Subscribe

Sign up for timely perspectives delivered to your inbox.

The effects of coronavirus are still being felt globally, yet vaccine rollout programmes are allowing progress to be made in reopening economies. This spring update covers the latest developments within the economy and our broad take on income expectations.

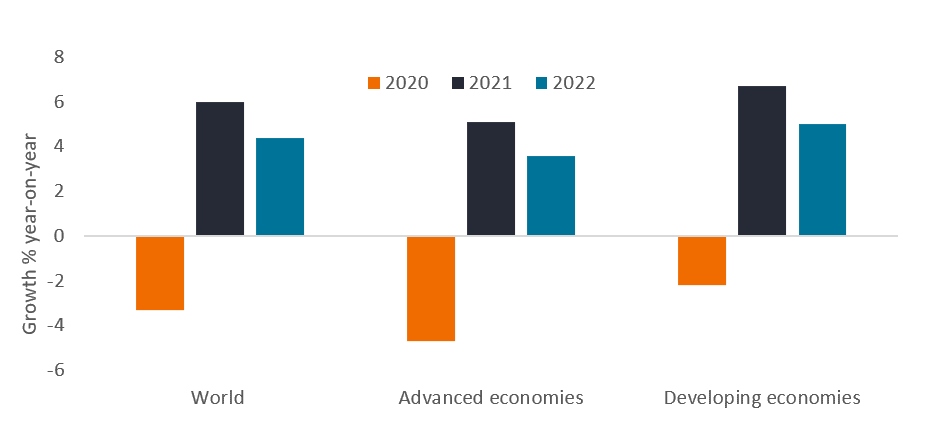

Global growth is expected to be firmly positive in 2021, as reflected in the latest (April 2021) forecast from the International Monetary Fund. A combination of support measures from governments and central banks, many companies successfully adapting to COVID restrictions and the success of vaccines allowing economic restrictions to be eased, has allowed economic activity to recover.

Progress has been uneven, however, with fresh lockdowns, threats from COVID variants and unequal vaccine distribution leading to differences in economic outcomes across markets.

Similarly, COVID has amplified disruption within sectors. It has brought forward the digitalisation of the economy (such as online shopping and remote working), which in turn has created winners and losers. Nonetheless, economically-sensitive sectors have responded positively since the first vaccines were rolled out. The third quarter of 2020 demonstrated that economies can rebound rapidly when lockdown restrictions are eased.

While the recovery is to be welcomed, it brings its own challenges. The stronger the growth, the harder it will be for governments and central banks to justify emergency support measures, such as furlough schemes and low interest rates. Yet it is not clear whether economies are ready to stand up without these crutches. We think the removal of support will be gradual, measured in months and years, but debate around when this occurs and at what pace may lead to market volatility.

Headline inflation figures are also rising. This is because year-on-year figures are comparing prices today with prices last spring and summer when the pandemic had depressed economic activity. Investors may recall that oil prices fell to record lows last year. While major central banks such as the US Federal Reserve and the Bank of England have said they are treating inflationary pressures as transitory, so are unlikely to start raising interest rates any time soon, the move towards a more normal environment has seen government bond yields rise from their lows.

Markets tend to be forward-looking and equity markets and corporate bond markets have rallied strongly since vaccines began to be rolled out. With some markets back near their highs they are potentially more vulnerable to earnings disappointment.

The lockdowns and other safety impositions restricted economic activity. Many companies saw a collapse in revenues, unemployment rose and government finances were hit as tax revenues declined and borrowing increased. This put strains on the ability of some economic participants to make payments to others. To preserve cash, many companies cancelled or deferred dividend payments, some tenants struggled to meet rent payments to property landlords and weaker companies were unable to meet their coupon payments on bonds.

The reopening of economies ought to mean a return to a more normal environment but as with the broader economy this is likely to be uneven. Many households have been able to save money during lockdowns but these savings are unevenly distributed and typically weighted towards richer households that have a greater tendency to save rather than spend.

There has been a clear divergence within companies as those with already strong finances or operating in sectors less affected by the virus have emerged stronger. For many companies that had to take on additional debt or cancel or lower dividends, investors should not assume an immediate return to previous dividend levels – some may be reset lower. Similarly, regulatory impediments may linger. The Bank of England back in December 2020 relaxed its curb on dividend payments by banks but restrictions still exist and many banks are taking a cautionary approach to resuming dividends.

