Subscribe

Sign up for timely perspectives delivered to your inbox.

Recent economic and monetary data confirm that the monetary backdrop for markets has become temporarily less favourable.

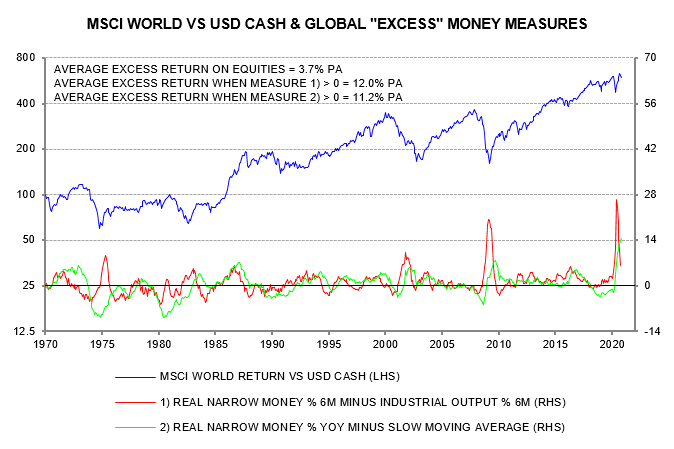

Market prospects are related to the concept of “excess” money growth – the gap between the actual rate of growth of the money stock and the growth rate needed to support economic expansion. A positive gap is associated with an increase in demand for financial assets and upward pressure on their prices.

Excess money growth is unobservable. Two proxy measures are monitored here – the gap between real narrow money and industrial output growth, and the deviation of real money growth from a slow moving average.

Global versions of the two measures are shown in the first chart, which provides evidence of their usefulness for anticipating market environments.

Both measures surged after the Q1 slump in equity markets, suggesting an unusually favourable buying opportunity.

The final data points for the measures in the chart are for September. The second measure – the deviation of 12-month real narrow money growth from its moving average – will remain positive well into 2021. Recent data, however, confirm that the first measure – the gap between six-month growth rates of real money and industrial output – will have turned negative in October.

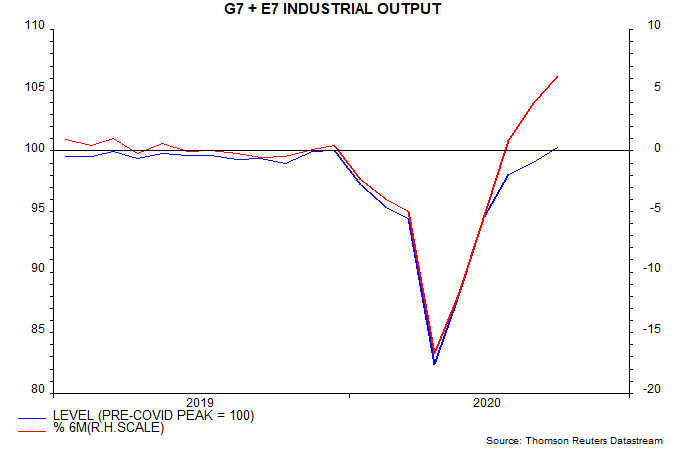

September industrial output data are now available across countries. Global (i.e. G7 plus E7) output surpassed the pre-covid peak in September, one month earlier than had been expected here – second chart. Six-month growth rose to 6.2% (not annualised) and is likely to have reached more than 20% in October, reflecting the dropping out of April’s 12.8% output plunge.

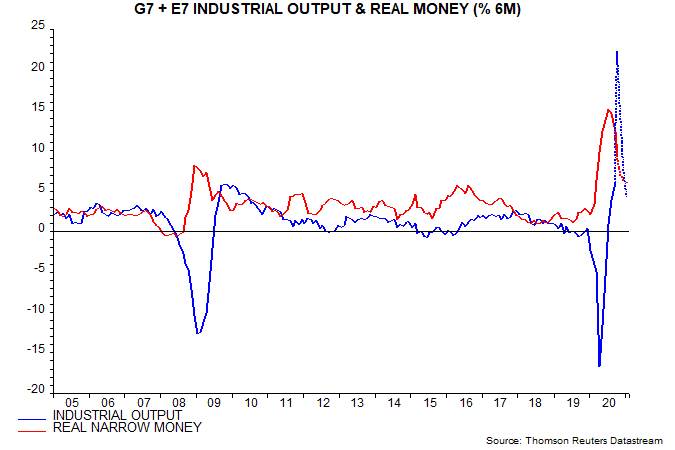

G7 plus E7 six-month real narrow money growth, meanwhile, is estimated to have moderated to 9.5% in October, based on monetary data for the US, Japan, China, Brazil and India, together accounting for 70% of the G7 plus E7 aggregate. So real money growth will have crossed beneath industrial output growth last month – third chart.

This real money growth shortfall is likely to prove temporary. Six-month industrial output growth will fall back sharply as base effects shift from positive to neutral. Recent monthly momentum suggests that real money growth will stabilise above likely output growth. The illustrative projections shown by the dotted lines in the chart imply restoration of a positive real money / output growth gap in January.

The current move into negative, nevertheless, warrants a more cautious view of immediate market prospects than in the spring and summer.

A relevant comparison may be with September 2009-June 2010 during the initial economic recovery from the GFC recession. G7 plus E7 six-month real narrow money growth was below (strong) industrial output growth during this period but 12-month real money growth remained above its moving average – see first chart. The global stockbuilding cycle, moreover, was in an upswing phase, as it is likely to be through late 2021, at least.

Global equities were little changed in July 2010 from September 2009 but there was significant volatility over the period. Cyclical sectors outperformed slightly, led by industrials and consumer discretionary. Financials lagged, partly reflecting a post-GFC regulatory clampdown – not a current feature. Emerging markets outperformed and commodity prices strengthened. Treasury yields initially moved higher but ended the period lower after equities corrected.

The current negative real money / output growth gap, as noted, may last at most three months versus the 10 months in 2009-10. The market effects could be smaller than in 2009-10, particularly in view of the earlier record positive gap. The suggestion in previous posts was to maintain a cyclical bias in portfolios but dial down risk pending a new excess money “buy” signal and / or a significant market correction.