Subscribe

Sign up for timely perspectives delivered to your inbox.

Euroland money growth is moderating but remains solid, signalling favourable economic prospects for 2021. Relative money trends suggest much greater strength in the US, however.

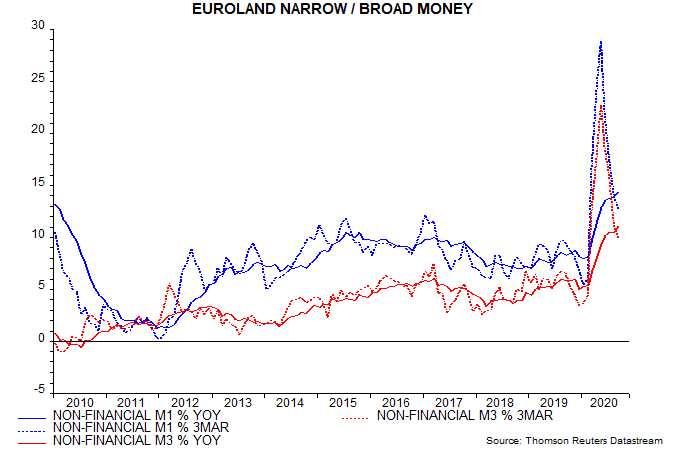

As usual, the focus here is on non-financial monetary aggregates, i.e. comprising money holdings of households and non-financial businesses. The headline M3 and M1 measures include financial sector holdings, which are volatile and less informative about future economic trends. There is little divergence between the non-financial and headline measures at present.

Three-month growth of non-financial M3 peaked at 22.7% annualised in May, falling steadily to 10.0% in September – still high by historical standards. Three-month growth of non-financial M1 eased from 28.9% to 12.8% over the same period – see first chart.

Year-on-year growth rates continued to rise in September, reflecting weak monthly increases in September 2019.

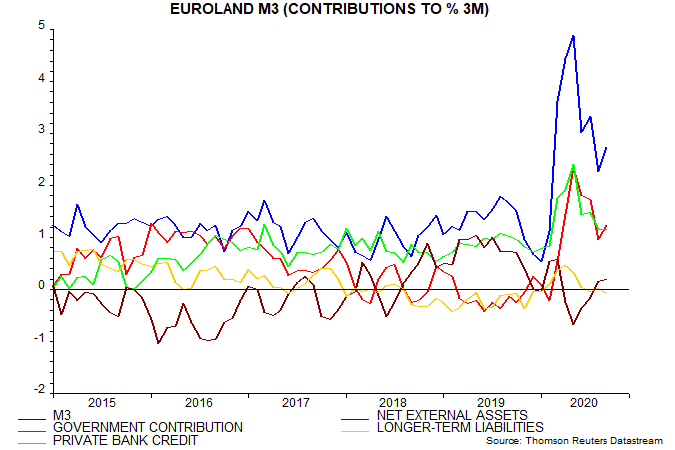

Why has shorter-term momentum slowed? According to the M3 “credit counterparts”, the fall in its three-month growth is attributable roughly equally to a moderation of bank lending growth to the private sector and a slowdown in banking system purchases of government bonds – second chart. The latter reflects both a reduced pace of ECB buying and a cessation of purchases by commercial banks, following a March-May spike.

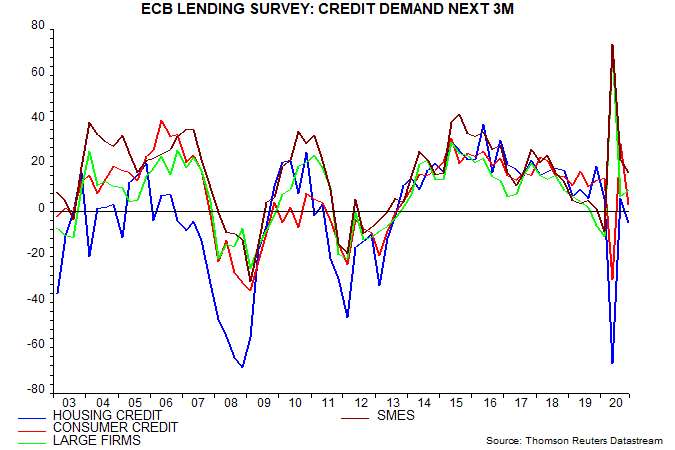

The ECB Q3 bank lending survey, also released today, reports subdued expected credit demand across loan categories, suggesting that lending growth to the private sector will moderate further – third chart. Maintenance of solid broad money expansion, therefore, is likely to depend on ongoing large-scale QE.

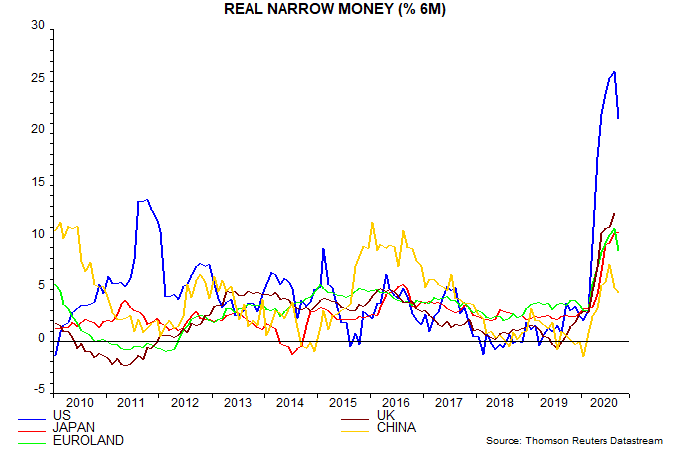

The fourth chart shows six-month growth rates of narrow money in real terms (i.e. deflated by consumer prices) in the major economies. The September Euroland fall mirrors declines in the US and China – global money trends are clearly now cooling. US growth, however, remains far higher – true of broad money too. The global money backdrop continues to suggest stronger economic growth and inflation in 2021 than forecast by, for example, the IMF but upside risks appear much greater in the US than Europe, while China could disappoint an overbullish consensus.