Subscribe

Sign up for timely perspectives delivered to your inbox.

Emerging Market Equities Portfolio Manager Daniel Graña, Emerging Market Equities Analyst Matt Doody and Emerging Market Credit Portfolio Manager Jennifer James consider the massive investment implications of China’s decarbonization plan.

At the 2020 United Nations General Assembly, Chinese President Xi Jinping caught the world’s attention when he stated that his country would target peak carbon emissions in 2030 and seek to achieve carbon neutrality by 2060. Considering that China, home to the second-largest economy in the world, is the world’s largest carbon emitter and President Xi’s targets are more ambitious than those of other industrialized countries, this initiative has the potential to reframe the global debate on what’s possible when addressing climate change.

In China’s rapid ascent to becoming the world’s second-largest economy, it also achieved the more dubious distinction as the largest carbon emitter. The conventional assumption is that China placed economic objectives over environmental stewardship as it sought to increase national wealth. To an extent, that may have been true in the past. China burns more coal than any other nation and was responsible for more than a quarter of world greenhouse gas emissions in 20191. But that image is changing.

Chinese authorities have chosen now to double down on its decarbonization commitment because the political and economic calculus is clear and compelling. From the perspective of the CCP, whose hallmark is continuity and stability, it is in China’s best interest to decarbonize as environmental, social, economic and geopolitical factors are all aligned. From an environmental and social perspective, cleaner air equals a healthier, happier and likely more productive population.

From an economic perspective, a shift away from fossil fuels to a less carbon-intensive economy offers considerable rewards. Renewables can help remove the reliance on imported fuel, while the growth of a home-grown renewables industry also means employment opportunities. New opportunities in forward-looking renewables stand to offset lost mining jobs – and in a cleaner, safer and more productive working environment. Advancements in wind and solar manufacturing also present China with the opportunity to become the dominant player in a high-growth, value-added global industry.

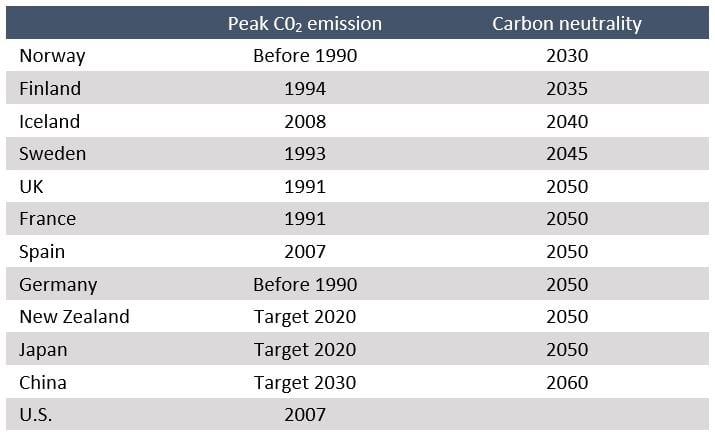

We have seen that there is political enthusiasm, indeed imperative, to decarbonize, but the targets are challenging. The table below highlights peak emissions and carbon neutrality dates: China intends to achieve in 30 years what many developed countries are taking twice as long to do.

[caption id=”attachment_352446″ align=”alignnone” width=”550″] Source: International Energy Agency, World Resources Institute[/caption]

Source: International Energy Agency, World Resources Institute[/caption]

China has made progress on shifting the mix and reducing carbon intensity, but the absolute amount of fossil fuel demand remains near peak levels while carbon intensity remains well above that of the developed market. If China is going to dramatically reduce fossil fuel demand, it must formulate policies aimed directly at power generation, transport and industrial sectors. By improving the energy efficiencies of these key sectors, along with the steady ascendency of consumption and services as economic drivers, the composition of China’s economy will look decidedly different in 2060 than it did only a few decades prior.

While the phrase is liberally applied by investors, few global developments actually rise to the level of “mega-theme.” China decarbonization, however, meets this standard. We believe that this ambitious initiative has the potential to change the landscape for multiple asset classes, regions and economic sectors. As with any paradigm shift, there will be winners and losers in each of these categories.

Lastly, decarbonization aligns well with the acceleration of ESG investment themes. China has the potential to turn a vulnerability – its management of the environment – into a strength. The social implications are considerable. Wage gains for workers engaged in more productivity-enhancing industries, improved health outcomes for urban dwellers and a lower risk of social and economic disruption caused by the worst effects of climate change are all societal benefits. Within the context of governance, management teams and boards will need a deep understanding of how the energy marketplace is changing so that they can develop strategies that enable them to act in the long-term interest of shareholders.

For a more in-depth look at this topic, read the full version, China Decarbonization: The Emergence of a Mega-theme, on our Insights page.