Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager, Elissa Johnson, and Associate Portfolio Manager, Tim Elliot, secured loans specialists within the Secured Credit Team, highlight how European loans can provide the opportunity to invest in an asset class offering a wide range of risk‑adjusted returns.

As every good Harry Potter fan knows, Bertie Bott’s Every Flavour Beans provide every flavour imaginable. While we would not suggest that European loans are quite as versatile, we would point to the opportunity to invest in an asset class that offers a range of risk‑adjusted returns dependent on investor preference.

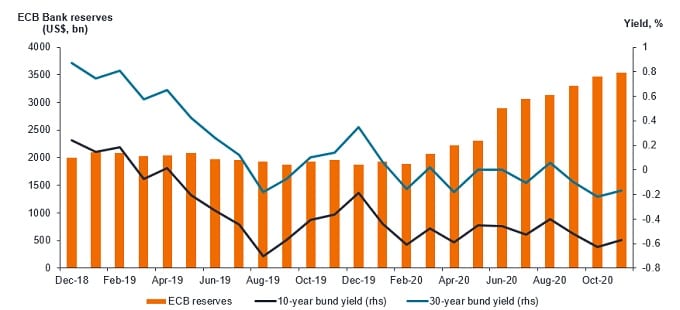

The search for yield has been a theme in financial markets for many years now, exacerbated by the quantitative easing (QE) programmes of central banks, which have multiplied the size of their balance sheets by buying government, and corporate, bonds. Figure 1 shows an example of how reserves have grown at the European Central Bank (ECB) while bund yields have fallen. With the expectations of a strong bounce back in global gross domestic product (GDP) in 2021, as economies recover from the COVID‑19 pandemic, we see the potential for credit to outperform government bonds.

Source: Bloomberg, Janus Henderson Investors, as at 30 November 2020

Note: bank reserves at the European Central Bank (in US dollar billions) and 10‑year generic bund yields.

In addition to the QE demand shock, concerns over global growth and global stagnation over the past year or so have led to declines in government bond yields and the rise of negative yielding bonds. This phenomenon has continued, and despite a short respite in March 2020 ― at the height of the pandemic ― when global government bonds saw price falls (yields rise), the trend has resumed and the percentage of the total global bond market with negative yields is once again over 25% — see figure 2.

Source: Bloomberg, Janus Henderson Investors, as at 30 November 2020

Income matters for those seeking to deliver pensions and investment returns against insurance risk. It matters for those who rely on their savings to deliver retirement income in the absence of a formal pension. It matters to those who granted guaranteed yield savings products.

In a world devoid of the traditional, historical sources of income, European loans can offer an alternative.

Currently, the European loan market, as measured by the Credit Suisse Western European Leveraged Loan Index (CS WELLI), has a 3‑year discount margin of 4.7%. That means investors will receive a return per annum of 4.7%, assuming all loans trade at par (100%) in three years’ time. This might seem like a stretch given that 2.0% of the market trades at a price of 80 or below. However, excluding those loans, the 3‑year discount margin is just 0.3% lower, at 4.4%.

European loans are predominantly rated sub‑investment grade, and as such, minimising default loss (losses from actual defaults; ie, net of recoveries) is a critical consideration in any investment decision. Thus, we can fully understand that not all investors will want a portfolio that mirrors the risk profile of the broader loans market, which has currently an average rating of single-B, with 7.8% in CCC or lower rated names1.

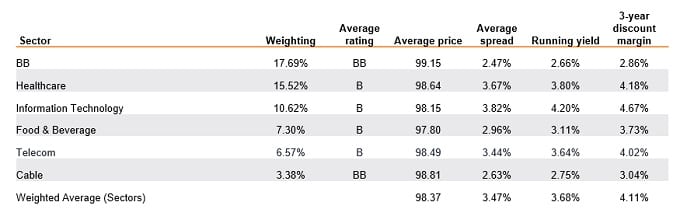

For example, investors may prefer to focus on more defensive sectors such as healthcare, technology, telecoms, cable and food and beverage, which together make up just under half of the market (43%). Others may prefer to invest only in BB‑rated issuers, which account for 18% of the market2.

