Subscribe

Sign up for timely perspectives delivered to your inbox.

At its last policy meeting for 2020, the Federal Reserve (Fed) explicitly linked accommodative policy measures to inflation and employment goals but did not expand the amount of stimulus. That decision could prove to be a prudent one as the U.S. economy potentially nears an important crossroads, says Head of Global Bonds Nick Maroutsos.

Some observers may fret at what they perceive as the Federal Reserve (Fed) sitting on its hands at the conclusion of its last policy meeting for 2020. Exercising a flagrant example of “what have you done for me lately,” these same observers seem to have forgotten the heretofore unimaginable actions taken by the Fed in the midst of the COVID-19 pandemic. We, on the other hand, are not surprised by the Fed’s circumspect approach. Chairman Jay Powell and his peers, in our view, did not offer up muscular forward guidance or codified yield-curve control because they don’t have to. Longer-term Treasury yields aren’t going anywhere any time soon. Furthermore, it benefits Mr. Powell to keep a few bullets in his magazine should the optimism that riskier assets are pricing into the global economy for 2021 prove misguided.

The Fed can afford to be methodical because it recognizes the magnitude of support it has already provided to the U.S. economy and that any additional steps may, in fact, result in diminishing returns. Instead, Mr. Powell has been vocal in his pleas for additional fiscal help from elected officials. That may be coming once President-elect Joe Biden is sworn in on January 20, although the exact size of a package will be influenced by the outcomes of Georgia’s two Senatorial runoffs. Should the two Republican candidates prevail, resulting in an underwhelming fiscal lifeline, the Fed may be forced to become more assertive in supporting the economy.

Another reason the Fed may have held fire for now is the still-uncertain timing of a nationwide rollout of COVID-19 vaccines. What the scientific community has achieved in nine months would stun epidemiologists from earlier generations. But while developing and approving a series of vaccines in under a year is laudable, effectively implementing a global vaccination program that materially stunts the spread of virus is another matter. In addition to logistical complexity, surveys indicate that there is trepidation among citizens about taking a vaccine. With markets pricing in a “better case” scenario for both fiscal policy and vaccines, we believe the Fed is wise to wait and see how these situations play out before committing itself to new policy initiatives.

Should the economy stall in 2021 or meaningful fiscal help not be forthcoming, Mr. Powell could then reiterate the Fed’s commitment to accommodation. We still believe that negative rates are off the table given their dubious record in other countries, and official yield-curve control is not necessary, as Mr. Powell’s words – backed by the power of the Fed – should suffice to keep bearish Treasury investors in line. At critical times throughout his tenure, Mr. Powell has proven again and again to out-dove the doves.

Yet even if riskier assets are correct and the global economy finds solid footing in 2021, it is our view that interest rates still won’t rise much. The Fed has all but etched in stone that its benchmark overnight lending rate will stay pegged to the zero-bound well into 2023. Given that in the decade since the Global Financial Crisis, the Fed consistently underdelivered on its own estimates for rate hikes, its capitulation with respect to flat interest rates speaks volumes.

Longer term rates, in our view, won’t budge much either. The Fed likely recognizes the economic dislocations caused by the pandemic. Structural unemployment has risen, and given the sea-change in several industries, among them travel and retail, low unemployment rates like 2019’s 3.5% may become a relic of the past. With the labor force having undergone such a rapid and likely secular contraction, we doubt that the Fed’s historical preeminent foil – inflation – will be a major concern over the medium term. Also diminishing the prospect of inflation is the acceleration of digital adoption by households and businesses during the pandemic. As we have espoused in the past, technological disruption of this nature tends to be disinflationary.

