Subscribe

Sign up for timely perspectives delivered to your inbox.

While investors will always be looking for ways to time the markets, there are no shortcuts to investing success. Retirement Director Ben Rizzuto considers the lessons to be learned from the recent GameStop trading activity and outlines three steps to building a strategic long-term investing plan.

Many investors of a certain age will recognize the symbols in the image above as “cheat codes” from the video game Contra. For those who aren’t familiar with the classic Nintendo game – which made its debut back in 1987 – these codes would give you extra lives and ammunition, allow you to skip over levels (i.e., Level Up) and, ultimately, play longer. Because of course the longer you played, the higher your score, and the more likely you were to win.

I started reminiscing about playing Contra as a kid when the trading activity around GameStop (GME) stock began dominating headlines recently. For one, GameStop is a retailer where one might actually be able to find a copy of Contra these days. But as a retirement planning specialist, it immediately occurred to me that the clear lesson of the GME saga is that there are no cheat codes in investing. And then I was inspired to write a piece that introduces new investors to what I believe are the core principles of a strategic long-term investing plan.

The steps that follow aren’t quick and easy. They take time, discipline and consistency. But as you’ll see, there are a number of opportunities to “Level Up” your investing strategy so you can stay in the game for the long run.

The first, most basic step to implement is creating a budget to help keep track of your income, your expenses and how much you have left over to invest. We’ve created a simple worksheet if you need help getting started.

Now that you’re ready to enter the realm of the financial markets, where should you invest your money?

Trusted family members and friends who have experience with investing can be helpful resources. Or you might consider working with a financial professional who can provide expert guidance.

Alternatively, you could do your own research, but remember that there is as much misinformation out there as there is sound advice, so it can be challenging to piece everything together into a coherent picture. Also be sure to consider the source of the information. Someone who calls him/herself TechnoKitty, YOLO_Boy or NiNJaInVeSToR may be an intelligent investor, but do they have your best interests in mind?

Regardless of what resources you choose to consult, the important thing is to take the time to develop a solid understanding of core investing concepts like risk, asset allocation, stocks, bonds and mutual funds. Once you have those basic concepts down, generally speaking, you will likely want to invest in a diversified portfolio of assets that match your risk tolerance and time horizon.

But what is in this portfolio, exactly? It could have one stock in it – but in that case, it wouldn’t be considered “diversified.” Diversification is a strategy that is intended to limit an investor’s exposure to any one type of asset. If diversification is your goal, you may want to consider investing in diversified baskets of stocks like mutual funds or exchange-traded funds (ETFs). The key thing to remember is that your portfolio should fit with your risk tolerance and time horizon.

