Subscribe

Sign up for timely perspectives delivered to your inbox.

David Elms, Head of Diversified Alternatives, argues for new thinking for investors’ portfolios in 2021, following a year in which the pandemic posed unfamiliar challenges for industries.

As we move into 2021, we see two key factors that could unsettle markets again. We think that COVID-19 and its implications will continue to dominate the agenda, with consequent risks and opportunities for investors. COVID, and the global vaccination response, remain an unknown with regards to the logistics of production, delivery and inoculation, or how effective any approved vaccine might be beyond a test environment. There is a risk that any vaccine may not be effective for a long period of time. It is not clear how much or in what way the virus might mutate, and how vaccine development can track that.

We also think the policy response to cover it is also going to be a key factor. Has there been enough stimulus to lift the economy back to a more normal growth trajectory? Or have stimulus measures been too aggressive, particularly in a scenario where a vaccine performs better, and arrives sooner, than expected? Investors will need to factor these and other considerations into their decisions. This is an environment where market norms have become outdated, and investors will have to work harder to find investment strategies capable of meeting their investment objectives.

The alternatives category is a broad one, covering any financial asset that does not fall into the traditional asset classes like equity and fixed income. We see opportunities for adaptable investment propositions that can allocate between different strategies, deploying or withdrawing capital as market conditions change, or specific investment opportunities become more or less crowded.

Diversification is always an important focus for us – not just diversification by asset class, but real diversification, in terms of the underlying drivers of performance. Investors have benefited from strong, supportive market environments generally for equities and bonds for the past three decades, but this has left these asset classes priced at levels that are on the expensive side of history.

We think that there is a strong argument for investors to make more space for alternatives in their portfolios. Ultimately, it comes down to client experience. If you can deliver attractive, risk-adjusted returns with performance drivers that have little or no correlation to equities and bonds, or hedge funds, then you are likely to be far more useful to a client in the current market environment.

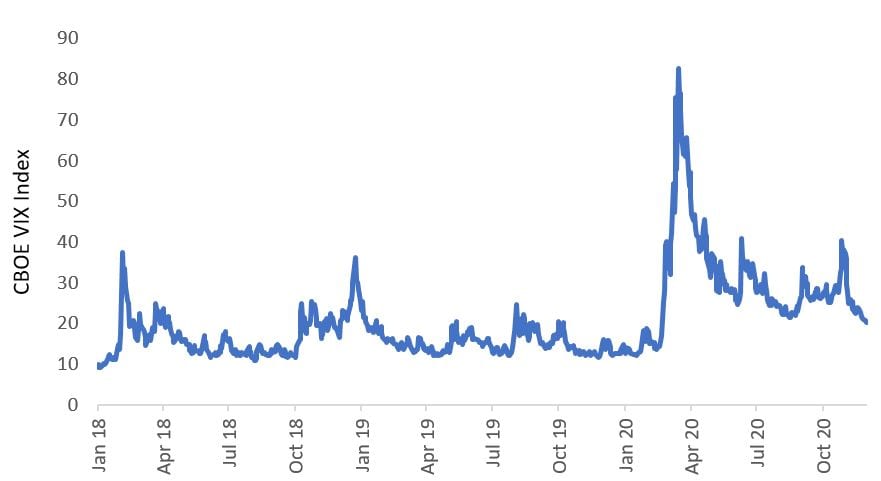

This year saw the coronavirus deliver a significant shock to markets, characterized by a sharp increase in volatility. Exhibit 1 is a simple chart of the VIX since the start of 2018, which clearly shows the “quiescent” market conditions that we talk about as having characterized 2018-2019 together – and the magnitude and speed of onset of the spike in volatility when the dangers of COVID became apparent in early 2020. It is nothing innovative, but it clearly frames why 2020 was different.

[caption id=”attachment_338707″ align=”alignnone” width=”881″] Source: Bloomberg, 31 December 2017 to 29 November 2020. The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) – commonly called the “Fear Index” – shows expectations for price changes in the S&P500 Index over the next 30 days.[/caption]

Source: Bloomberg, 31 December 2017 to 29 November 2020. The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) – commonly called the “Fear Index” – shows expectations for price changes in the S&P500 Index over the next 30 days.[/caption]

For a long time now, investors have been relaxed about what they might wake up to in the morning. In these environments, the temptation is often to take more risks, commonly in the form of leverage (borrowing money to invest), in an effort to augment returns and avoid “missing out.”

The speed and severity of market falls in the first quarter of 2020 reminded us that leverage can be dangerous in adverse environments as many market participants failed to adapt quickly enough to the change in market conditions. The risk of 2008-style contagion was avoided after the US Federal Reserve stepped in to stabilize markets, with valuable lessons learned from 2008 about the importance of rapid action when a crisis emerges.

While we may have turned a corner in the fight against COVID-19, there are still plenty of challenges to face in 2021 and there is still potential for further surprises – something we believe investors should factor into their investment decisions in the coming months.

What should be on the radar for investors in 2021?

Explore Now