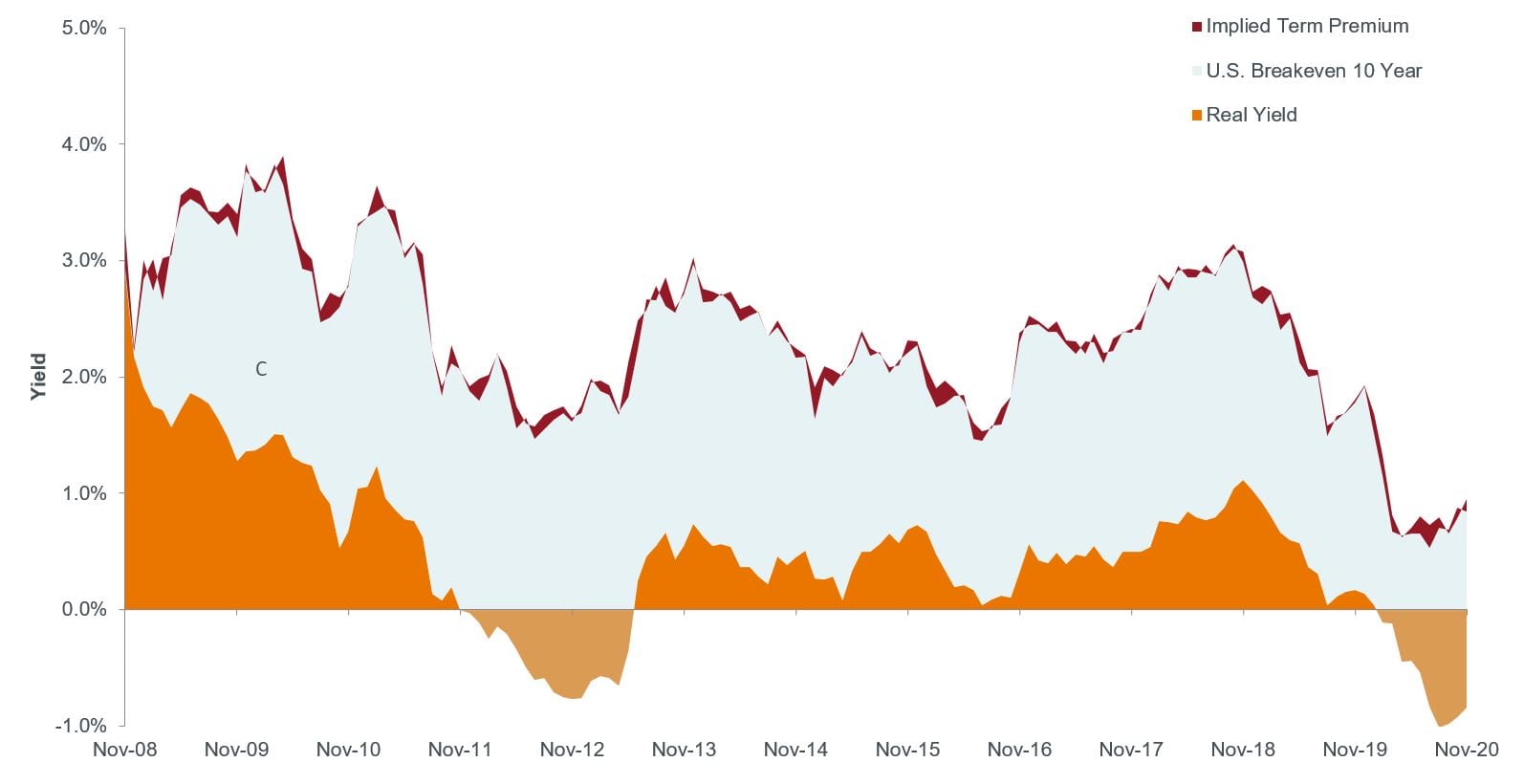

Investors have been particularly fixated on the yield of the 10-year U.S. Treasury reaching 1.0%. Such obsessions miss the mark as the real yield on the 10-year – the nominal yield less expected inflation – is well below 0.0%. Simply put, even if nominal rates rise, the level of real interest rates – those that truly impact investment decisions in the economy – will remain highly accommodative.

Unlike roaring equities, bond markets are more cautious on U.S. economic growth, as evidenced by real yields on U.S. Treasuries sitting at less than -0.8%. Real yields tend to equal real economic growth expectations, and while accommodative monetary policy has likely pushed down bond yields, low real yields still hint at subdued economic growth.

[caption id=”attachment_343801″ align=”alignnone” width=”1594″] Source: Bloomberg, as of 30 November 2020. Implied term premium refers to the excess return that investors can expect for holding longer-dated bonds over shorter-dated bonds. The 10-year breakeven rate measures the difference between 10-year Treasury bonds and Treasury Inflation Protected Securities.[/caption]

Source: Bloomberg, as of 30 November 2020. Implied term premium refers to the excess return that investors can expect for holding longer-dated bonds over shorter-dated bonds. The 10-year breakeven rate measures the difference between 10-year Treasury bonds and Treasury Inflation Protected Securities.[/caption]

Yet even if nominal rates slowly creep up – that alone being a welcome sign of economic recovery – we believe Treasury yields would be capped as foreign buyers stuck in zero-to-negative yielding regions would rush in to capitalize on yield differentials. The U.S. as a destination for foreign capital is only enhanced by Treasuries’ status as a “safe haven.”

A low rate environment presents a conundrum for bond investors. To be sure, attractive capital gains could have been harvested in 2020 given the wide spreads between yields on riskier asset classes such as corporate bonds and those on their risk-free benchmarks. With spreads much tighter now, those opportunities have diminished. While high-yield credits and emerging market bonds appear to offer relatively attractive yields, these higher beta segments of the market tend to be more volatile. With any downside surprise to the global economy, the characteristics of diversification and capital preservation that one typically expects from bonds would likely not be there.

No one knows with certainty exactly what path the global economy will take in 2020. We do know that riskier assets such as stocks and high-yield bonds are pricing in a better-case scenario. That leaves little margin of error should growth stall. Similarly, while we believe that longer-term Treasury yields won’t move much higher, they could inch up and at current yields it would only take a minimal capital loss to wipe out the annual income generated by these instruments.

We also know that the Fed and other major central banks are committed to low rates and other accommodative measures. Accordingly, it is our belief that shorter-dated bonds remain one of the few destinations that still offer investors the potential for capital preservation and diversification from equities. And for those seeking more attractive yields, rather than simply making one’s bond allocation “equities light,” several countries offer higher yields to U.S. issuers with similar credit quality. The market for new issuance also stands as one of the few destinations where bond investors get access to securities at attractive pricing.

What should be on the radar for investors in 2021?