Subscribe

Sign up for timely perspectives delivered to your inbox.

I probably speak for much of our industry when I say that managing portfolio risk this year has been a fascinating collision of the personal and professional. In March and early April, during the initial wave of the pandemic, many questions fielded within the Portfolio Construction and Strategy Team were around interpreting portfolio losses amid extreme market volatility and potential strategy rebalancing in a time of chaos.

The feedback we gave tended to be built around reminders of the importance of good portfolio hygiene. This view was partially motivated by my own emotions and challenges as I tried to keep a level head about my own investments throughout a terrifying sell-off. The feedback we had suggested the themes and best practices discussed resonated with clients during the best and worst market swings this year.

In recent weeks, spikes in COVID-19 infections throughout much of the northern hemisphere – coupled with uncertainty around the U.S. election – led to another wave of large market swings and created daily fodder for second-guessing one’s investment plan. A sell-off the week prior to the U.S. election on 3 November quickly reversed as we then saw the S&P 500 Index, for example, record its best week since April 2020 and its best post-election week since 1932.

Even more recently, global stock markets surged on the news that Pfizer’s COVID-19 vaccine had proven 90% effective in trials, providing more face-palm fodder for anyone who reacted out of fear and sold out amid the pre-election volatility.

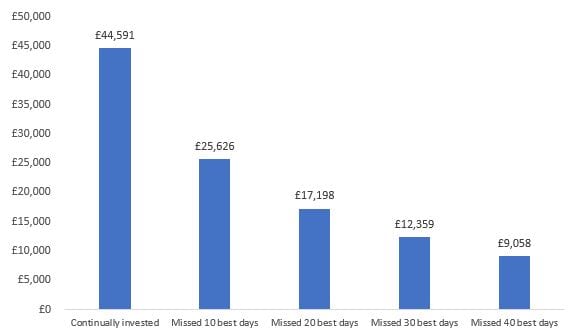

In line with our good portfolio hygiene conversations, many of us would be well-served with a simple yet striking reminder of our motivation for staying the course during Q1 and Q2 2020. It is certainly worth reviewing the potential agonizing penalty for attempting to sidestep short-term market losses:

Value of a hypothetical £10,000 investment in the FTSE World Index

For those of us who did not panic or sell low and instead stayed the course through the unsettling ups and downs in 2020, the reason you’re feeling like a hero is illustrated well in the following chart:

Value of a hypothetical £10,000 investment in the FTSE World Index

Uncertainty is not unusual. Even with the U.S. election decided and a promising COVID-19 vaccine on the horizon, questions remain about the prospect of a divided U.S. government, the outcome of Brexit and the ultimate efficacy of a vaccine. Staying the strategic course does not mean you will always be right. Yet history teaches us, again and again, that it has been generally wise to stick to a long-term plan throughout all market cycles – no matter how terrifying some might be.

Are you concerned about your clients’ portfolios in uncertain markets? Our Portfolio Construction and Strategy (PCS) Team provides support through detailed analysis and recommendations aimed at helping your clients stay on track towards their investment goals. The consultative service offered is 100% objective – providing a whole-of market view, not focused on Janus Henderson products. It is bespoke to your requirements as the team customises portfolio diagnostics and reports to meet your needs and support conversations you have with clients. The service is complimentary and we would be delighted to discuss in more detail the service the PCS Team can offer. Please visit the PCS section of our website or speak to your usual Janus Henderson representative.