Subscribe

Sign up for timely perspectives delivered to your inbox.

John Pattullo, Co‑Head of Strategic Fixed Income, explains why an expected and predictable cyclical reflation should not be confused with a longer-term structural breakout of inflation.

As we navigate our way through the COVID‑19 crisis, people have started to worry about inflation once again. A couple of years ago I wrote that the Phillips Curve – a useful gauge for inflationary pressures in an economy and used by central banks in setting policy – has broken. What follows is an update of our thoughts on inflation as we see it on the Strategic Fixed Income team.

Nearly 10 months into the COVID‑19 crisis, we are moving from the disinflationary demand shock, first stage, toward the cyclical recovery “bottleneck” reflation, second stage. Now, an expected and predictable cyclical reflation should not be confused with a longer-term structural breakout of inflation and inflation expectations. This confusion presents opportunities and threats for investors, but headaches for central bankers.

As we head into the spring and summer of 2021 and escape the pandemic lockdown, we expect to see a rise in both core and headline inflation. This is driven by the cyclical rebound in activity: as economies reflate and people, once again, go outside and start spending and living (yippee!).

We expect this will be more of a cost‑push inflation (bad or tax-like inflation), driven primarily by bottlenecks in production. In a nutshell, the rate of change in demand may, for a short time, outstrip the rate of change in output. Inventory levels are currently low and tight because of the lockdown, and it will take time to rebuild.

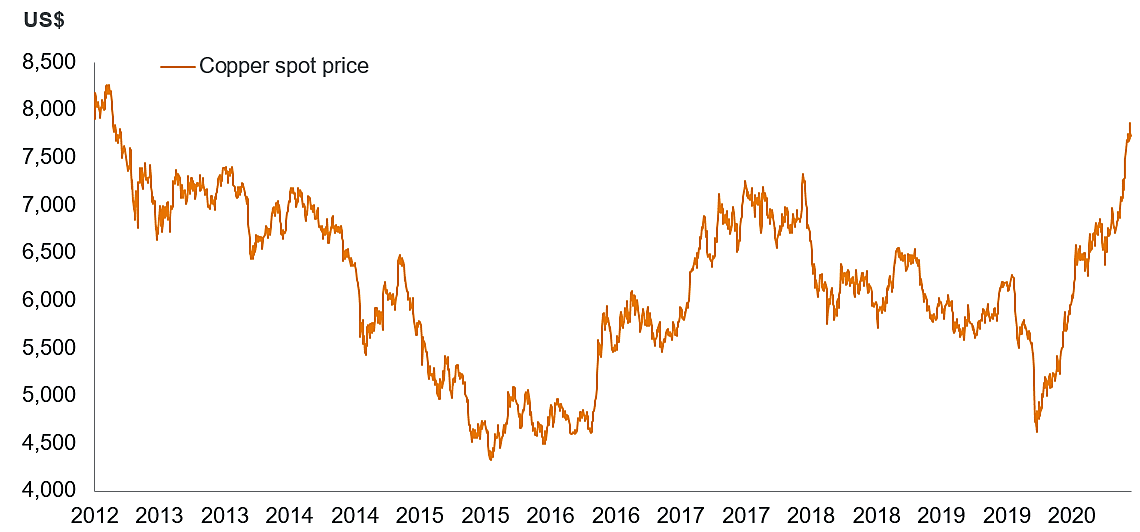

Just look at copper or lumber prices. “Dr. Copper” is at a six‑year high (see figure 1) while lumber is in short supply given the strength of the U.S. housing market. Further, if we all start flying again, aviation fuel supply cannot be switched on overnight. When I went to fill my car up for the fourth time this year, the petrol station was desolate, but this can all change very quickly. Consumption patterns will, to some degree, revert back to what they were: fewer exercise bikes and patio heaters and more sun cream and holidays.

[caption id=”attachment_344194″ align=”alignnone” width=”1140″] Source: Bloomberg, Janus Henderson Investors, as at 14 December 2020. Note: London Metal Exchange (LME) copper, cash, U.S. dollar; cash prices at the end of LME day.[/caption]

Source: Bloomberg, Janus Henderson Investors, as at 14 December 2020. Note: London Metal Exchange (LME) copper, cash, U.S. dollar; cash prices at the end of LME day.[/caption]

As Simon Ward, our economic adviser, has pointed out, the inventory cycle has bottomed, as has the capital expenditure (capex) cycle, while we are roughly halfway through a long-running housing cycle. In addition, we obviously have accommodative monetary and fiscal policy.

