Subscribe

Sign up for timely perspectives delivered to your inbox.

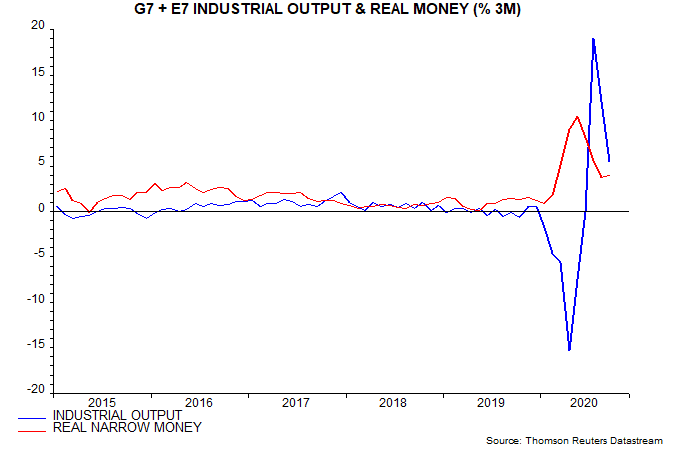

A surge in global money growth starting in March suggested that the economy and markets would rebound strongly from virus-driven losses. The monetary forecast, so far, has been on track. Global (i.e. G7 plus E7) retail sales volume surpassed its pre-covid peak in June, with industrial output likely to have done the same in October.

Hospitality, travel and leisure activities have remained constrained by virus restrictions but the services sector as a whole has also recovered impressively. Global GDP was on course to return to peak in early 2021.

International forecasting organisations have been forced to revise up their 2020 growth projections substantially.

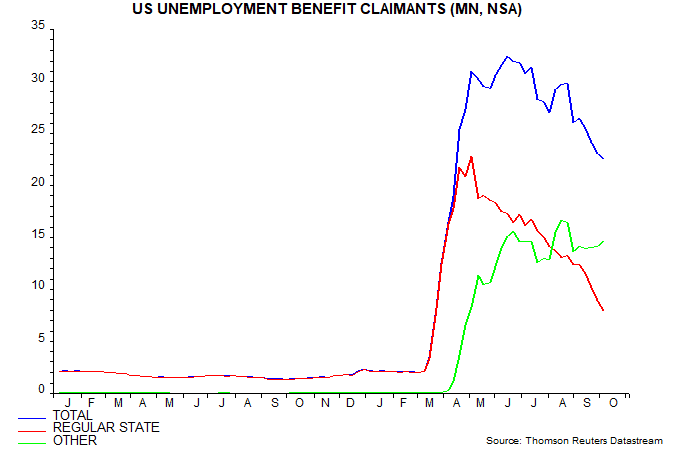

Glass-half-empty commentary has focused on labour market weakness. The labour market is a lagging economic indicator but the US unemployment rate had reversed 60% of its spike by September, with weekly claims data suggesting a further decline – see first chart. Adjusted for furlough and short-time working schemes to make them comparable with US data, European unemployment rates have traced a similar profile. The global composite PMI employment index moved back above 50 in September.

Markets are fearful that the reimposition of virus restrictions in Europe will be mirrored globally, derailing recovery. Market weakness could trigger credit tightening and a downward spiral into a “double dip”. These worries are occurring against a backdrop of moderating money growth.

Economic forecasters can’t avoid incorporating assumptions about virus developments. The rise in global new case momentum has been rather modest, with the European pick-up partly offset by declines in India and Brazil. European momentum, moreover, is weaker than in the spring. Current restrictions could be effective more swiftly than projected by epidemiologists incentivised to emphasise tail risks.

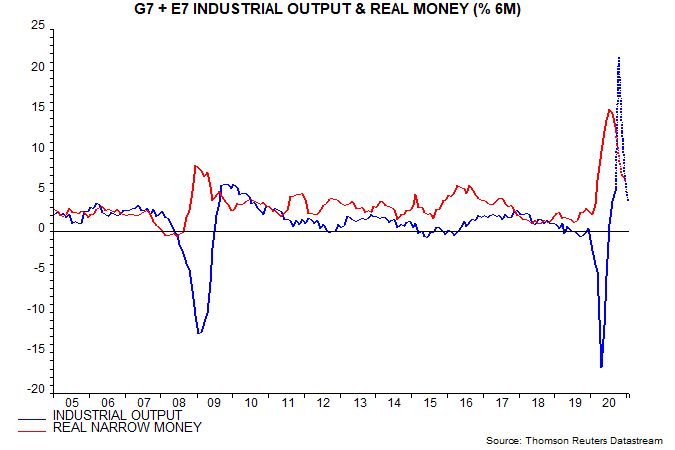

The monetary backdrop remains supportive. Three-month growth of global real narrow money has subsided from a May record but stabilised in September at an above-average level by historical standards – second chart. Governments are ramping up fiscal support again with central banks to provide the financing.

