Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio managers Guy Barnard, Tim Gibson and Greg Kuhl highlight how investor misconceptions are creating attractive opportunities and why an active selective approach could be the most rewarding.

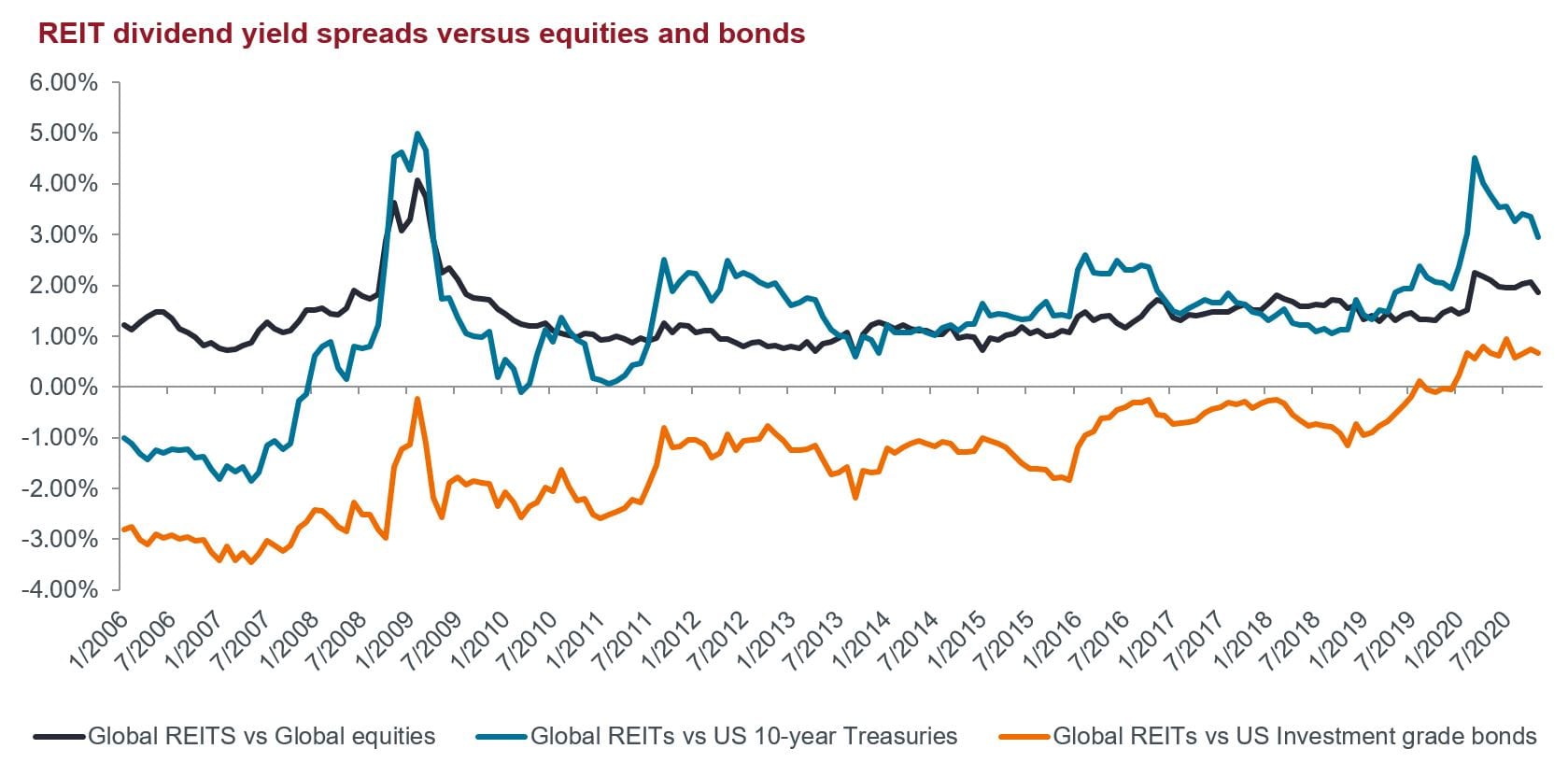

Listed real estate, as an asset class, found itself on the wrong side of investor perceptions for much of 2020, with its performance significantly lagging that of global equities.1 However, in spite of perceived uncertainty, we have seen the cash flow (via rent collections) for many types of real estate with long‑term contractual leases remain resilient.2 This has resulted in the mainly high-quality income streams of global real estate stocks looking undervalued versus other major asset classes, such as general equities and bonds (see chart).

