quantitative easing programme. Clearly, much will depend on when, and to what extent the reduction in the central bank’s bond buying will be. However, markets have historically not responded favourably when this has happened. Having said that, the ongoing fiscal stimulus in the US shows no signs of abating soon, especially in light of new US leadership led by Democrat, Joe Biden. Perhaps this will act as the balm to calm markets.

We expect secular trends driven by digitisation, demographic changes and lifestyle conveniences to continue to support the growth segments of Asia Pacific properties such as logistics and data centers despite them having outperformed for several years. On the other hand, some traditional real estate sectors like retail and office have been hurt by changing lifestyles and habits and will likely find their rental pricing power diminished amidst increased competition for tenants.

However, as we set out on the gradual path to normalcy, we think there are opportunities in areas that can be classified as “cheap but not broken”. Select high-quality companies in sectors such as office, hotel as well as certain retail areas have suffered from depressed valuations and could begin to see fundamentals recover in 2021. As active investors, we continue to position the portfolio to take advantage of these opportunities.

Footnotes

1 Source: Janus Henderson Investors, Bloomberg, January 2021, FTSE EPRA Nareit Developed Asia Dividend Total Return Index, annualised return from 2001 to 2020.

2 Source: BofA Global Research, 17 December 2020.

3 Source: Janus Henderson Investors, Bloomberg, January 2021

4 Source: Janus Henderson Investors, Bloomberg, January 2021