Subscribe

Sign up for timely perspectives delivered to your inbox.

Andrew Mulliner, Portfolio Manager and Head of Global Aggregate Strategies, explains why 2021 will likely be a year of recovery, though he cautions that investors should keep one eye on inflation and inflation expectations.

Whatever 2021 brings, it is unlikely to beat 2020 for novelty. For one, markets have one less bit of uncertainty going into this year with the last-gasp trade agreement between the UK and Europe, just seven days before the end of the UK’s transition period on 31 December. With coronavirus vaccines having become available before the end of 2020, an economic recovery in 2021 now looks increasingly like a sure thing. However, knowing that things are going to get better is not enough. There are a few big questions we need to address to get the 2021 view right.

With mass vaccinations and a return to normality on the cards, the question we need to ask is how fast does this happen?

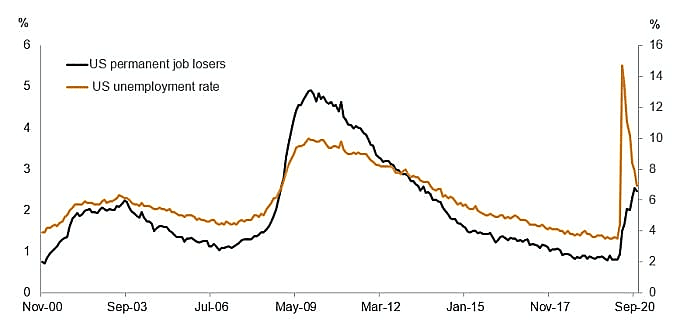

Unemployment is perhaps the most critical factor when we think about economic recovery. The time it takes for individuals who have lost jobs to regain employment plays a crucial role in the pace of the economic recovery. The longer it takes, the longer the economy experiences a fall in consumption – both directly (those without income spend less) but also indirectly, as economic confidence in the rest of the labor force falls. Historically, it takes time for the unemployment rate to fall and confidence and consumption to return to its prior peak and hence economic recovery tends to be slow (see figure 1).

[caption id=”attachment_346349″ align=”alignnone” width=”680″] Source: Refinitiv Datastream, monthly data, 30 November 2000 to 31 October 2020.[/caption]

Source: Refinitiv Datastream, monthly data, 30 November 2000 to 31 October 2020.[/caption]

However, this time might just be different. Many of those who have lost jobs in the past year worked in service industries like bricks and mortar retail, restaurants and bars. These jobs typically have low threshold skill requirements. As the economies reopen and demand for retail and leisure activities returns, a waiter in a restaurant that has permanently closed, is likely to able to find similar work in the new businesses that emerge as demand for eating out returns. If this assumption holds true more broadly, then we may find that economies recover extremely rapidly in 2021 as normality returns.

So, a faster recovery may be on the cards. How does that impact on our 2021 investment outlook?

Well, it could be key. One of the important features of the COVID‑19 crisis has been the willingness of governments and central banks to provide support for their economies. Governments acted quickly to support consumption through various employment schemes while central banks cut interest rates back to their lowest levels and bought enormous quantities of bonds, facilitating market function and the fiscal spending by governments.

However, there have been significant shifts in central bank ideology, informed by their experience of the Global Financial Crisis (GFC) and the decade of low inflation that followed, the Federal Reserve in the U.S., the world’s most important central bank, adjusted its statement of principles in such a way that is increasingly tolerant of inflation and which actively looks to foster as low an unemployment rate as possible. This change has resulted in financial markets assuming that interest rates will likely remain incredibly low, far into the future. A swifter economic recovery, especially one that perhaps comes arm in arm with some inflation, may result in a sharp reappraisal in the level of interest rates in markets.

As a fixed income investor, it always comes back to inflation!

Dark mutterings can already be heard in some corners of the bond market that inflation may be back soon. Rampant quantitative easing and fiscal spending stokes fears among those of the view that money supply growth is the ultimate arbiter of inflation. However, demand is also critical and here the story is less straightforward. Unemployment is elevated, so even if this falls rapidly, inflation of the sort that rattles central banks is unlikely to be a 2021 situation.