The table in figure 3 shows the returns available from these perceived defensive sectors. As can be seen, the BB‑rated segment of the market has a lower return on offer (2.9% discount margin), reflecting the lower average spread and higher average price in the market, given the lower risk nature of the investments.

Source: Credit Suisse, as at 30 November 2020

Past performance is not a guide to future performance.

The weighted average potential return of these sectors, as measured by the 3‑year discount margin, is just over 4%, which we believe looks attractive. This compares with the broader market return, which is higher at 4.7%, reflecting the higher return on offer from sectors such as chemicals, industrials and leisure.

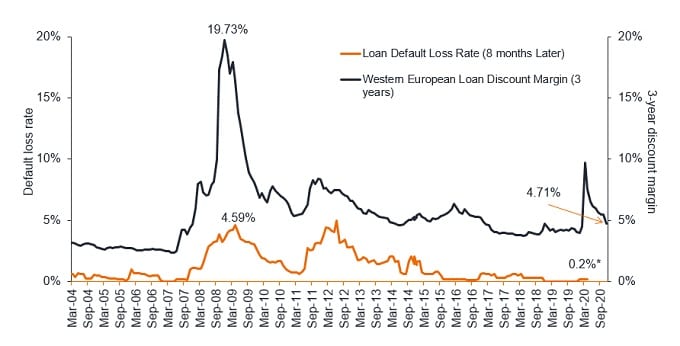

As for defaults, figure 4 shows historical default losses versus returns in European secured loans. We understand that defaults in the market are ‘backwards looking’, and that credit rating agencies have published expectations of higher defaults (example, Fitch forecasting 5.5% in 2021). However, many of the big investment banks have lowered their default forecasts for the European sub‑investment grade credit, suggesting default rates of 2-4% for 20213, with European loan recovery rates currently at 64%4.

Source: Credit Suisse, as at 30 November 2020

Note: * as at 30 April 2020

Past performance is not a guide to future performance.

In the competition for consumer spend over the last few years we have preferred the leisure sector over retail for two principle reasons:

Pre‑COVID, both sectors represented a similar level of the CS WELLI, at 5% each.

COVID‑19 has turned some of this thinking on its head in the short term, as throughout Europe consumers have been severely restricted in their movements, but have been able to continue to acquire retail products through e-commerce channels even when stores were closed. At the same time, many of the leisure businesses have had to endure negligible or no revenues, especially in the first wave of COVID‑19 as their businesses were prohibited from trading altogether, leading to eye‑watering leverage levels5.

In most ‘normal’ circumstances this would have led to swift liquidity issues and subsequent defaults; yet, to date, there have been no defaults of any businesses in the leisure and gaming sector of the CS WELLI. The main reason being the extraordinary support from furlough schemes, the ability to delay social and tax payments and landlords’ willingness to renegotiate rental obligations; all of which have reduced the fixed costs of these businesses. Financial markets have remained highly accommodative too, such that many businesses have been able to raise incremental debt to bolster their liquidity positions. Of the 25 issuers in the leisure sector of the CS WELLI we estimate that 11 (45%) have raised incremental debt because of COVID‑19.

We need to recognise that as the extraordinary support is withdrawn, unemployment is likely to rise and businesses will have to take up the slack on personnel payments as furlough schemes end. At the same time, many leisure businesses have much higher debt burdens than they had going into the crisis, and we believe that some will struggle to grow back into their capital structures. That said, COVID‑19 vaccine announcements by Pfizer/BioNTech, Moderna and Oxford‑AstraZeneca in November 2020 (and the UK authorisation of the Pfizer/BioNTech vaccine in early December) suggest that a return to a more normal modus operandi for summer 2021 is highly likely.

While we do not expect social distancing and associated measures to disappear completely, recognising the time that it will take to roll out the vaccine fully, it seems a reasonable base case to assume most leisure businesses in Europe will be able to open for their key season in 2021. There is no doubt, in our mind, that there is pent-up demand to get back out and enjoy leisure activities again. We have seen from data, provided by some of the leisure businesses where we own loans, that even during this year, when they were able to open their facilities, revenues were hitting prior year levels on some metrics.

