Subscribe

Sign up for timely perspectives delivered to your inbox.

Tom Ross, corporate credit portfolio manager, takes a drive in the auto sector to demonstrate how both upgrades and downgrades can be a source of returns.

In the first month of 2021, it was announced that Fiat Chrysler, the automaker, had been upgraded by S&P Global Ratings. The decision to move the rating from BB+ to BBB- meant the car maker now had two of the big three rating agencies rating the company investment grade (Fitch also rates it BBB-), automatically qualifying it for investment-grade status. As a result, around €7 billion worth of Fiat Chrysler bonds will cross the divide.

This contrasts with last March, when another big auto company – Ford – was downgraded from investment grade to high yield to become a so-called “fallen angel.” This action caused $36 billion worth of debt to move down into high yield.

Investment-grade rated companies are typically able to command lower yields from lenders. As such, when investing in high yield, it makes sense to identify “rising stars” – those companies that are on a likely trajectory to achieving investment-grade status. This would be a sound strategy because companies that move up through the ranks typically see their credit spreads narrow. (Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers while narrowing spreads indicate improving.)

Yet there is a lot of truth in the old investment adage “it is better to travel than to arrive.” The factors that caused the upgrade of Fiat Chrysler had been circulating for some time, most notably the merger of the company with higher-rated rival auto group Peugeot to form a combined group called Stellantis. S&P noted that the benefits of economies of scale achieved through this merger, coupled with improved geographic diversity and a stronger capital structure, contributed to the upgrade decision. Holders of Fiat Chrysler bonds saw the prices of its bonds rise during late 2020 as investors in the market anticipated the ratings move.

Potential gains from further changes in credit rating may be less dramatic, simply because the distinction between an investment-grade credit rating and a high-yield credit rating is powerful in terms of index composition and its impact on the investor base. Passive investors and those with mandates that stipulate either investment grade or high yield can be forced to buy or sell whenever a bond crosses the divide.

The market is also made up of investors who might have different opinions on the outlook of a company. This can make the crossover space (i.e., the credit ratings area bordering the investment grade/high yield divide) somewhat nebulous in terms of valuations, and it is not uncommon for some BBB rated companies to have higher yields than BB rated companies.

Taken together, these blurred lines of valuations and the technical impact of forced trading when bonds cross the divide typically create significant pricing inefficiencies in the crossover space, making it a fertile hunting ground for active managers.

Returning to our opening story on automakers, the immediate assumption might be that it would have been a bad investment to hold Ford’s bonds after they were downgraded. Yet downgrades from investment grade to high yield can often be quite lucrative for active high-yield investors.

History has shown that, on average, credit spreads typically widen ahead of a downgrade – indicating deteriorating creditworthiness – and tighten after. The driving force behind this trend is often the strong technical impact of investment-grade bond holders seeking to offload a bond they may no longer be permitted to hold after it is downgraded, and high-yield bond investors subsequently buying it.

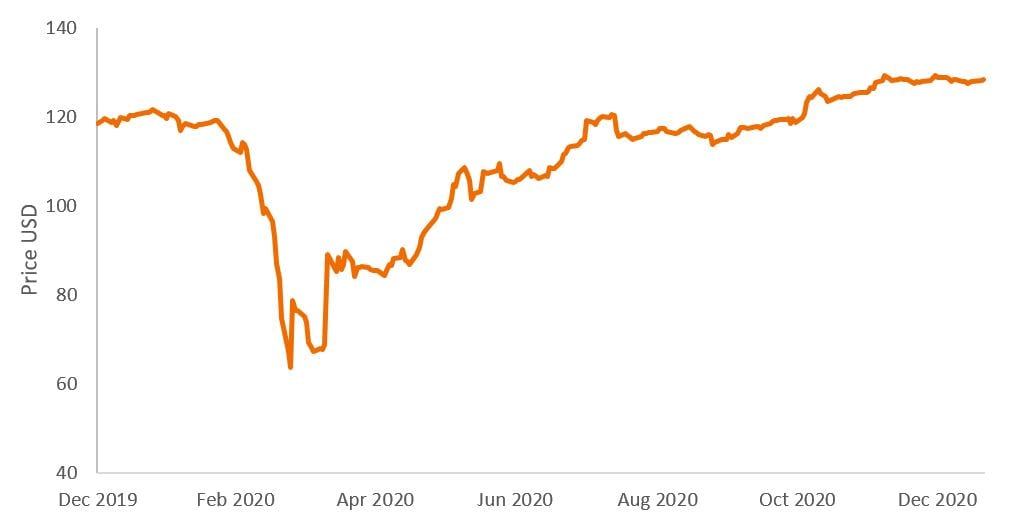

This impact was in evidence with Ford. For example, Ford’s 7.45% 2031 USD bond sold off ahead of the date of the S&P downgrade (25 March 2020) and again around the index rebalancing date at the end of March 2020. It then began to rise from early April (Figure 1).