Looking into 2021, the reality of several highly effective COVID-19 vaccines being on the brink of distribution (at the time of writing) may improve investors’ perceptions of listed real estate, removing some of the more dire outcomes from the menu of possible future scenarios. In turn, we are hopeful that valuations for listed real estate will “return to normal” along with the lives of those who inhabit it.

[caption id=”attachment_340425″ align=”alignnone” width=”1679″] Source: FTSE EPRA/NAREIT Global Developed Index (global real estate investment trusts = REITs), MSCI World Index (global equities), Bloomberg GT10 Govt (U.S. 10-year Treasuries), Moody’s Bond Indices Corporate BAA (U.S. investment grade bonds), as at 30 November 2020. Past performance is not a guide to future performance. Note: Dividend yield is the dividend expressed as a percentage of current share price. Dividend yield spread = difference between dividend yield for REITs and the asset classes shown. Dividend yields are not guaranteed.[/caption]

Source: FTSE EPRA/NAREIT Global Developed Index (global real estate investment trusts = REITs), MSCI World Index (global equities), Bloomberg GT10 Govt (U.S. 10-year Treasuries), Moody’s Bond Indices Corporate BAA (U.S. investment grade bonds), as at 30 November 2020. Past performance is not a guide to future performance. Note: Dividend yield is the dividend expressed as a percentage of current share price. Dividend yield spread = difference between dividend yield for REITs and the asset classes shown. Dividend yields are not guaranteed.[/caption]

When speaking of “the market” and “the asset class,” it is important to keep in mind that these terms are a shorthand, useful means of communicating generalities. A more appropriate approach is to look more deeply at the parts that make up the whole. The listed real estate asset class is comprised of hundreds of companies owning thousands of physical assets across dozens of property types around the world. Each of these variables comes with its own set of supply and demand characteristics, some of which are much more favorable to landlords than others.

Before, during and after the pandemic, there are several important long-term trends that are likely to continue to endure, and, in our view, can be used to identify which real estate sectors and locations are likely to generate the strongest returns. Specific examples are demographics, digitization, sustainability and the increasing adoption of convenience lifestyles. The confluence of these factors will most likely continue to benefit listed real estate companies owning logistics warehouses, cell towers, data centers, housing tailored to baby boomers and millennials, and various forms of experiential real estate.

However, owners of bricks and mortar retail and commodity office buildings, which form a significant percentage of the listed real estate market, are likely to find the competition for tenants ever fiercer and their rental pricing power diminishing. The world of real estate was made up of “haves” and “have nots” before the pandemic and, if anything, 2020 has only served to further separate the future prospects of these two groups.

While the weightings of an index, by definition, reflect what has worked in the past, the holdings of a successful actively managed portfolio need to reflect what will work in the future. In an asset class comprised of winners and losers with such vastly differing future prospects, we believe a high conviction, differentiated approach is crucial to achieving attractive returns from real estate.

With the world on the verge of a return to normal as 2020 draws to a close, there are select opportunities in areas of the listed real estate market that can be classified as ‘cheap but not broken’. These stocks have been severely punished by the stock market but could still offer a reasonable path to sustainable growth. We intend to continue to take advantage of these opportunities where we find them. However, our expectation is that over time, a bias toward well-managed, attractively priced real estate companies with property types and geographies in the path of growth will win the day.

What should be on the radar for investors in 2021?

Explore Now

1Global REITs (FTSE EPRA/NAREIT Developed Index) versus global equities (MSCI World Index) total returns in U.S. dollars, 31 December 2019 to 30 November 2020. Past performance is not a guide to future performance.

2Source: Janus Henderson Investors, company filings and commentary as at Q3 2020. Based on US REIT (real estate investment trust) rental collections for April to July 2020. Excludes retail, only properties with contractual leases are included.

Experiential real estate: using cutting-edge technology and data to create a more memorable, highly personalized buying experience.

High conviction: an investment approach that focuses on a small number of stocks that have the potential to outperform.

The FTSE EPRA/NAREIT Developed Index is a free-float adjusted, market capitalization-weighted index designed to track the performance of listed real estate companies in developed countries worldwide. Constituents of the Index are screened on liquidity, size and revenue.