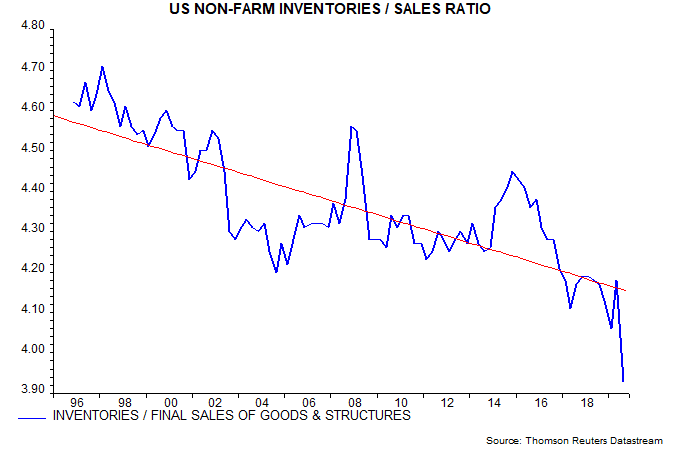

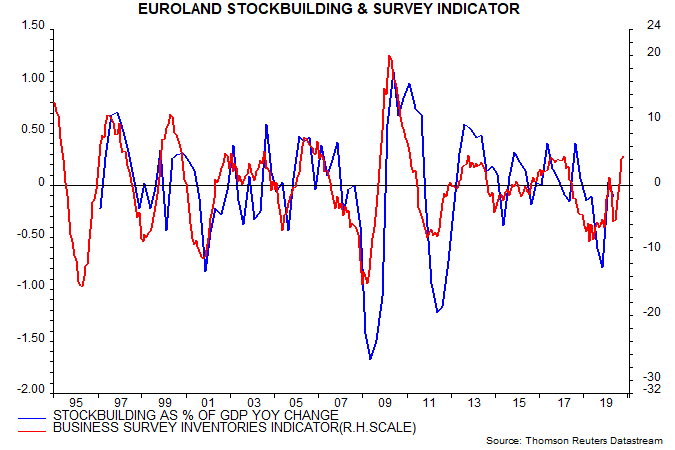

The global industrial pick-up could power through virus disruption as a stockbuilding cycle recovery moves into overdrive. Inventories contributed 6.6 percentage points to the 33.1% annualised growth of US GDP in Q3 but this reflected a stabilisation of levels after record Q2 destocking rather than any rebuild: the ratio of inventories to sales plunged as final demand surged – third chart. Japanese manufacturing inventories fell again in September to their lowest level since 2017. Euroland manufacturing surveys suggest that the cycle recovery is accelerating – fourth chart.

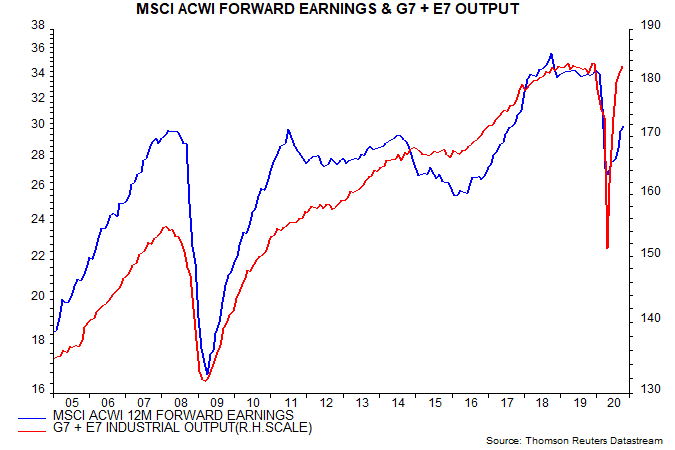

Industrial output is a better guide to equity market earnings than overall GDP. Forward earnings estimates have been recovering but are lagging well behind output, suggesting limited downside even if the output pick-up now stalls – fifth chart.

The negative market reaction to virus news may partly reflect a temporary loss of “excess” money support. As previously discussed, the gap between six-month growth rates of global real narrow money and industrial output will have turned negative in October but is likely to move back above zero in December or January – sixth chart.

A post two weeks ago discussed limiting pro-cyclical positioning until the six- and three-month excess money growth gaps returned to positive alignment and / or a market correction presented an opportunity to increase exposure at more attractive levels. The correction may have further to run but monetary trends and cycle analysis argue against shifting to a defensive strategy.