Subscribe

Sign up for timely perspectives delivered to your inbox.

News of game-changing vaccines in late 2020 heralded a dramatic shift in expectations for markets and the economy in 2021. Paul O’Connor, Head of the UK-based Multi Asset Team, considers the rationale behind this optimism, and areas he believes can benefit.

It is hard to avoid the conclusion that COVID-19 will be the dominant driver of financial markets in 2021, as it was in 2020. The coronavirus changed everything, killing over 1.6 million people, wiping $22 billion off global stock markets in a few weeks, plunging the global economy into the worst recession since WWII, and provoking a $21 trillion monetary and fiscal policy response. Yet, while 2020 ended with the coronavirus still rampant in Europe and the U.S., the surge in risk assets in the final months of the year showed that financial markets were clearly looking beyond these concerns and focusing on better times ahead in 2021.

The unusually rapid development and approval of COVID-19 vaccines has been the catalyst for a dramatic reappraisal of expectations about the speed at which economic life can return to normal. Projections based on vaccines that are now at the approval stage or beyond suggest that G7 economies should have enough doses to immunize the most vulnerable people and health care workers by the spring and get close to herd immunity by the middle of the year.

There are, of course, many risks to these projections related to vaccine effectiveness, vaccine hesitancy, and production and distribution practicalities. A more pressing concern, arising around the turn of the year, has been the emergence of more contagious new variants of the coronavirus in the UK and South Africa, and to a lesser extent in some other countries. Initial analysis finds no evidence that the new variants have greater morbidity than the previous strains and scientists are generally optimistic that existing vaccines should be effective against them. Investor sentiment will be highly sensitive to any doubt emerging on the latter point. Still, even if vaccines do work against the new variants, these mutations will nevertheless require longer and more severe economic restrictions to contain their spread and serve as a reminder of the sort of setbacks that seem inevitable on the road to herd immunity.

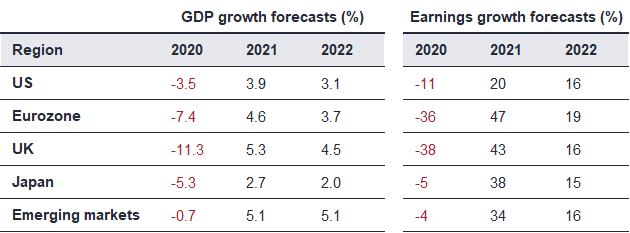

Despite these uncertainties, 2021 begins with expectations of a second-half reopening as the key macro theme and consensus forecasts projecting a V-shaped recovery in global growth and corporate earnings. Although many countries and sectors will bear the scars of the COVID-19 shock for years to come, 2021 is expected to see some decisive steps down the road to recovery, as restrictions on economic activity ease as the year progresses, unlocking pent-up consumer spending.

[caption id=”attachment_345976″ align=”alignnone” width=”630″] Source: Janus Henderson Investors, Bloomberg, Refinitiv Datastream, as at 31 December 2020. Note: Japan earnings forecast shifted by one year due to different fiscal year end.[/caption]

Source: Janus Henderson Investors, Bloomberg, Refinitiv Datastream, as at 31 December 2020. Note: Japan earnings forecast shifted by one year due to different fiscal year end.[/caption]

Against this backdrop, both monetary and fiscal authorities can reasonably expect to be less busy in 2021 than they were in 2020. With interest rates, bond yields and credit spreads at or near historic lows, central banks are already doing much of what they can to support growth. Fiscal authorities have played their parts well too, providing big stimulus programs that offset many of the economic impacts of COVID-19 and left consumers entering the new year with unusually high savings balances. While it seems clear that central banks are likely to keep monetary policy highly accommodative long into the economic recovery, it is also clear that they have fewer tools to deploy than they had in the past, if the economy stumbles. From here on, fiscal policy will have to take on more responsibility for managing the economic cycle than it has done in recent decades. The big policy questions for 2021 will probably no longer be focused on the central banks but will instead be about whether governments will keep fiscal policy generous enough to support the recovery.

Somewhat remarkably, after the shocks and surprises of 2020, investors are starting the year with notably optimistic expectations for financial markets in 2021. Indeed, key indicators show that consensus sentiment and positioning is now at the upper end of historic ranges for equities and other risk assets. These sorts of levels of exuberance are typically contrarian tactical indicators, warning that markets probably need good news just to validate consensus optimism and have limited scope to absorb disappointments. Still, while this suggests that there is a relatively high chance of some market turbulence in the early months of the year, it does not challenge the supportive bigger picture beyond that, based on the premise of a strong upswing in growth, beginning in the middle of the year accompanied by unusually low interest rates for years to come.