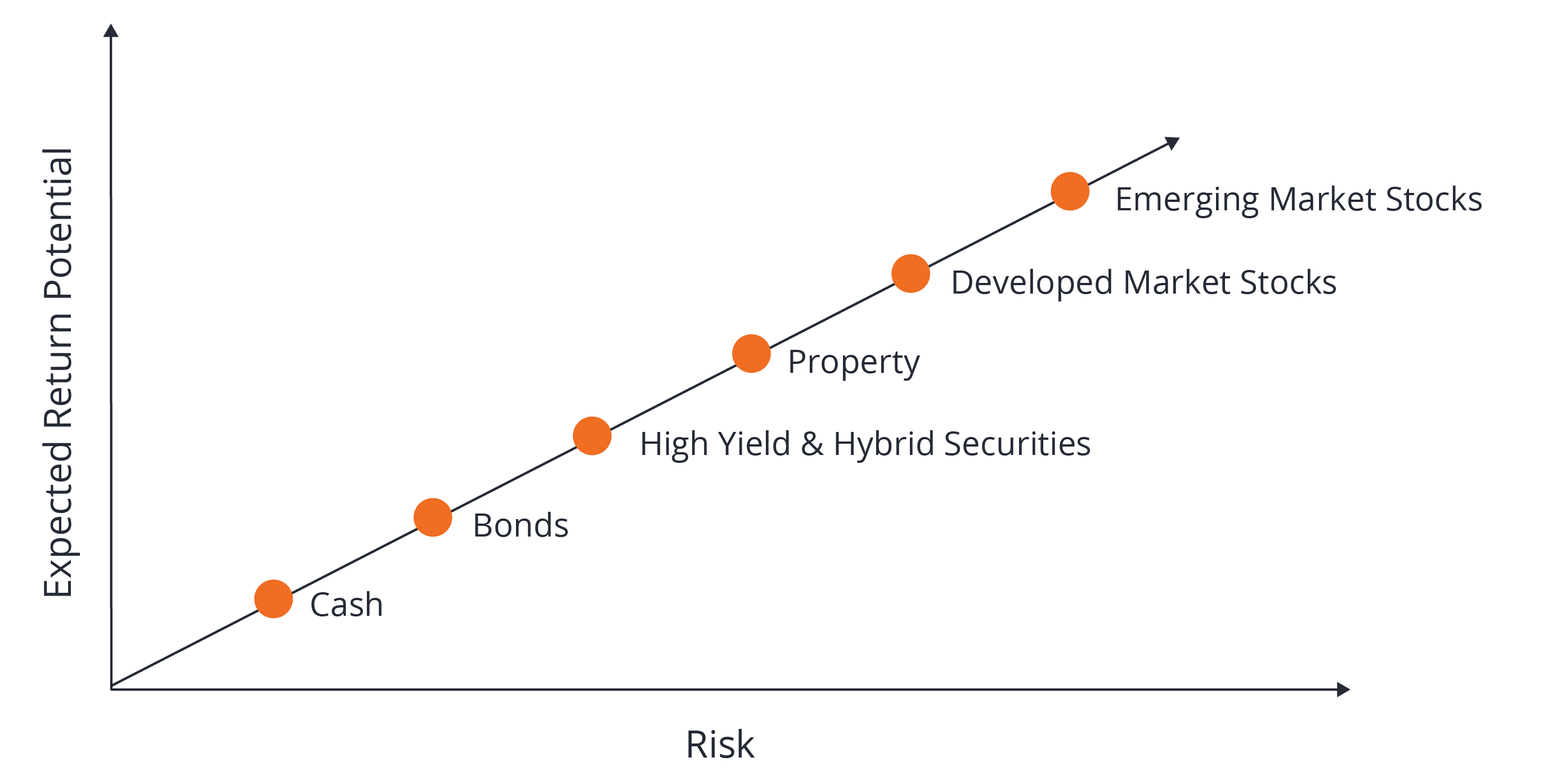

Risk tolerance refers to how quickly you will start feeling sick to your stomach (or, more importantly, face serious financial consequences) should your investment lose value. Time horizon refers to the length of time until you will need to access the assets you’re investing. Again, in general terms – because every investor’s situation is different – the shorter your time horizon and the lower your risk tolerance, the more conservative your investments may need to be. The opposite is true for those with longer time horizons and a higher tolerance for risk.

The chart below illustrates, very generally, the potential level of risk and return associated with various asset classes.

[caption id=”attachment_354056″ align=”alignnone” width=”2751″] For illustrative purposes only.[/caption]

For illustrative purposes only.[/caption]

After you’ve created your portfolio and had some time in the market, it’s important to periodically assess your asset allocation and investments to ensure that they remain in line with your risk tolerance and time horizon. Events like a new job, marriage or purchasing a home are all events that may require you to rethink how you’re invested.

Even if you don’t experience one of these life events, it’s still a good idea to rebalance your portfolio on a periodic basis. Rebalancing is the process of realigning the weightings in your portfolio by buying and selling positions to maintain your desired asset allocation. This process can help ensure you don’t become overly exposed to undesirable risks.

So there you have it. A road map to disciplined, informed investing.

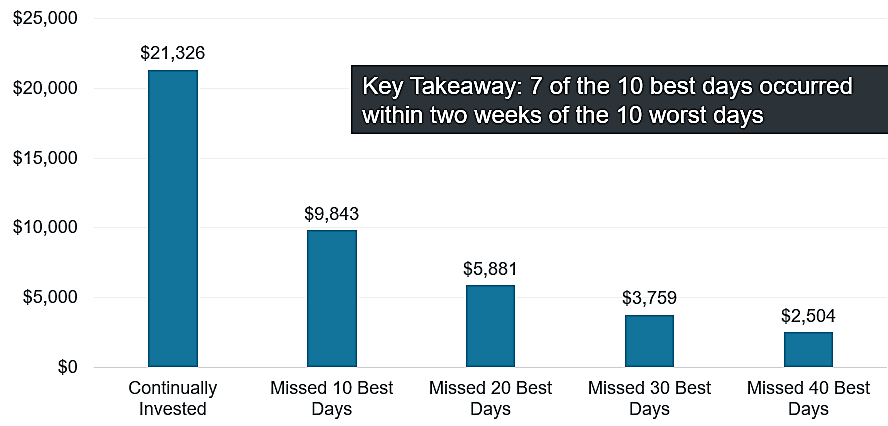

You may be asking: “When do I implement a ‘short squeeze’? … When do we start using options? … Where’s all the whiz-bang investing secrets?” The answer is that none of those things are part of a time-tested, long-term investing strategy. And history has shown that trying to time the market rarely pays off. As the chart below illustrates, staying continually invested has historically resulted in a better outcome than trying to anticipate market corrections.

[caption id=”attachment_354089″ align=”alignnone” width=”888″] Source: FactSet Research Systems, Inc. from 1/1/88 – 3/31/20. U.S. equity market represented by the S&P 500® Index. The example provided is hypothetical and used for illustration purposes only. It does not represent the returns of any particular investment. The hypothetical example does not represent the returns of any particular investment and includes the reinvestment of dividends. Fees and expenses that apply to continue investments are excluded.[/caption]

Source: FactSet Research Systems, Inc. from 1/1/88 – 3/31/20. U.S. equity market represented by the S&P 500® Index. The example provided is hypothetical and used for illustration purposes only. It does not represent the returns of any particular investment. The hypothetical example does not represent the returns of any particular investment and includes the reinvestment of dividends. Fees and expenses that apply to continue investments are excluded.[/caption]

These techniques may seem boring. They don’t offer the thrill of uncovering a hidden gem in the stock market – or a secret passage in a video game. But remember, in your real-life financial quest, boring may just be the best route to follow to help you win.