[caption id=”attachment_352057″ align=”alignnone” width=”1010″] Source: Bloomberg, 31 December 2019 to 20 January 2021. Past performance is not a guide to future performance.[/caption]

Source: Bloomberg, 31 December 2019 to 20 January 2021. Past performance is not a guide to future performance.[/caption]

But one might ask, weren’t there other factors driving the bond price that had nothing to do with the downgrade? After all, the Ford downgrade coincided with the market sell-off caused by the coronavirus crisis and the economic lockdowns; most corporate bonds fell in March and rallied as 2020 progressed.

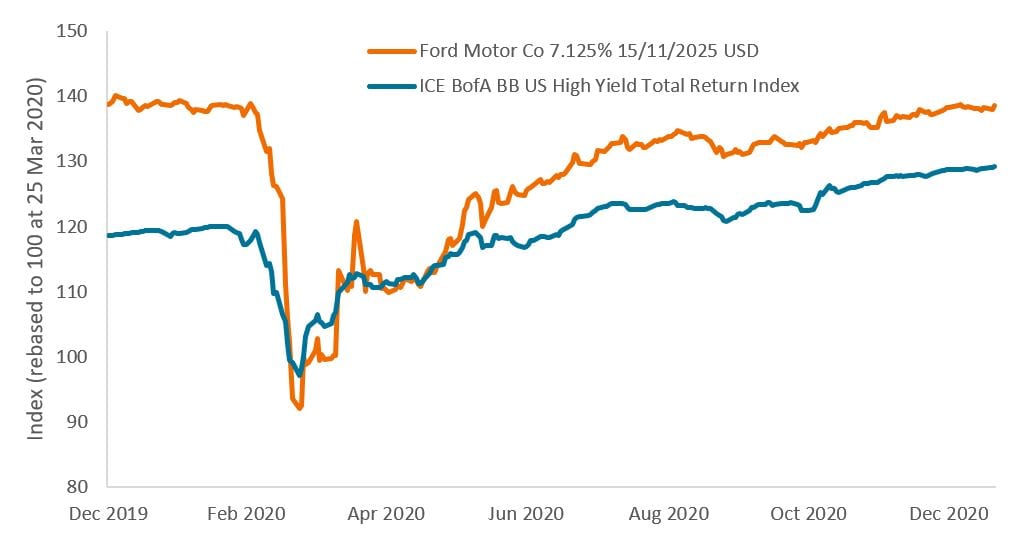

To make it a fairer comparison, let us plot a Ford bond against the U.S. high-yield market. To make it fairer still, we will include just the BB rated bonds for the market (so we are not comparing with lower-rated B and CCC bonds). And we will use a Ford bond that matures in 2025 so it has a similar duration (i.e., interest rate sensitivity) to the BB rated market (around 4.5 years), helping cancel out any duration effect.

In Figure 2, we have rebased the market, represented by the ICE BofA BB U.S. High Yield Index, and the Ford bond to the date of the Ford downgrade. The chart demonstrates significant outperformance from the Ford bond since its downgrade.

[caption id=”attachment_352169″ align=”alignnone” width=”1027″] Source: Bloomberg, Ford Motor Co 7.125% 15/11/2025 USD Bond, ICE BofA BB US High Yield Total Return Index, in USD, 31 December 2019 to 20 January 2021.[/caption]

Source: Bloomberg, Ford Motor Co 7.125% 15/11/2025 USD Bond, ICE BofA BB US High Yield Total Return Index, in USD, 31 December 2019 to 20 January 2021.[/caption]

Clearly, not every issuer downgraded into high yield will outperform following the downgrade. Some may see their bonds underperform if the credit fundamentals deteriorate. What this demonstrates, however, is that the high-yield market is not as straightforward as it might appear, which is why in-depth analysis is necessary to make prudent evaluations amid so many complexities. Moreover, it can be advantageous for a credit analyst to cover the entire credit spectrum since this can help to maintain a continuous understanding of the fundamental drivers of a company, regardless of its credit rating.

They say what goes up must come down. In the world of high-yield bonds, however, the reverse can be just as true.

Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).