Subscribe

Sign up for timely perspectives delivered to your inbox.

Jenna Barnard and John Pattullo explain how credit markets navigated COVID-19 with relative ease and why corporate bonds remain in the sweet spot for 2021.

“Idyllic” is the word we have been using to describe the investment environment for corporate bonds since March 2020. This is in stark contrast to the news flow surrounding the pandemic (the positive vaccine news only arrived in November), but a confluence of market factors served to make this economic crisis one which has had only minor ripples for credit (corporate bond) markets.

It is worth noting that lenders (banks and credit markets) were not the villains of the piece on this occasion, as they have been in the last two economic downturns in which they either caused or exacerbated economic weakness. Rather, this time around, lenders have stepped up to bridge liquidity shortfalls for companies adversely affected by COVID‑19, ensuring that a liquidity crisis has not become a widespread solvency crisis for the large companies that access public capital markets.

Further, the key concern for corporate bond investors – solvency of the borrower, or defaults – have been remarkably muted in aggregate and concentrated in obvious problem areas, which have disappointed for years, such as energy fracking companies in the U.S. and traditional retailers in structural decline. Clearly, government and central bank support have played a crucial part in encouraging this generosity and putting a floor under the economy and capital markets. However, it has been a most unusual credit cycle, different to any experienced in living memory.

In the first few weeks of the COVID shock, we took the view that this is a liquidity rather than a solvency crisis (which subsequently proved to be correct and gradually became a consensus view after April).

