Subscribe

Sign up for timely perspectives delivered to your inbox.

G7 headline and core CPI inflation are likely to pick up into Q2 2021. The “monetarist” view here is that increases will be sustained into 2022, reflecting the surge in G7 broad money in Q2 / Q3 2020.

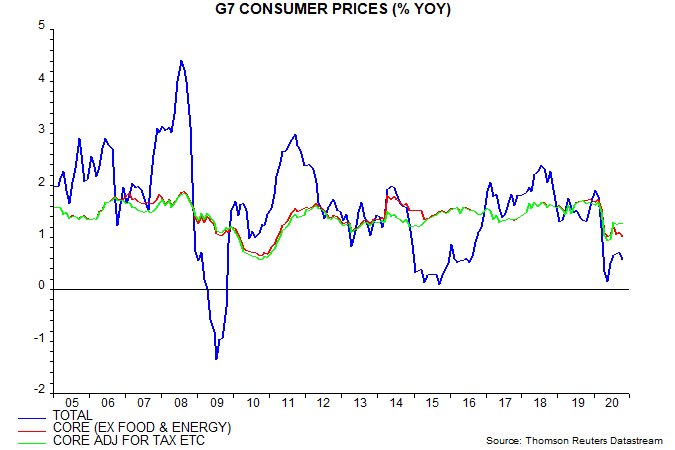

Headline CPI inflation eased to 0.6% in October, above a May low of 0.2%; core inflation, i.e. ex. food and energy, returned to its low of 1.0% – see first chart. Core inflation is at its weakest level since 2011. These numbers are calculated by averaging national data using GDP weights.

Both headline and core rates have been temporarily depressed by covid-related tax relief and subsidies, including the temporary VAT cuts in Germany and the UK and the Go To Travel programme in Japan. The headline rate also reflects a steep year-on-year fall in energy prices. Core inflation ex. tax and subsidy effects is estimated here at 1.3% in October, close to a 1.4% average since 2012 – first chart.

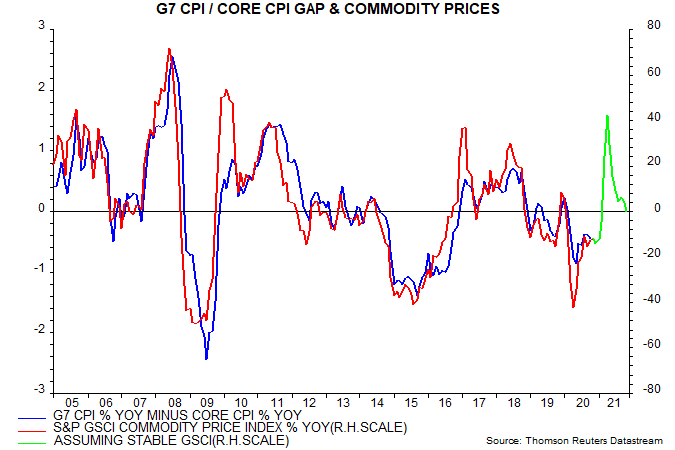

The impact of energy and other commodity prices on headline inflation will shift from negative to significantly positive by Q2 2021, reflecting a base effect from the plunge in prices into April 2020. The gap between headline and core inflation could move from -0.4 percentage points (pp) in October to +1 pp or more, assuming that commodity prices are stable at their current level – second chart.

The tax / subsidy measures are scheduled to expire by Q2. If “true” core inflation is stable at 1.3%, headline inflation could rise to 2.3% or higher, representing a sharp increase from the current 0.6%.

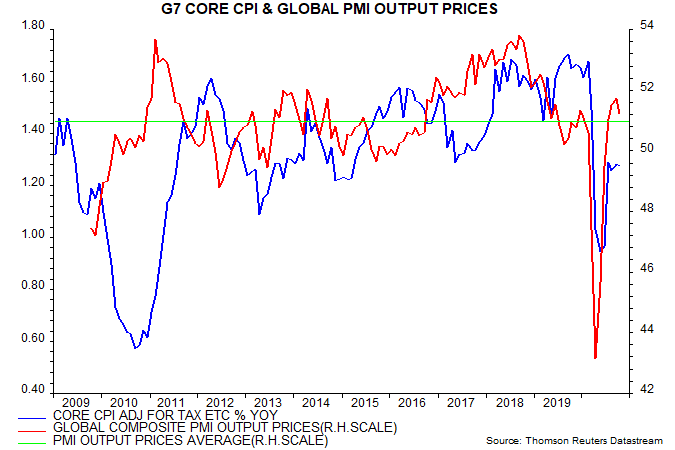

Will core inflation also rise? The recent recovery in the adjusted measure mirrors a rebound in the global composite PMI output price index, which is above its average since 2009 (when the series starts) – third chart. The index fell slightly in October but November flash results suggest a rise to a new recovery high.

The consensus view that inflation will remain weak relies on “output gapology”. The “monetarist” forecast of a significant pick-up rests partly on strong demand growth rapidly eroding slack but also a direct effect of monetary excess on commodity prices and pricing power more generally. Manufacturing capacity use is already approaching normal while pent-up demand may result in bottlenecks in services as economies reopen, allowing firms to widen margins to offset covid-related losses.

How far could G7 inflation rise? A smaller increase in broad money growth in the late 2000s was associated with a pick-up in CPI inflation to a peak of over 4%. That rise, however, was rapidly reversed as broad money contracted in the aftermath of the GFC. A reasonable expectation is that headline CPI inflation will reach 4%+ again in 2021-22 and will remain elevated as central bank financing of fiscal deficits supports broad money growth above its 2010s average.