Subscribe

Sign up for timely perspectives delivered to your inbox.

“This time it’s different” … the four most costly words in the annals of investing, according to legendary value investor John Templeton. In our view, history does indeed rhyme in markets. While we saw a sharp rotation away from growth and towards value stocks in the last few weeks of 2020, sceptics will rightly point out that we have seen value rallies a few times in recent years and they have been short-lived.

However, this time we believe it is different.

Taking a longer-term perspective, the prospects for mean reversion alone at the start of 2021 suggests that this value rally could have legs, potential risks aside. The building blocks for a significant and long-lasting rotation to value are in place, echoing an environment we saw in 1999/2000. The economic backdrop is also supportive in a manner that has been missing until now. The move from an era of austerity to one of fiscal largesse represents a fundamental shift in government policy from the past decade. This is expected to add inflationary pressures, and central bank attitudes have clearly changed towards accommodating a modest rise in inflation – quite a shift from decades of suppressing it. Hence, in a reversal of the previous trend, bond yields have risen and yield curves are steepening. This, in our view, undermines long-duration growth valuations and supports more value-biased or economically sensitive ‘cyclical’ stocks.

Reflecting Templeton’s words, this value bull market was certainly born in pessimism; value stocks have been all but written off for a protracted period. Growth stocks have been rampant as persistently low interest rates pushed valuations to extreme levels. As a result, the dispersion between value and growth stock valuations was (and still is) well beyond anything seen before (Exhibit 1).

One would have been very hard pressed to find anyone who still identified themselves as a ‘value investor’ at the start of 2020 – only a few hardy stalwarts remained. Many are now talking about the value opportunity in the UK, but portfolios have a long way to go to reflect a tangible style shift, despite the multi-decade levels of valuation dispersion within the UK market.

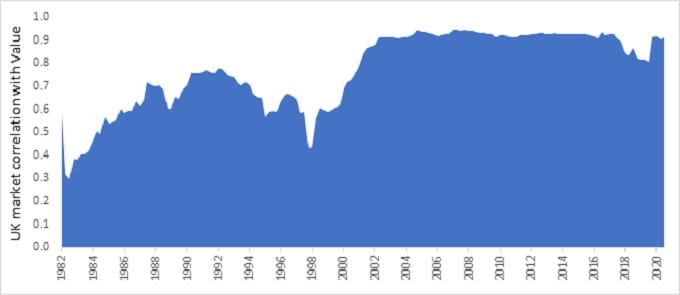

The UK equity market (FTSE All Share Index) underperformed the FTSE World Index by a staggering 63.7% in sterling terms (total return) between the UK referendum on 21 June 2016 and 29 December 2020. This has not just been due to Brexit; in recent months the UK economy suffered more than most from the COVID crisis. The UK equity market has typically been more highly positively correlated with the ‘value’ style than other major markets (Exhibit 2), with a bias towards more economically sensitive (‘cyclical’) sectors, such as oil and banks, and is less exposed to more growth-oriented sectors like technology.

At the start of 2021, the UK equity market seems to have the ingredients in place for a significant recovery relative to the rest of the world. The end of 2020 represented the end of the Brexit process, helping to dispel some of the uncertainty for investors. A more substantial economic recovery from the pandemic seems ahead of us (setbacks aside), with the UK leading the way with vaccinations. Value has huge scope to recover and could well be back in fashion.

Mean reversion: the theory that asset prices and returns revert to their long-run averages over time.

Fiscal largesse: fiscal policy refers to government spending and taxation. A period of fiscal largesse is where government spending increases, the opposite of austerity.

Yield curve: a graph that plots the yields (vertical axis) of similar quality bonds against their maturities (horizontal axis). Typically, it is upward sloping, as lenders demand a higher yield to compensate for the risk of lending for longer periods. A steeper upward-sloping curve can signal expectations of higher economic growth and higher inflation in the future.

Bull market: a term used to describe rising markets

Value stock: a company share that trades at a lower price relative to its fundamental metrics and is therefore believed to be undervalued by the market. Often found among more cyclical parts of the market.

Growth stock: a company share where earnings are anticipated to grow at a rate significantly above the average growth rate for the market.

Valuation dispersion: Dispersion is a statistical term that describes the size of the distribution of values expected for a particular variable; in this case, the range of share price valuations attributable to different stocks in the market.