Subscribe

Sign up for timely perspectives delivered to your inbox.

The IMF’s new forecast that Chinese GDP growth will rise from 1.9% in 2020 to 8.2% in 2021 is representative of current consensus bullishness. Recent monetary trends sound a note of caution, however.

The IMF’s projections imply that Chinese GDP will expand by 10.3% over the two years despite a 2.1% GDP contraction in advanced economies – an implausibly large divergence.

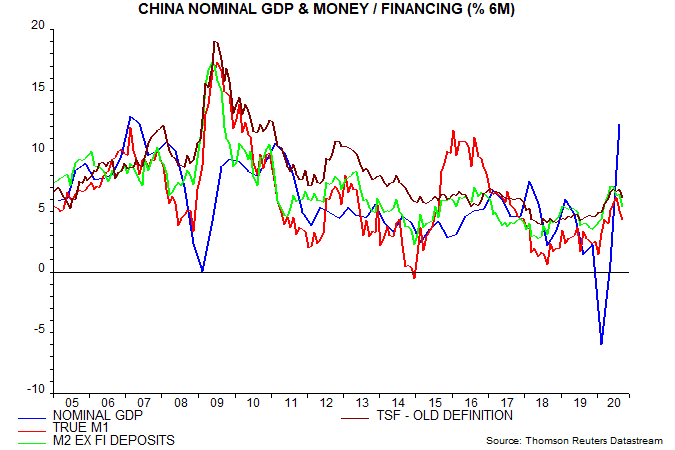

As reported in a post last week, six-month growth rates of narrow and broad money peaked over the summer and fell further in September. Growth of broad credit – “total social financing” (TSF) – has been more resilient, partly reflecting government bond issuance, which may slow as fiscal stimulus moderates. The first chart shows six-month credit growth on the previous definition, which excluded such issuance and several other recently added components; this has shown a more pronounced recent fall, echoing the money measures.

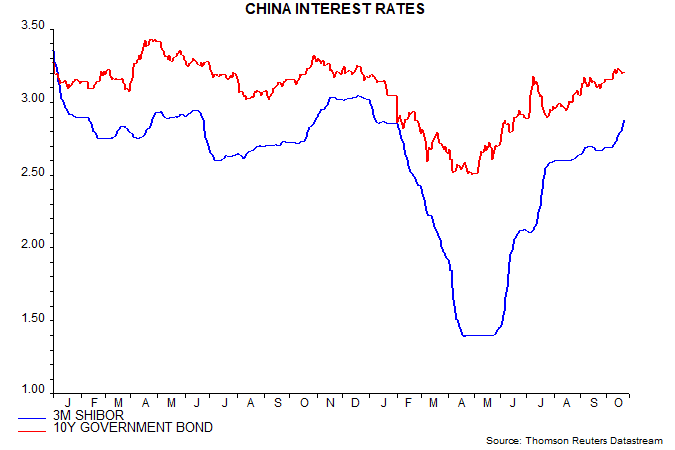

The money / credit slowdown is unsurprising given a significant rise in market rates since the PBoC withdrew excess money market liquidity in the spring. The three-month interbank rate is up by 145 bp from its trough – second chart. With inflation low and the currency strengthening, the PBoC has ample scope to resume easing if economic data show a loss of momentum.

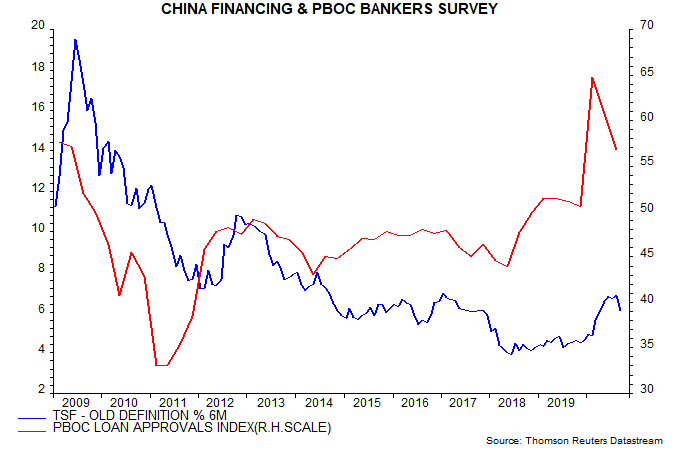

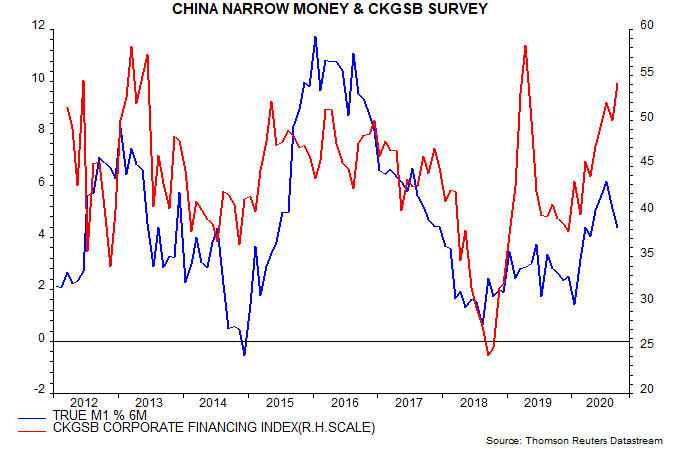

The money / credit slowdown is also consistent with the most recent PBoC quarterly bankers’ survey, which showed a decline in the loan approvals index, although this remained at a historically high level – third chart. By contrast, the September Cheung Kong Graduate School of Business survey of private sector firms reported a further rise last month in the corporate financing index, measuring ease of obtaining external funds – fourth chart. This index generally trends in the same direction as money growth, suggesting a pullback in the upcoming October survey.

The message, for now, seems to be that monetary conditions, though tightening at the margin, remain growth supportive. The PBoC’s reduction of policy support may prove wise: officials may be anticipating a significant external boost to growth next year as advanced economies boom in response to this year’s monetary largesse – a possibility ignored by the (usually wrong) IMF.