Subscribe

Sign up for timely perspectives delivered to your inbox.

Technology equities portfolio managers Alison Porter, Graeme Clark and Richard Clode highlight the rapid acceleration of long-term tech themes this year and explore expectations for 2021.

Entering this year, we fully expected that strong secular technology growth themes such as payment digitisation, internet transformation (everything on demand) and next generation infrastructure, would continue to gain traction. Before COVID-19, however, we would not have predicted the accelerated pace at which this would occur in 2020. The digital transformation of our lives, across all demographics and geographies was mandated by the measures put in place to tackle the global virus, at the same time when central banks and governments unleashed funding and policy support at levels unseen since the 2008 Global Financial Crisis.

As the Chief Executive of online education provider Chegg commented, “…a crisis often accelerates the inevitable…”. We see strong evidence that the convergence of long-term growth themes is driving an even broader set of opportunities for investors within technology. As commerce increasingly moves online, social media platforms are establishing their roles as shopping malls ̶ developing social commerce patterns that we have seen emerge in China. This is driving demand for payment digitisation as small and medium-sized businesses, governments and consumers seek more efficient transactions and peer-to-peer transfers. The ease of transacting online is broadening the spectrum of the internet transformation theme to areas such as education, e-sports, primary healthcare, pharmacy and groceries, which have moved from nascent to early stages of adoption. As a virus vaccine is rolled out, we believe societies will revert to ‘a new normal,’ where we will inevitably rely more on technology, have more flexibility for workers, more convenience for families, more efficiency for businesses, more accessibility for students, and be kinder to the environment.

We believe companies that stand to benefit from the rising and broadening adoption of technology by consumers and businesses will require an acceleration of investment to ensure scalable, seamless, fast and reliable connectivity. Investment in next generation infrastructure, such as 5G, cloud, edge computing1 and the associated silicon (used in microchips, transistors, electronic circuits etc), could be further boosted by fiscal policy via increases in government spending and/or lowering taxes to create a greener and more inclusive economy.

Our conviction and enthusiasm for the growth prospects of the tech sector remain high, but we recognise that a combination of low interest rates and pandemic conditions has resulted in a rapid acceleration in valuations in some segments of the sector, like high growth software and certain commerce-related areas.

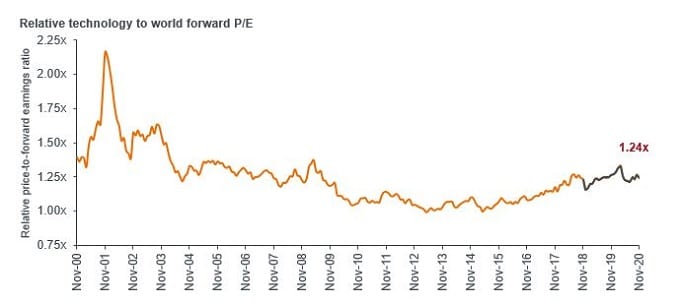

Source: Bernstein, as at 30 November 2020. Note: Forward P/E = Price to forward earnings. (Orange line) MSCI ACWI Information Technology Sector, price-to-forward earnings relative to MSCI All Country World Index (ACWI) from November 2000 to November 2018 pre GICS sector changes in MSCI Global indices, then (black line) MSCI ACWI Information Technology + ACWI Communication Services Index relative to MSCI ACWI Index to 30 November 2020 post GICS sector changes in MSCI global indices. Past performance is not a guide to future performance.

Chart 1 above shows that the valuation – based on the market price of companies compared to their forward (estimated) earnings – of the technology sector as a whole relative to the broader global equity market currently appears attractive given the superior growth profile and balance sheets2 of many tech companies.

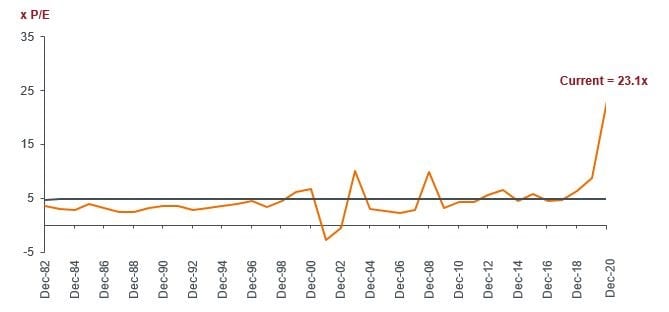

Source: Bernstein Quantitative Team (Larson), as at 2 December 2020. Note: Chart uses price-to-earnings (P/E) year-end datapoints to 2019 and current datapoint as at 2 December 2020. Past performance is not a guide to future performance.

Chart 2, however, shows the divergence between the most and least expensive stocks in the technology sector. This bifurcation in valuations within the sector is extreme by historical standards and reflects in part the increasing diversity within the sector. It also, however, indicates that there are pockets of hype (some stocks trading on more than 30 times’ forecast revenues), which warrant caution and requires experience in stock selection and a disciplined valuation-aware approach.

Given the consistent outperformance of the technology sector versus the broader equities market over the past twenty years,3 the fact that high relative valuations remain within historical ranges (chart 1) often comes as a surprise to investors. This sustained outperformance can be attributed to the superior earnings growth that the technology sector has achieved compared to other sectors, which we believe has the potential to be sustainable over the long term.

Earnings for the technology sector have grown this year – one of only three sectors to do so (utilities and consumer staples being the others). While we expect that the earnings recovery in the broader market may be faster in 2021, simply due to comparisons with 2020, the tech sector has the potential for a return to superior earnings growth. This reflects the sector’s record of exceptional financial strength and having the highest propensity to reinvest for growth through research and development.4

We believe that the long-term drivers of technology share gains ̶ demographics and a host of powerful long-term growth themes are even more relevant in a post-pandemic world than ever before. While pockets of hype in the sector temper our enthusiasm, overall, we enter 2021 with optimism for a recovering global economy and a political backdrop that will continue to be favourable for technology equities but where valuation discipline will be required.

Footnotes

1Edge computing is computing that is done at or near the source of the data, instead of the cloud (centralised computing). This enables improved response times and reduces the required bandwidth.

2Credit Suisse as at 9 November 2020. Information Technology versus other MSCI World Sector indices excluding Financials. Comparison based on net cash (cash minus debt) as percentage of market capitalisation = a measure of the net cash on a company’s balance sheet as a percentage of its total market capitalisation. Data correct at time of publication and is subject to change.

3Refinitiv Datastream. Price returns in US dollars, MSCI ACWI Information Technology Index relative to MSCI AC World Index (broader equities), 20 years to 30 November 2020, Past performance is not a guide to future performance.

4 Source: Bloomberg. Top ten global spenders on R&D (in billions of US Dollars) as at 31 October 2020.