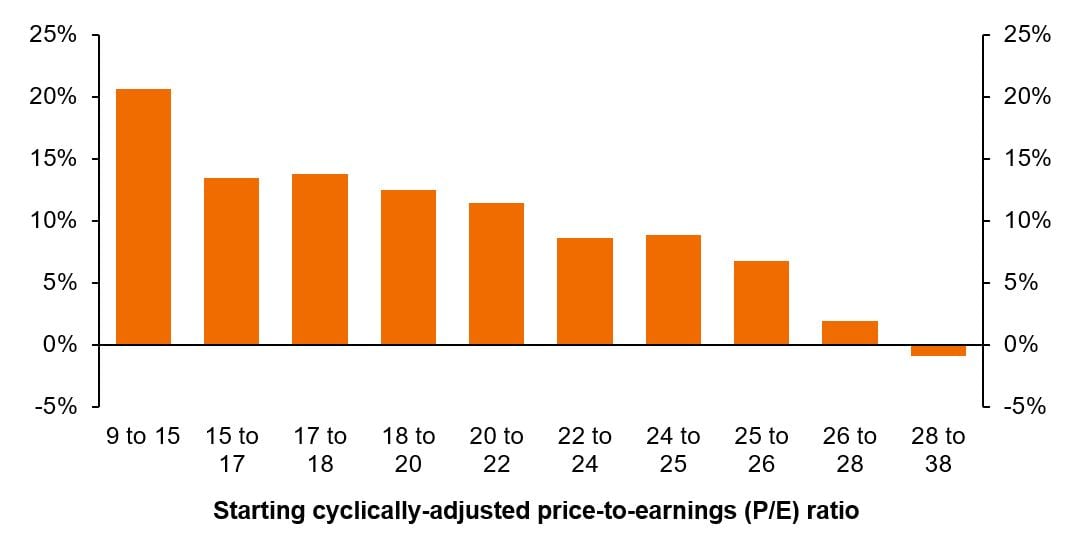

While equities are not exactly cheap relative to history, valuations are nevertheless at levels from which mid-single digit returns can reasonably be expected, well ahead of the other main asset classes, even when risk adjusted. In our view, 2021 looks like being a year of exceptionally strong earnings growth, with projected growth rates of between 40% and 50% in the UK, Europe and Japan. While the recent rally clearly suggests that some of this recovery is already priced in, we see plenty of scope for investment flows to rotate from cash and other assets towards equities, once the recovery becomes more visible.

[caption id=”attachment_345987″ align=”alignnone” width=”1067″] Source: Janus Henderson Investors, Refinitiv Datastream World Index, as at 16 December 2020. Note: The cyclically adjusted price-to-earnings ratio (current share price divided by the average of ten years of earnings, adjusted for inflation) is used to project possible future returns from equities – in this case over a five-year period, Higher valuations theoretically imply lower long-term annual average returns. Past performance is not a guide to future performance.[/caption]

Source: Janus Henderson Investors, Refinitiv Datastream World Index, as at 16 December 2020. Note: The cyclically adjusted price-to-earnings ratio (current share price divided by the average of ten years of earnings, adjusted for inflation) is used to project possible future returns from equities – in this case over a five-year period, Higher valuations theoretically imply lower long-term annual average returns. Past performance is not a guide to future performance.[/caption]

If expectations for the recovery are broadly realized this year, equity market leadership is likely to look very different to that seen during the first six months of the coronavirus era, when technology stocks and other growth sectors massively outperformed all other equity styles. With relative valuations and investor sentiment now highly skewed in favor of secular growth plays, we see plenty of scope for the late-2020 rotation towards the year’s laggards to continue in 2021. Regionally, that argues for a tilt away from the U.S., towards eurozone, Japanese and UK equities, so long as the recovery story remains on track. Emerging market stocks should do well in an environment of strong growth and low interest rates, although the outlook here is somewhat complicated by the high weighting of Chinese growth stocks in the key indices.

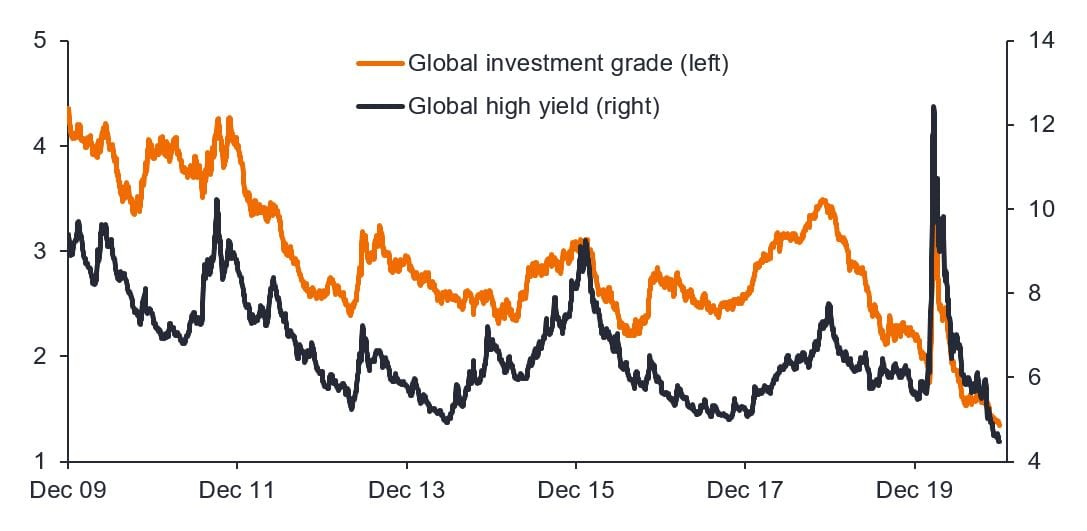

Beyond equities, we see good opportunities in some alternative assets, such as in the infrastructure and renewables sectors, which seem to offer attractive valuations and access to diversifying non-cyclical earnings streams. For corporate debt, however, the outlook is less appealing than it has been in years. The fundamental picture here looks solid, and supply should be modest, given the surge of corporate cash-raising in 2020. The problem is simply valuation. The year begins with high-yield bonds offering record low yields and investment grade yields and spreads not far from historic lows. While, macro and market conditions should be very supportive for corporate bonds, it is hard to avoid the conclusion that these assets have already priced in a lot of good news and the risk-return prospects are better elsewhere.

[caption id=”attachment_345998″ align=”alignnone” width=”1087″] Source: Janus Henderson Investors, Bloomberg, as at 31 December 2020. Notes: Bloomberg Barclays Global Corporate and High Yield indices.[/caption]

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2020. Notes: Bloomberg Barclays Global Corporate and High Yield indices.[/caption]

What should be on the radar for investors in 2021?

Explore Now