In a reflationary period you would expect commodities to motor, the yield curve to steepen, bond yields to rise, the dollar to weaken and value/cyclical stocks to (at last!) outperform growth. As we often say, “live in growth, but holiday in value.” Well, it’s holiday time, but the vacation never lasts long enough. The point being: Always distinguish a cyclical trade from a structural one in all aspects of investing, frankly (or even life) but especially in credit selection and in interest rate management.

The other point on inflation is, of course, that the headline number swings around – a lot – due to the oil price. We had a negative oil price in April, so when this drops out of the 12‑month rolling number, ceteris paribus, the price will rise. Do the math! I look forward to commentators telling us we have a breakout of inflation in the summer.

A weak dollar also tends to raise the price of imported goods for Americans and is generally reflationary for the world. In addition, with the lockdown, the constituents of the inflation numbers have moved around; namely, second-hand car prices and shelter (housing costs) in the U.S. calculation.

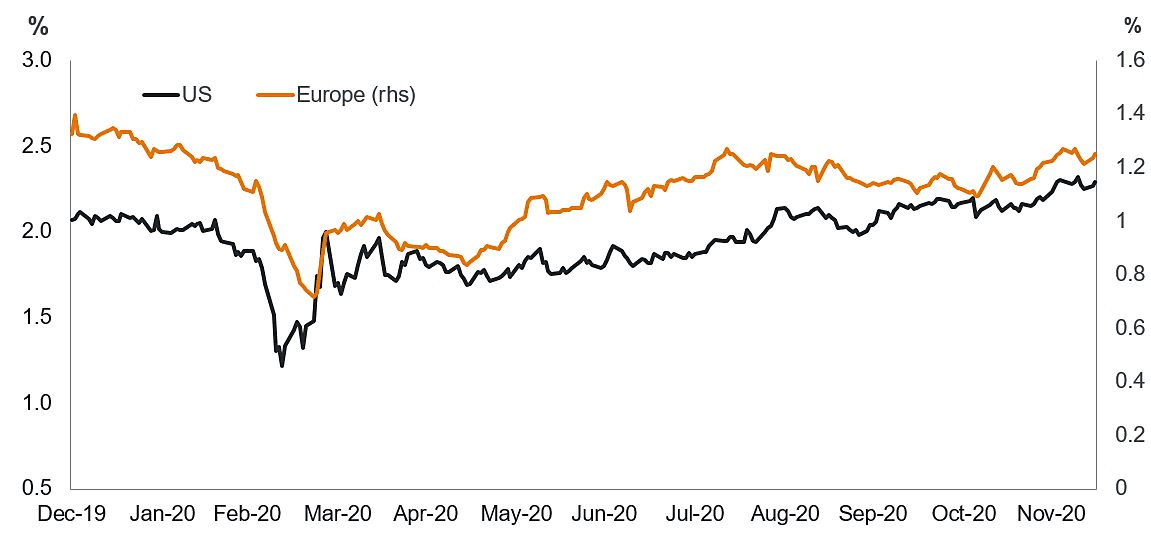

In Europe, the inflation outlook is, as ever, more benign and lower than the U.S., but still at the mercy of base effects. Figure 2 shows the market’s expectations for inflation in the second half of the next decade in Europe and the U.S. The levels are still benign in both regions.

[caption id=”attachment_344205″ align=”alignnone” width=”1151″] Source: Bloomberg, Janus Henderson Investors, as at 15 December 2020 Note: 5-year, 5-year forward inflation swap rates in the U.S. and Europe. A common measure used to look at the market’s future inflation expectations.[/caption]

Source: Bloomberg, Janus Henderson Investors, as at 15 December 2020 Note: 5-year, 5-year forward inflation swap rates in the U.S. and Europe. A common measure used to look at the market’s future inflation expectations.[/caption]

We actually think the bounce back could be quite violent. Australia and New Zealand both seem to be bouncing quite hard. The massive growth in the money supply has been well flagged, but until recently has been offset by a collapse in the velocity of circulation1 as the savings ratio has ballooned. In the U.S., the savings ratio rose to 33.7% in April but fell back to 13.6% in October (a more normal level is around 8%). There are trillions of dollars of pent‑up spending ready to go.

