Subscribe

Sign up for timely perspectives delivered to your inbox.

Why markets could weaken

1. Global six-month real narrow money growth fell below industrial output growth in October. Equities have underperformed cash on average when this has been the case historically (allowing for a two-month reporting lag, i.e. the signal is negative from December).

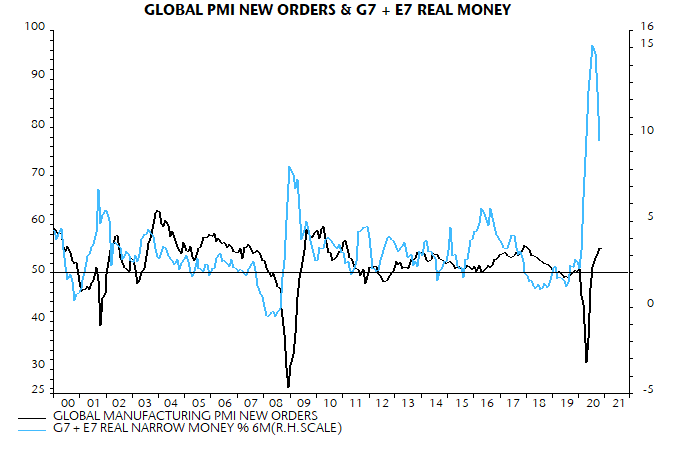

2. Global manufacturing PMI new orders are probably closing on a short-term peak. Six-month real narrow money growth peaked in July and has led peaks in PMI new orders by seven months on average historically – see chart. PMI peaks are often associated with market weakness.

3. Headline CPI inflation rates will rise sharply into Q2 2021, reflecting energy price movements and a likely increase in core momentum as policy effects reverse and firms pass on higher costs (global PMI manufacturing and services output price indices are above average).

4. The Chinese economy could disappoint current bullish expectations in H1 2021: market rates have risen significantly and money / credit growth is moderate and slowing.

5. The pattern of market returns since the Q2 2020 stockbuilding cycle low has been consistent with prior cycle recoveries but some of the moves look extended.

Why any significant correction could represent a buying opportunity (conditional on confirmation from monetary and other signals)

1. The negative real narrow money / industrial output growth gap reflects a temporary spike in the in the latter – a reversal is possible as early as January (implying a positive market signal for March, allowing for the two-month lag).

2. Real narrow money growth remains above average and the three investment cycles – stockbuilding, business capex and housing – are all now in upswings, so any PMI weakness is likely to be modest and short-lived.

3. Bear markets usually start after the stockbuilding cycle peaks – unlikely before late 2021 at the earliest.

4. The Chinese authorities will probably act to cap rates and stabilise money / credit growth at an expansionary level.

5. The global broad money stock remains well above the level consistent with current levels of nominal GDP and asset prices, implying medium-term upward pressure on some combination of activity, goods and services prices and markets.

What could derail the correction scenario

The correction possibility derives from the moderation in global real money growth after its March-July surge. An immediate new pick-up in money growth would give markets an additional boost and could neutralise the above-mentioned short-term negative factors. Commodity price strength would probably extend significantly further in this scenario, implying a larger rise in inflation. Associated upward pressure on bond yields could lead to more serious and sustained weakness in equities later in 2021. November / December monetary data will be important for assessing the validity of this alternative scenario.