Knowledge. Shared Blog

November 2020

The Inevitable Face-Palm in Market Timing

Adam Hetts, CFA

Adam Hetts, CFA

Global Head of Portfolio Construction and Strategy

Reflecting on his own attempts to remain levelheaded through 2020’s best and worst market swings, Adam Hetts from Janus Henderson’s Portfolio Construction and Strategy (PCS) team discusses the importance of staying the course amid ongoing uncertainty.

Key Takeaways

- The staggering market swings of the past several months have led some investors to make irrational decisions, such as panicking or selling low.

- The penalty for attempting to sidestep short-term market losses – missing the market’s best days – illustrates the potential benefits of long-term investing.

- While the uncertainty of the past year has provided daily fodder for questioning one’s investment plan, history tells us it is generally wise to stay the course through market cycles – no matter how terrifying some might be.

I probably speak for much of our industry when I say that managing portfolio risk this year has been a fascinating collision of the personal and professional. In March and early April, during the initial wave of the pandemic in the U.S., I published two posts here: The first was about interpreting portfolio losses amid extreme market volatility and the second outlined strategies for rebalancing in a time of chaos.

Both pieces were intended to serve as reminders of good portfolio hygiene, and both were partially motivated by my own emotions and challenges as I tried to keep a level head about my own investments throughout a terrifying sell-off. The themes and best practices discussed in the two articles resonated with clients throughout the myriad client portfolio consultations our Portfolio Construction and Strategy team conducted during the best and worst market swings this year.

In recent weeks, spikes in COVID-19 infections throughout much of the country – coupled with uncertainty around the U.S. election – led to another wave of large market swings and created daily fodder for second-guessing one’s investment plan. A sell-off the week prior to the Nov. 3 U.S. election quickly reversed as we then saw the S&P 500® Index record its best week since April 2020 and its best post-election week since 1932.

Even more recently, U.S. stocks surged on the news that Pfizer’s COVID-19 vaccine had proven 90% effective in trials, providing more face-palm fodder for anyone who reacted out of fear and sold out amid the pre-election volatility.

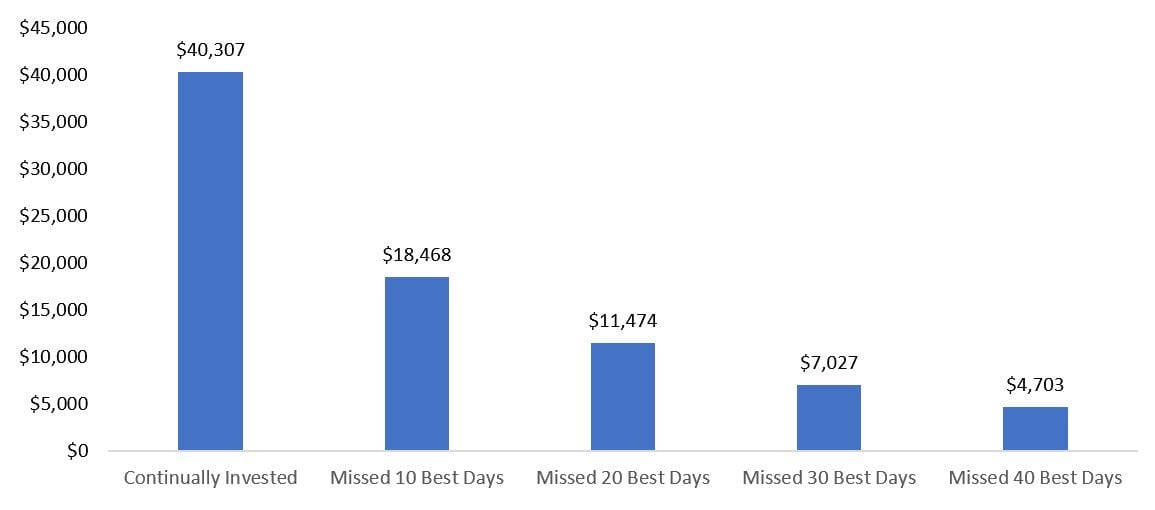

Many of us would be well-served with a simple yet striking reminder of our motivation for staying the course during Q1 and Q2 2020. It’s certainly worth reviewing the potential agonizing penalty for attempting to sidestep short-term market losses:

You Are Only as Good as Your Best Days: 1999-2020

Value of a hypothetical $10,000 investment in the S&P 500® Index

[caption id=”attachment_330034″ align=”alignnone” width=”1155″] Source: Morningstar, 1 January 1999 through 30 October 2020.[/caption]

Source: Morningstar, 1 January 1999 through 30 October 2020.[/caption]

For those of us who didn’t panic or sell low and instead stayed the course through the unsettling ups and downs in 2020, the reason you’re feeling like a hero is illustrated well in the following chart:

An Unforgiving Year: YTD 2020

Value of a hypothetical $10,000 investment in the S&P 500® Index

[caption id=”attachment_330046″ align=”alignnone” width=”950″] Source: Morningstar, 1 January 2020 through 30 October 2020.[/caption]

Source: Morningstar, 1 January 2020 through 30 October 2020.[/caption]

As we’ve written before, uncertainty is not unusual. Even with the election decided and a promising COVID-19 vaccine on the horizon, questions remain about the prospect of a divided government and the ultimate efficacy of a vaccine. Staying the strategic course does not mean you’ll always be right. Yet history teaches us, again and again, that it is generally wise to stick to a long-term plan throughout all market cycles – no matter how terrifying some might be.

The example provided is hypothetical and used for illustrative purposes only.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox