Subscribe

Sign up for timely perspectives delivered to your inbox.

Andrew Mulliner, Portfolio Manager and Head of Global Aggregate Strategies and Bethany Payne, Portfolio Manager, outline the implications of the announcements by the UK government in November 2020, that RPI will be aligned with CPIH from February 2030 and green gilts are to be issued from this year.

In November 2020, the UK Treasury announced that it will go ahead with planned reforms to the Retail Price Index (RPI) from February 2030, aligning the calculation methodology with the Consumer Price Index including owner occupiers’ housing costs (CPIH)*. There will be no compensation in lieu. This is expected to reduce the future change in RPI by around 1% per year on average.

With the announcement of the RPI review in the summer of 2019, index-linked gilt supply has been reduced by the UK Debt Management Office (DMO) as uncertainty over the future calculation weighed on demand, particularly on longer maturity index-linked gilts that would be most sensitive to any change. Between April 2020 and just prior to the announcement of RPI reforms in November 2020, index-linked supply dwindled to just £22bn, equivalent to 6% of total gilt issuance over the period; but this is expected to rebound with estimates of total supply for 2020-21** of around £33bn — above the ten year average of £31bn but a dwindling percentage of the record gilt issuance of close to £486bn in the 2020 fiscal year.

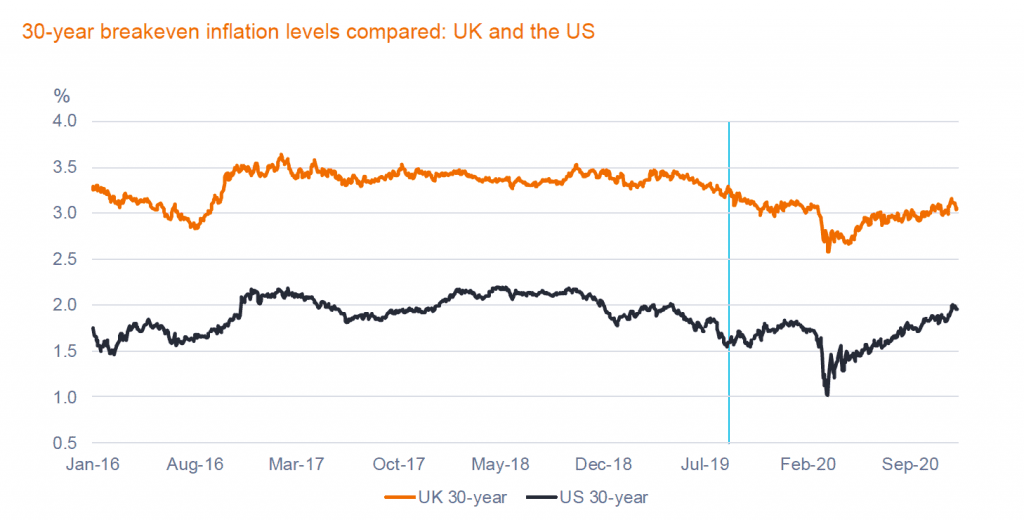

Index-linked gilts still remain an asset class in short supply. This rarity value is apparent in inflation breakevens, which remain elevated compared to global peers, despite the move to CPIH. The strength in shorter maturity index-linked gilts (due to Brexit uncertainty) may well help to explain some of this and the recent trade deal between the UK and the European Union, will in our view, put pressure on this to normalise. Over the last ten years, CPIH has averaged 2.0% in the UK versus 1.7% in the US. The chart below, 30-year breakeven inflation in the UK versus that of the US, shows how strong the UK inflation-linked market has been.

Source: Bloomberg, Janus Henderson Investors, as at 14 December 2020.

Source: Bloomberg, Janus Henderson Investors, as at 14 December 2020.Back in November 2020, the Chancellor, Rishi Sunak, announced that the UK government would issue green gilts — government borrowing where proceeds are used to finance projects that have environmental benefits, such as renewable energy, water and waste management, energy efficiency and clean transport. As such green gilts have been viewed as an important signal to demonstrate the government’s commitment to its 2050 net zero target, clean growth and the green economy.

This move could also help to ignite the growth of the sterling green bond market (ie, including corporates), which has really lagged European counterparts. To date, 46% of total issuance outstanding is in euro, compared to only 1.2% in sterling.

It is important to note that in a green bond framework, while the proceeds of the green gilt sales are earmarked for green projects and schemes, the cash flow to pay the coupons and redeem green gilts at maturity will be no different to a conventional gilt (ie, it comes from general government revenues). While green bonds fund specific projects, they are not generally secured against those projects (there is no “hypothecation”), and so share the same credit risk as non-green bonds with the same issuer and seniority.

Taking this into account, from a valuation standpoint we would note that there appears to be a small premium paid by investors for green sovereigns — a ‘greenium’ as it is now referred to, which reflects the demand for green bonds. This means investors may actually give up a small amount of return currently to invest in green gilts. Taking European sovereign debt as an example — current greeniums are -1 to -2 basis points on average***.

Given the infancy of the green gilt market, one of the key questions is the development of the market and its depth. We expect green gilts to be less liquid than conventional gilts. One approach might be to concentrate issuance at specific maturity points on the curve in larger size rather than looking to establish a full ‘green’ curve initially.

The model followed by Germany, which issued its first green bond is September, may also help inform the UK Debt Management Office (DMO) approach. Germany has ‘twinned’ its green bonds by issuing the green bonds with the same maturity and coupon as conventional bonds. Investors can also swap their holdings with a conventional German government bond with the same maturity and coupon as they require, thereby increasing the marketability of green bonds and facilitating greater liquidity in the green bond market.

With the UK hosting the 26th UN Climate Change Conference (COP26) in November 2021, the government is keen for issuance to start this year. Longer term, with investor demand high, issuance is more likely to be constrained by the amount of available green projects than a lack of willing buyers.

* CPIH: a measure of UK consumer price inflation that includes owner-occupiers’ housing costs, the Consumer Price Indices (CPI) and the Retail Prices Index (RPI).

** 2020/21 UK fiscal year (6 April 2020 – 5 March 2021).

*** HSBC estimates as at 11 September 2020.