Subscribe

Sign up for timely perspectives delivered to your inbox.

Paul O’Connor, Head of the UK-based Multi‑Asset Team, responds to President Biden’s planned $1.9 trillion fiscal stimulus, considering the implications for the U.S. economy, monetary policy and the markets.

In his speech to the Economic Club of New York on February 10, U.S. Federal Reserve (Fed) Chair Jerome Powell reiterated his recent message that the U.S. central bank was in no rush to rethink either its stance on interest rates or its asset purchase program. Powell basically restated the broad guidance that was introduced in the Fed’s new monetary policy framework last year. This strategy shifted the Fed’s policy priorities to putting more emphasis on getting the U.S. economy back to full employment and less on tightening monetary policy to pre-empt rising inflation. This is a patient and dovish Fed that does not plan to raise rates until full employment has been reached and which does not expect to reduce asset purchases until “substantial further progress” has been made toward this goal.

Of course, a lot has changed since the Fed introduced its new policy framework last summer. While back then, there was no clear path out of the pandemic and confidence in the global economy was low, consensus opinion on both fronts has significantly improved in recent months. The rapid development and rollout of vaccines has reinforced confidence in the V-shaped U.S. recovery that is expected to surge through this year and into 2022. While a key question in financial markets last year was whether central banks could do enough to support the recovery, some are now beginning to wonder whether the Fed is doing too much, given the anticipated mid-year reopening and the scale of the fiscal stimulus now coming through from the new U.S. administration.

The Biden government has moved boldly on the fiscal front, following up the previous administration’s $900 billion December stimulus package with an additional $1.9 trillion proposal that is now working its way through the legislative approval process. Scaled relative to gross domestic product (GDP), these packages are worth over 4% and around 9%, respectively. While most commentators expect the current proposal to be scaled back a bit in the weeks ahead, it is nevertheless still expected to remain a massive fiscal injection. Beyond this lies an even bigger economic recovery plan that should emerge in the months ahead, focused on infrastructure, affordable housing and the environment. That is expected to be a $2 trillion to $3 trillion package, spread over four or five years.

Economists are still scrambling to calculate the impact of these fiscal innovations from the new government. Unsurprisingly, consensus U.S. GDP and inflation forecasts are rising and expectations for the size of the 2021/2022 boom keep climbing higher. Some commentators have expressed concern that the scale of the unfolding stimulus is excessive, since U.S. households have already accumulated sizable savings and are generally expected to start spending once the service sector reopens in the months ahead. The impact of the fiscal splurge on the size of U.S. government debt is a longer-term worry here, given that the stock of debt looks set to grow from a pre-pandemic 80% of GDP to well over 100% of GDP this year. While funding this is not difficult when interest rates are low and stable, the fiscal arithmetic could become more challenging later on if inflation gets sustainably back on target and interest rates and bond yields move meaningfully higher.