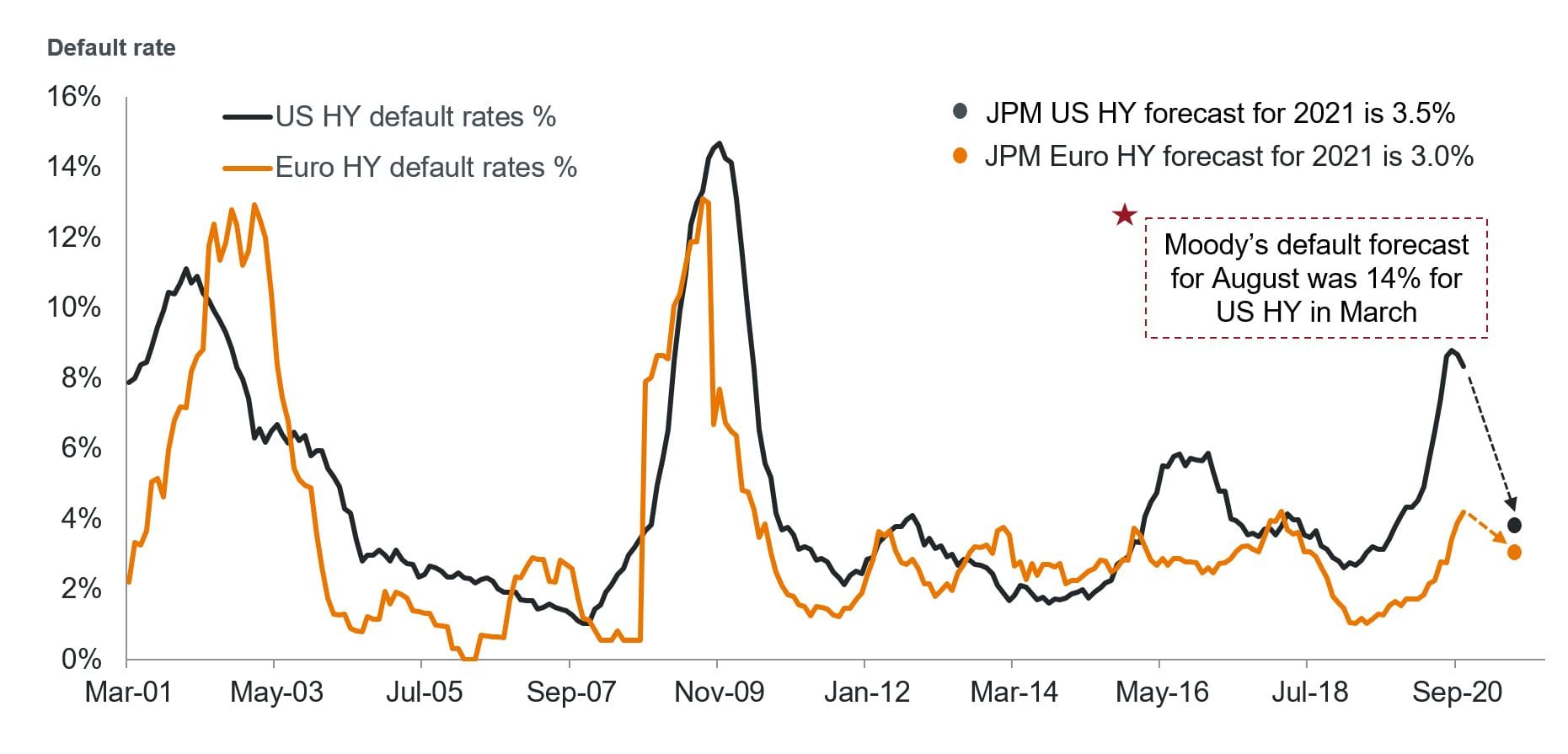

Figure 1 shows the actual defaults experienced in the riskiest part of the corporate bond market, i.e., high yield in the U.S. and Europe. At the height of the market crisis in March, the extreme economic downturn led credit rating agency Moody’s to forecast default rates of around 14% for both the U.S. and Europe.

In contrast to the forecast, Europe has not experienced a major rise in default rates in 2020, currently running at 4.1% defaults and peaking. In the U.S., although the high-yield sector has suffered (again), default rates are remarkably similar to Europe at 2.6%, excluding energy and retail.

[caption id=”attachment_339791″ align=”alignnone” width=”1861″] Source: Moody’s, JP Morgan and Janus Henderson Investors, as at 31 October 2020 Note: HY = high yield.[/caption]

Source: Moody’s, JP Morgan and Janus Henderson Investors, as at 31 October 2020 Note: HY = high yield.[/caption]

Apart from in the very obvious sectors, there has not really been a default cycle in the high-yield market. Its absence is remarkable and is a function of the government response and the willingness of credit (and in some cases equity) investors to provide monies to bridge the challenging months ahead. There have been pockets of defaults and problems of course, but it has not been a generalized, cross-sector default story. That is a very important point, and one that gets missed amid the doom and gloom.

Credit rating downgrade volumes reinforce the story. The surge in downgrades in the spring was expected but it collapsed very quickly and did not linger as in previous crises. With authorities’ support, the lights were switched back on in the corporate bond markets, which witnessed a surge in issuance, mainly in investment grade markets but also in high yield.

