Subscribe

Sign up for timely perspectives delivered to your inbox.

Key Takeaways

In September we presented an analysis based on signals from the options market that indicated investors using these derivatives had priced in a greater chance of victory by Democratic nominee Joe Biden than what was then being reflected in widely followed polling data. With the election just around the corner, we revisit the model to see how options now view the race relative to what the consensus polls tell us.

Our conclusion is that the options market views the race as having tightened in President Trump’s favour over the last couple of weeks and having done so at a pace quite faster than what we have seen in polling data. By using our proprietary tail-based Sharpe ratio[1] to measure the tail risk of two baskets of stocks – one positioned to do well should Republicans prevail and another more aligned with the fate of Democrats – options markets currently signal that President Trump’s chances for re-election are slightly higher than what is being reflected in the polls. This shift in Trump’s favour, however, does not negate the considerable lead options markets indicate that Biden still maintains.

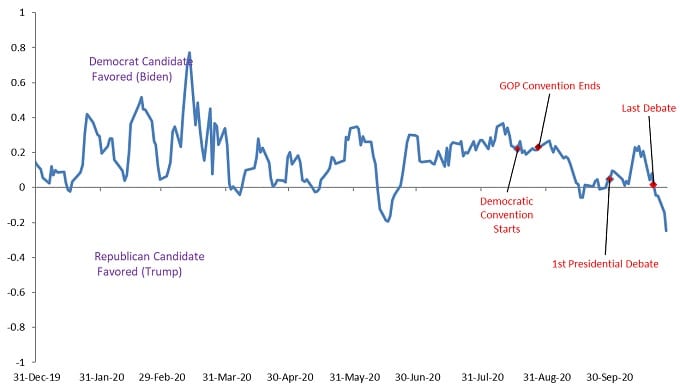

By utilising data from research firm Strategas, we measure the attractiveness of a basket of “Democratic stocks”, identified as those stocks that historically have done well under a Democratic administration, and a basket of “Republican stocks” – defined similarly. The options market today sees the Republican basket as having a higher tail Sharpe ratio than the Democratic basket, as illustrated in Exhibit 1.

Source: Janus Henderson Investors; data as at 27 October 2020.

Assuming the equity cash market has priced in the public polls, this indicates that the options market is slightly favouring Trump relative to the conventional wisdom reflected in the polls. According to Real Clear Politics, Biden’s lead in the polls has fallen from roughly 10 percentage points about two weeks ago to about 7.5 percentage points today (27 October); the fact that the options market sees the Republican basket as more attractive implies that this market pegs Biden’s lead at much less than 8 percentage points.

While Biden’s lead is still considerable, we have seen over the last weeks the options market’s stance meaningfully move in Trump’s favour. With one week to go to the election, the probability of a tighter race and a potential contested election should not be ruled out.

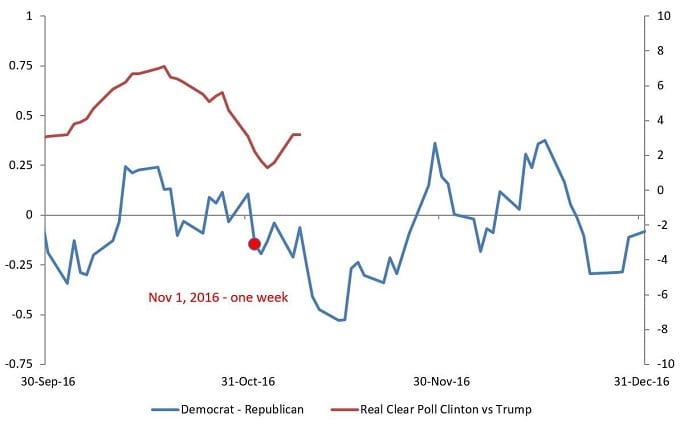

The current options markets dynamics show similarity to 2016 with its bullishness for then-Democratic nominee Hillary Clinton fading two weeks before the election date. The key difference, however, is Clinton’s polling lead was much lower than what Biden enjoys today (Exhibit 2).

Source: Janus Henderson Investors; Note: Red dot indicates roughly one week before 2016 election.

In the closing days of the campaign, should the options market show any significant changes in how it sees the race relative to what is reflected in the major public polls, we will try to convey that in the most timely manner.

[1] Our team arrives at its outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each basket of stocks. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each basket. We view this ratio as a “Tail-Based Sharpe Ratio”.