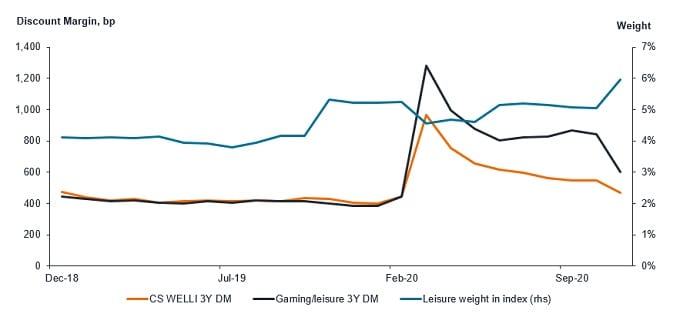

The sector’s 3-year discount margin of 6.0% is 1.6% higher than the market as a whole, excluding distressed names (the sector does not contain any sub‑80 priced loans). This is despite very strong outperformance in November, where the average price for the sector rose by nearly four points on the positive vaccine news. The higher yields available in this sector are shown in figure 5.

Source: Credit Suisse, Janus Henderson Investors, as at 30 November 2020.

Past performance is not a guide to future performance.

By our calculations, the average price of the sector is just over 926. It may be that considering a three year return to par is too conservative for many leisure sector loans. Just over half of the loans in the sector are rated in the CCC category by at least one credit rating agency, following swift action by the agencies at the start of the pandemic.

Under our base case, the leisure sector companies in which we are invested, have access to enough liquidity to operate until the key summer 2021 season. We believe that selective investments in the sector can provide an interesting kicker (boost) to returns over the next 12 months, particularly if our base case of a much more normalised summer 2021 comes to pass. As always, individual security selection will be key and we prefer leisure businesses that are more exposed to low ticket spend (ie, cheaper ‘experiences’) and domestic demand than those that are reliant upon significant outlay and cross-border tourist flows, which we expect to remain subdued at least until 2022.

At the time of writing in December, 2021 forecasts are being made available from market participants. One element is especially worthy of note in the context of the European loan market. The largest buyers of the asset class are collateralised loan obligation (CLO) vehicles and they are expected to see material growth in 2021. Both BNP Paribas and Morgan Stanley investment banks are forecasting €25bn of CLO issuance — up 22% versus the issuance level year‑to‑date, to 30 November 2020.

After the hiatus of 2020, merger and acquisition activity will likely take some time to get back on its feet (given the lead times involved) so we expect demand to outstrip supply, especially in the first half of the year, and accelerate price appreciation.

After a tumultuous year, it does finally feel that we are in sight of a return to a degree of normality. In that context the perennial challenge of income will once again be front and centre of many investors’ minds. The European loan market can provide an attractive income for investors looking to diversify their portfolios. We believe that, with a combination of income and continued price appreciation, returns have the potential to reach 5% over the next 12 months.

We continue to expect defaults to remain benign, albeit higher than in the past couple of years, and hence see the asset class providing good, relative, risk‑adjusted returns for investors. We remain invested in many leisure names reflecting our base case that certain loans in the sector will see significant price appreciation within the next 12 months as the vaccine rollout allows for more normal operations and consumers can once again enjoy experiences.

1 Includes loans rated CCC or lower by at least one credit rating agency.

2 Includes loans with a BB rating from just one credit rating agency.

3 Examples: Deutche Bank (Credit Strategy, 19 November 2020); JP Morgan LevFin Conference (Daniel Lamy), 9 September 2020.

4 Credit Suisse, default review, 2 December 2020

5 Financial leverage, a company’s ability to pay off its debt, is calculated as net debt/EBITDA. Thus, should EBITDA fall from 100 to 50, then if leverage was at 5x to begin with, it would finish at 10x after the fall in earnings.

6 The CS WELLI constituents of leisure/gaming saw the reclassification of two borrowers from the media sector into the leisure sector as of November 2020. Our analysis has removed the impact of this change to provide a consistent series.