As active managers we endeavour to improve outcomes for investors. This means, within our income-orientated funds, we seek out investments where the income is likely to be paid, while being mindful of the capital value of the fund.

The funds we manage will all perform differently, given the composition of their portfolios. In the main, we are expecting income from equity and property funds to improve over the course of 2021, while distributions on bond funds are likely to be similar to 2020 levels. Please note that these are estimates and there is no guarantee that this will be the outcome given the variability in markets.

A more detailed look at individual asset classes is provided below:

A feature of more optimism around economic growth has been the re-emergence of inflation worries, which erode the returns from fixed income securities. Will pent-up consumer demand drive prices higher? Are President Biden’s stimulus packages in the US excessive? How will central banks treat the expected rise in headline inflation as weak oil prices last year wash out of the figures?

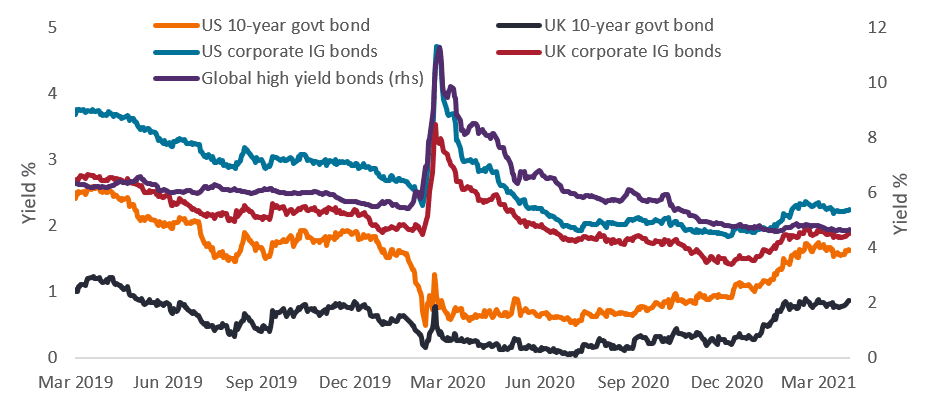

The prospect of higher inflation has led to a rise in government bond yields. Yields are now more attractive than they were, although this has come at the expense of capital values with developed market government bond prices coming under pressure in the first quarter of 2021. Major central banks have been vocal, however, in explaining that they are in no hurry to raise interest rates.

The rise in government bond yields has spilled over into investment grade corporate bonds. This should have the effect of making it easier to reinvest income at more attractive levels although yields remain lower than they were two years ago.

For sub-investment grade bonds – also known as high yield bonds – the prospects for economic recovery have lessened the threat of default (the failure of a borrower to meet a repayment to a bondholder), as revenues and cash flows look set to improve. In fact, the default rate appears to have peaked well below the levels of the 2008 Global Financial Crisis, in part thanks to pandemic support measures and a better-capitalised banking sector. While removal of government support may risk a rise in insolvencies, many companies have been able to access capital markets and refinance their borrowings; absent another major wave of lockdowns we do not envisage a pick-up in defaults. In fact, sentiment is beginning to shift, with markets increasingly discussing the prospect for companies to gain improved credit ratings.

Although the pandemic has changed the lives of billions in previously unimaginable ways, its impact on equity income investors and dividends has been consistent with a conventional, if severe, recession. Sectors that depend on discretionary spending have been more severely impacted, while defensive sectors have continued to make payments. At a country level, the UK, Australia and parts of Europe suffered a greater decline because some companies had arguably been overdistributing before the crisis and because of regulatory interventions in the banking sector.

How did COVID-19 affect global dividends in 2020?

Globally, dividends fell 12.2% on a headline (dollar-based) basis according to the latest Janus Henderson Global Dividend Index (JHGDI), a study into long-term dividend trends. On an underlying (local currency) basis dividends were 10.5% lower in 2020, a smaller decline than after the Global Financial Crisis.