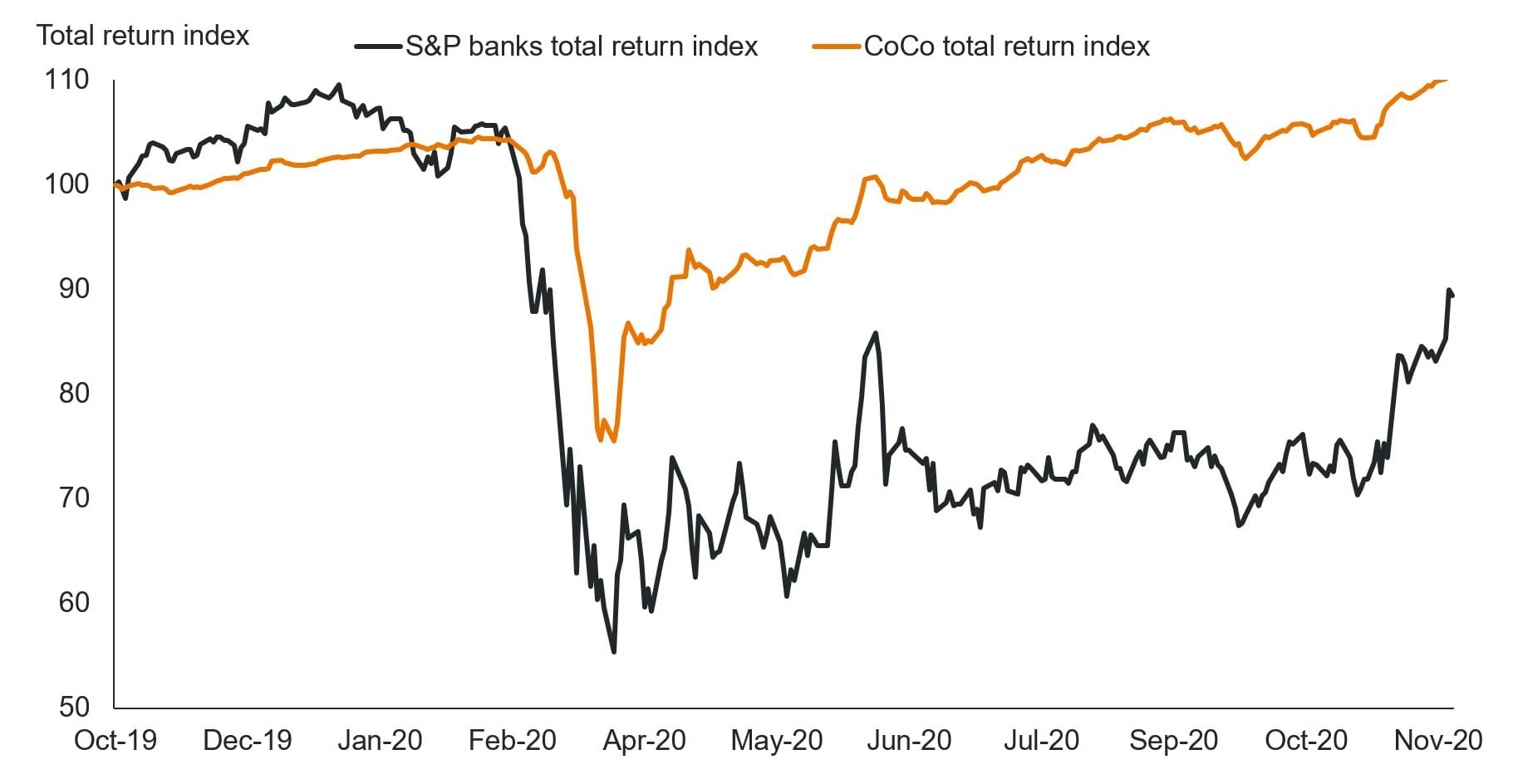

Looking at the other risky part of the credit markets, a similar pattern has emerged in the banking sector. Actual impairments have not been anywhere near as high as expectations when banks aggressively provisioned for future losses in their second quarter results.

Amazingly, for credit investors, this crisis has been beneficial for their bonds as banks across the UK, Europe and U.S. built up equity capital levels despite their conservative provisioning. This was due to both strong organic earnings and the intervention of regulators who unilaterally banned ordinary dividends and share buybacks.

Figure 2 shows the total returns of the most subordinated, hybrid contingent convertible, or “Coco” bonds, recovering almost all their losses by the end of October compared to ordinary equity returns. This is an interesting example of the divergence between credit and equity performance in this cycle.

[caption id=”attachment_339804″ align=”alignnone” width=”1821″] Source: Bloomberg, Janus Henderson Investors, as at 25 November 2020 Note: ICE BofA indices. Past performance is not a guide to future performance.[/caption]

Source: Bloomberg, Janus Henderson Investors, as at 25 November 2020 Note: ICE BofA indices. Past performance is not a guide to future performance.[/caption]

Since the height of the COVID crisis, companies have raised a war chest of cash and engaged in repairing their balance sheets. We believe that we are now past the peak in credit rating downgrades and lapping past the peak in default rates.

The outlook for credit investors remains encouraging, albeit tempered by the much lower yields on offer relative to Q2 and early Q3 of 2020. The backdrop, however, remains fundamentally positive, given we are in an early cycle environment in which debt investors continue to be treated preferentially relative to equity investors. This is a sweet spot for credit.

The positive vaccine news cements this outlook and 2021 looks set to be a more interesting year for central banks than credit investors. Should the economic recovery be stronger than their pessimistic forecasts, the guidance of no rate hikes for the next few years will be tested, as will their willingness and ability to monetize government debt via continued quantitative easing programs.

What should be on the radar for investors in 2021?

Explore Now

Glossary

Coco bonds: Contingent convertible notes, more commonly known as “cocos,” issued to enhance regulatory bank capital. The bonds are loss absorbing and are designed to prevent tax-payer bailouts of banks in the future.

Credit: refers to bonds within fixed income markets where the borrower is not a sovereign or government entity. Typically, the borrower will be a company or an individual, and the borrowings will be in the form of bonds, loans or other fixed interest asset classes.

Credit cycle: this reflects the expansion and contraction of access to credit (borrowing) over time. It is related to changes in the economy and the monetary policy pursued by central banks.

Credit market: a marketplace for investment in corporate bonds and associated derivatives.

Default: the failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Equity capital: equity capital is funds paid into a business by investors in exchange for common or preferred stock. This represents the core funding of a business, to which debt funding may be added.

Fiscal policy: connected with government taxes, debts and spending.

High yield: corporate bonds rated below investment grade (BBB/Baa3) by major credit rating agencies such as Moody’s or Standard & Poor’s (S&P).

Hybrid bonds: hybrid bonds are subordinated debt instruments issued by non-financial companies or corporates. They are known as ‘hybrids’ because they combine characteristics of bonds and equities.

Leverage: the use of borrowing to increase exposure to an asset or market.

Liquidity: typically refers to a company’s ability to use its current assets to meet its current or short-term liabilities.

Monetary policy: the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Solvency: the ability of a company to meet its long-term debts and financial obligations.

Structural decline: refers to when structural changes in society, including changing demographics, consumer behavior, low-growth economics and technology-driven disruption, impact a business.