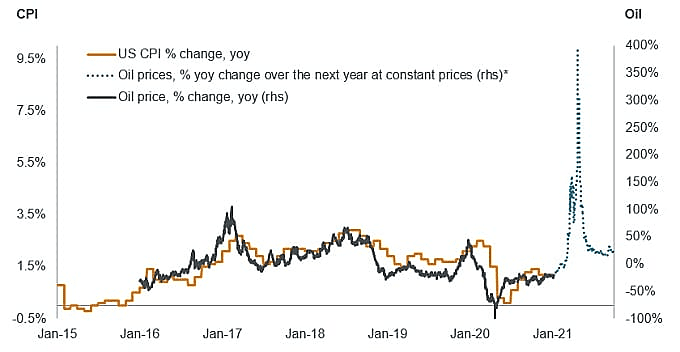

Still, given the falls in commodity prices in April last year (when the price of oil hit ‑$40 on the barrel!), we can expect some significant headline price inflation on a year‑on‑year basis. Figure 2 shows the relationship between oil prices and consumer price inflation (CPI) in the U.S. It also includes an illustration of how the low oil in April can impact the year‑on‑year changes in oil prices going forward, which is likely to be mirrored in inflation. While it seems unlikely to provoke huge amounts of angst as we discuss it today, in six months’ time, inflation rates above central bank targets in a rapid economic recovery scenario may sit less comfortably with investors.

[caption id=”attachment_346360″ align=”alignnone” width=”680″] Source: Bloomberg, actual data from 1 January 2015 to 5 January 2021, simulated model thereafter to 30 September 2021. Note: U.S. consumer price inflation (CPI) and West Texas Intermediate (WTI) oil prices. *Simulated model (dotted line) represents the percentage change, year‑on‑year (YoY), in oil prices between 5 January and 30 September 2021, assuming that the oil price remains constant at its 5 January level of $49.7 per barrel throughout the period.[/caption]

Source: Bloomberg, actual data from 1 January 2015 to 5 January 2021, simulated model thereafter to 30 September 2021. Note: U.S. consumer price inflation (CPI) and West Texas Intermediate (WTI) oil prices. *Simulated model (dotted line) represents the percentage change, year‑on‑year (YoY), in oil prices between 5 January and 30 September 2021, assuming that the oil price remains constant at its 5 January level of $49.7 per barrel throughout the period.[/caption]

Ultimately, the easiest conclusion is that the economy should be stronger in 2021 than it was in 2020. In addition we can be pretty certain that central banks and governments will not be falling over themselves to withdraw stimulus and to tighten financial conditions.

This could be a good environment for corporate profits growth, and by extension, riskier financial assets like corporate bonds and in particular higher yielding corporate bonds. Of course, with the improving macro environment, safer assets like government bonds will probably deliver sub‑par results; and that is our base case.

However, in a world where central banks are keeping rates low while expanding their balance sheets, the degree to which government bonds underperform is likely to be limited. This environment could also be good for bonds issued by emerging market issuers, both in U.S. dollar‑denominated issues and in their local currencies.

Hence, a pro-risk stance makes sense to us. Although, as with all bond investors, we must keep one eye on inflation and inflation expectations. While in our base case we do not see inflation posing challenges to financial assets, should investors (and, more importantly, central banks) start to internalize a higher inflationary regime in their forecasts and decision making, then 2021 could turn out to be just as turbulent as 2020, but for very different reasons. We do not believe this should be the central investment case for investors, but we will stay vigilant.

If anything, 2020 re-emphasized the importance of the economic cycle and of listening to the market. In 2019, credit spreads on corporate bonds were tight (i.e., hovering around their lower levels versus equivalent government bonds) and government bond yield curves were very flat (generally an indication of recessionary times ahead). As such, there was good reason to be cautious.

What should be on the radar for investors in 2021?

Explore Now