Dividend cuts were most severe in the UK and Europe, which together accounted for more than half the total reduction in payouts globally, mainly owing to the forced curtailment on banking dividends by regulators. But even as payouts in Europe and the UK fell below the levels seen in 2009, they rose 2.6% on a headline basis in North America to a new record. This was mainly because companies were able to conserve cash and protect their dividends by suspending or reducing share buybacks instead, and regulators there were more lenient with the banks.

In Asia, Australia was worst affected due to its heavy reliance on banking dividends, which were constrained by regulators until December. Elsewhere, China, Hong Kong and Switzerland joined Canada among the best performing nations.

OutlookThose parts of the world that proved resilient in 2020 look likely to repeat this performance in 2021, but some sectors are likely to continue to struggle until economies can reopen fully. The disruption in some countries and sectors has been extreme, but a global approach to income investing means the benefits of diversification should have helped mitigate some of these effects.

UK commercial property continues to offer investors diversification benefits and a steady supply of income. Returns from the asset class are predominantly derived from rental income typically paid on a quarterly basis by the tenant that occupies the property.

During 2020 and the first quarter of 2021 many businesses were forced to shut down as part of the government’s lockdown to try to slow the spread of COVID-19. This has affected the ability of some businesses to pay rent, which is impacting the income distributions that UK commercial property funds can make to investors.

However, property has continued to play its role in the pandemic with many businesses proving far more resilient than might initially have been expected. The exceptions were retail and leisure, which were already seeing a considerable set of challenges as a result of a restructure of how consumers choose to shop.

Rents, new lettings and leasesAs a result, approximately 28% of tenants are currently paying rent monthly (compared with 30% in April 2020) and some of these tenants are subject to rent deferments. Meanwhile, a vacant unit at a multi-let industrial premises in Luton continues to be used by the local council for COVID emergency distribution purposes. There is no rent but rate payments are being mitigated for the time being.

Rent collection remained robust during 2020 due to the strength and diversity of the underlying tenant base, with 93% of all rents collected to date.* Despite a tough start to 2021 for some areas of the market due to the lockdown the collection rates on the fund have remained high, although there is likely to be a marginal impact to the fund’s income distributions.

As at 30 April 2021, the first quarter rent collection percentage for the PAIF covering January, February and March was 87% and this is expected to rise as outstanding arrears are cleared. The alternatives sector (excluding leisure and student accommodation), which includes assets such as care homes, had a 100% rent collection rate, as did the supermarkets owned by the fund. Payments from tenants at industrial assets followed closely at approximately 98%, then offices at 91% and retail warehousing at 89%. Student housing rent collection was at 96%, followed by standard high street retail at just over 68%. While assets owned by the fund within the leisure sector have fared the worst, with around 45% of rents collected for the first quarter of 2021, it is worth noting that the leisure sector represents less than 10% of total portfolio income. The relaxation of lockdown rules is expected to benefit this sector over the summer months.

A value equating to just 1.3% of rents demanded as at 30 April 2021 has been written off owing to tenant defaults, where three of those are COVID-19 related. We have, however, increased our bad debt provision for tenants that have not settled their rent within 90 days or formally accepted a rent deferment. These tenants may pay at a later date but we believe it is best to take a prudent accounting approach in this regard.

It has been important to support the more vulnerable tenants through this challenging time rather than have lots of vacant properties when the crisis is over. Communicating with tenants has also allowed for in-depth conversations on how the investment team can work with occupiers on sustainability matters and energy efficiencies, and potentially taking longer leases as a trade-off for any rental breaks.

There is still a wide variation in economic forecasts based upon the length of containment of COVID-19. Nevertheless, with the UK having moved quickly to procure and administer vaccines, the easing of lockdown restrictions should over time be positive for good-quality, well-located commercial property that is sought after by tenants and supports our day-to-day social and working life.

The Janus Henderson UK Property PAIF remains focused on holding a strong portfolio of defensive, core assets – defined as being best in class in three of the following criteria: location, quality of tenant, lease duration, lease structure, building specification and sustainability – and a mix of robust tenants on long leases across all sectors.

We do hope that the information within this note helps to give some clarity in terms of income expectations over the short to medium term. Please also refer to the Insights section of our website www.janushenderson.com for further updates from our portfolio managers on COVID-19 and other areas of interest.