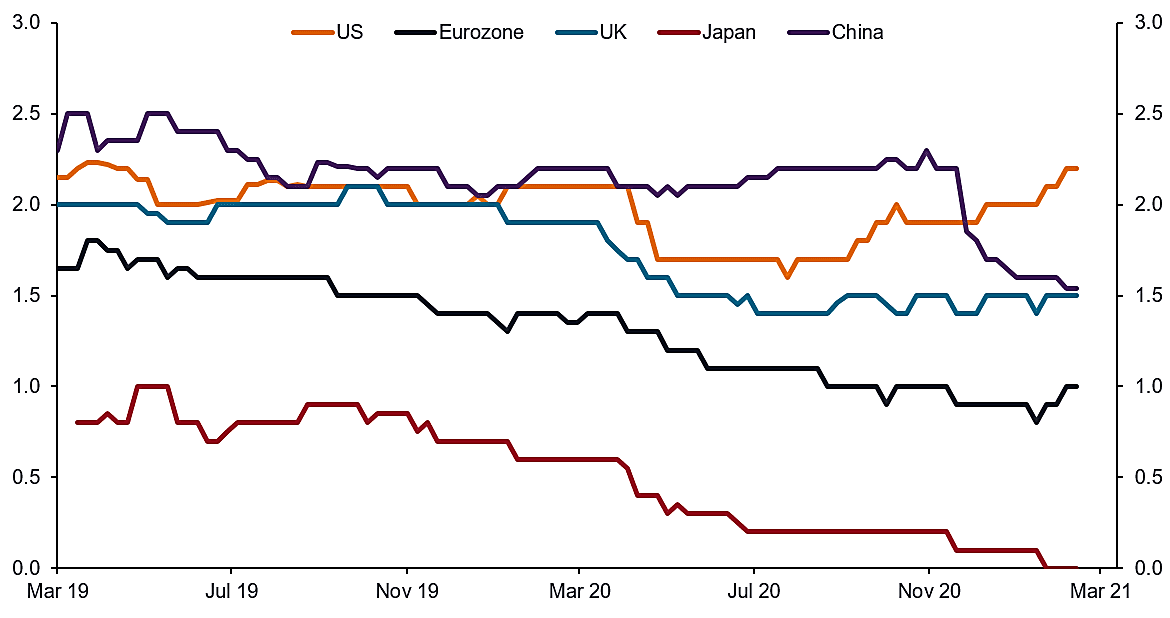

For now, with the mutating coronavirus still a formidable adversary, U.S. inflation well below target and U.S. employment some 10 million jobs below pre-pandemic levels, the risk of fiscal policy overheating the U.S. economy does not seem the most urgent concern. While consensus projections for U.S. inflation have crept higher in recent months, even the most optimistic forecasters do not see the Fed sustainably reaching its objective here until around 2023. Furthermore, neither fiscal dynamics nor broader growth momentum are as positive in other major economies as they are in the U.S. Consensus forecasts for 2021 Consumer Price Index inflation in China, the eurozone and Japan are 1.5%, 1% and 0%, respectively, and trending lower (see Exhibit 1). Data released last week showed China’s latest CPI print at -0.3%, close to a 10-year low.

[caption id=”attachment_354830″ align=”alignnone” width=”1170″] Source: Janus Henderson Investors, Bloomberg, as of 10 February 2021.[/caption]

Source: Janus Henderson Investors, Bloomberg, as of 10 February 2021.[/caption]

So, despite the unprecedented combination of supercharged U.S. fiscal policy and a highly accommodative Fed, the balance of evidence still suggests that it is too early to worry about the risk of the U.S. economy overheating. The enormous U.S. fiscal stimulus will supercharge the recovery this year and next but still seems unlikely to create the sort of inflationary pressures that will force a patient Fed to meaningfully rethink its plans. That seems to be the message the central bank sent last week.

This prospect of a rapid recovery in U.S. growth combined with a more gradual increase in inflation is clearly a very positive backdrop for financial markets. However, given that this optimistic economic scenario is now the consensus view among market participants, it is important to be alert to any threats to this rosy outlook.

One general concern worth flagging here is the unusually high level of uncertainty surrounding economic forecasts, given the unprecedented impact of the pandemic and economists’ limited experience in calibrating the impact of coordinated monetary and fiscal policy interventions of the current scale. While consensus forecasts have typically over-predicted inflation since the Global Financial Crisis, the new fiscal policy regime could well be a game-changer here. The possibility of a surprisingly rapid recovery in U.S. wages and inflation is now a risk scenario worth monitoring closely in the U.S. and one that will be increasingly relevant as fiscal stimulus increases.

The big story in financial markets in recent months has been a fairly simple one of embracing the optimism associated with the vaccines, the reopening economic boom and the supportive policy backdrop. From here, things could get more complicated. If U.S. inflation follows the slow climb higher that most expect, then monetary policy can be normalized at the gradual rate that is priced into financial markets. However, a surprising rebound in inflation would threaten a more abrupt asset repricing, with ominous implications for fixed income markets and inevitable collateral damage to other assets. For now, this is a tail-risk scenario for us, not our central case.

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of consumer prices.