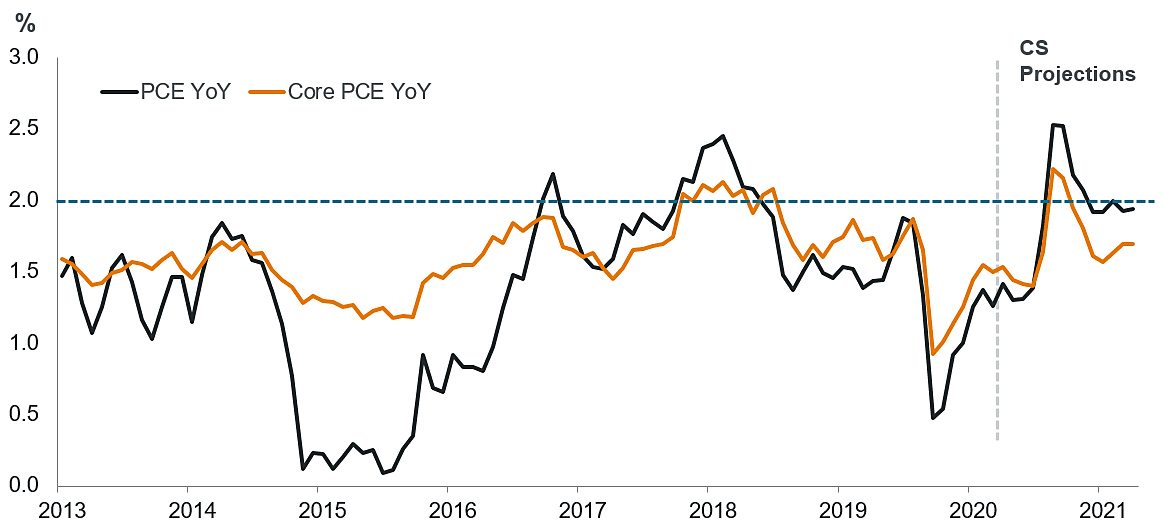

This is where it gets interesting for bond managers, confusing for market commentators and tough for central bankers. The U.S. Federal Reserve has publicly stated that it will let the economy run hot (Janet Yellen also said this years ago but failed). By doing so, it hopes to lower the unemployment rate and the output gap with its latest policy innovation of symmetrical inflation targeting. Figure 3 shows the actual personal consumption expenditure (PCE) inflation in the U.S. over the last few years, with forecasts for 2021 by Credit Suisse.

[caption id=”attachment_344216″ align=”alignnone” width=”1163″] Source: Credit Suisse, Janus Henderson Investors, as at 8 December 2020. Dotted line represents the Federal Reserve’s target inflation rate of 2.0%.[/caption]

Source: Credit Suisse, Janus Henderson Investors, as at 8 December 2020. Dotted line represents the Federal Reserve’s target inflation rate of 2.0%.[/caption]

We must try to distinguish what could be quite a large cyclical bounce back in “revenge” spending from all the other long‑term structural factors that explain why we live in a low-growth and low-inflation economy. In other words, some people may confuse short‑term, bottleneck, cost‑push, price volatility, imported inflation with demand‑pull inflation – the latter being where prices are pulled up permanently due to a lack of goods, services, capital or labor. In a demand‑pull situation, people would demand higher wages due to the scarcity of labor in order to afford more expensive goods in the shops. The price of capital – interest rates – would, or should, then rise to dampen the excess demand, in a classic 1970s upward price spiral.

We continue to think that the demand-pull scenario is highly unlikely, given all the experience we have gained observing growth and inflation dynamics in both Japan and Europe. Further, as I wrote in my previous article in July, there remains the threat of a regime change with the adoption of modern monetary policy (MMT)2-type strategies (though given the recent U.S. election result, we sense this risk has somewhat faded). However, we continue to live in a world of increasing financial repression3 with negative real yields, which will become increasingly challenging for all of us.

Thus, we remain long of credit risk and short of government/interest rate risk. The way central banks might react to the inevitable “bad” cost‑push inflation will be fascinating and will throw up threats and opportunities for all investors.

Keep an eye on the equity rotation trade, commodity prices, the U.S. dollar (the ultimate tell) and inflation expectations to see how long this trade lasts. And remember, try not to confuse a shorter‑term cyclical reflationary impulse with a continued disinflationary structural backdrop.

1Velocity of circulation (of money): the frequency at which one unit of currency is used to buy goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time.

2Modern Monetary Theory (MMT): an unorthodox approach to economic management, which in simple terms argues that countries that issue their own currencies can ‘never run out of money’ the way people or businesses can.

3Financial repression: in simple terms, using regulations and policies to force down interest rates below the rate of inflation; also known as a stealth tax that rewards debtors but punishes savers.