Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Daniel Graña explains that in light of the retreat from further global economic integration, reformist policies and value-added services are likely to become future drivers of emerging market growth and investment returns.

There is much to keep emerging market (EM) investors awake at night. Both near-term and longer-horizon challenges loom. Of immediate concern is a highly uncertain economic outlook as emerging countries brace for a potential second wave of the COVID-19 pandemic. Casting a longer shadow, however, is an acceleration in the recent trend of trade decoupling, with the U.S.-China trade war the most vivid – but not the only – example. With the world likely past the high-water mark of globalization that seemingly “lifted all boats,” EM investing has become considerably more complex. Yet, in a low-growth and low-yielding world, the EM equities asset class still merits investors’ attention given its exposure to a range of powerful secular growth themes, among them rising domestic consumption.

For two decades, EM countries were able to ride the wave of globalization as many exported their way to relative prosperity. Companies plugged into global supply chains saw their end markets broaden and also benefited from greater access to their own inputs. Consumers and businesses were the beneficiaries of production flowing to either the lowest costs or most uniquely skilled destination.

This model, however, was questioned not only by then candidate Donald Trump in 2015, but also by American and European workers who believed their fate was an afterthought in the pursuit of economic efficiency. Other reasons for questioning unfettered trade have come to the fore in recent years; geopolitical concerns, intellectual property (IP) protection, privacy and national security are now part of the calculus of policy makers and corporate managers. While 2019’s U.S.-China trade war, may have cooled, tensions were quickly replaced by heated rhetoric surrounding the pandemic. Few of these issues are going away. Consequently, economic considerations, in our view, will no longer be the primary criterion for companies as they construct value chains and seek new markets.

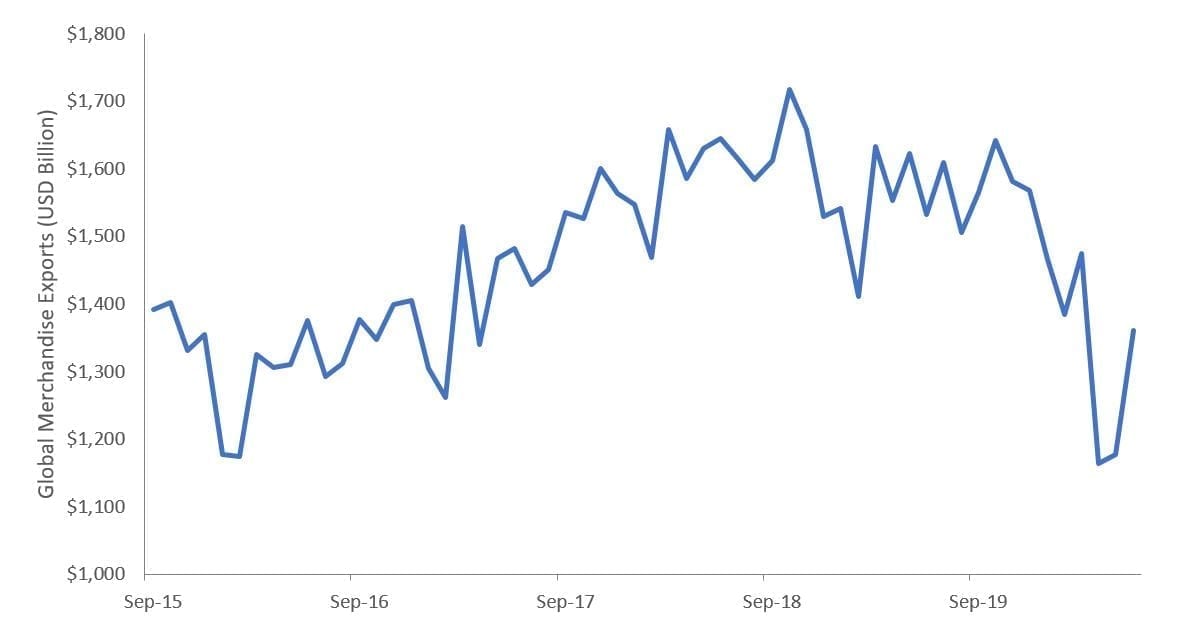

Even before this year’s historic plunge in exports due to pandemic-driven lockdowns, the value of exports fell 2.5% in 2019 as the U.S. and China locked horns in a trade war; the dispute is one example of nations no longer feeling unfettered trade is a win/win proposition.

Source: International Monetary Fund, Bloomberg. Data as of 30 June 2020.

Going forward, we expect a decoupling of global supply chains. Perhaps nowhere is this more likely than in segments where intellectual property (IP) and security are of chief concern. We expect to see parallel supply chains developing within U.S. and Chinese spheres of influence. From an investment perspective there will be winners and losers as the process unfolds. Some regional companies are likely to step into the void left by multinationals that must choose between one or the other geopolitical sphere.

Companies that currently enjoy a global footprint are likely to see their customer base shrink. Not only does this imply lower sales, but also means a smaller revenue base through which they can disburse research and development cost and other capital expenditure. To compensate, companies will either be forced to raise prices (potentially hurting sales) to maintain margins or accept lower profitability. More generally, the injection of noneconomic factors in corporate decision making, in our view, will result in both consumers and companies, on a net basis, being losers.

With exports playing a diminishing role in growth, EM countries will have to identify other economic drivers in their attempt to increase national wealth. In addition to raising domestic consumption, we believe that the countries with the most promising future will be the ones that can successfully move up the value-added chain, especially with respect to developing IP. And by this, we do not mean just technology and patents, but also brands and other difficult-to-replicate platforms that convey quality. By and large, we find these opportunities primarily residing in Asia.

In the wake of the pandemic, many central banks have committed to accommodative monetary policy for the foreseeable future. While low interest rates may push investors toward EM equities in a search for yield, low interest rates could prove to be a double-edged sword. Reform-minded countries are presented with an opportunity to get their fiscal house in order by paying down debt and investing in initiatives that stand to increase national productivity and, thus, wages. Yet for other countries, low rates could be a green light to continued profligacy and kicking the can of substantive reform down the road. They may get away with it over the near term as yield-starved investors gravitate toward the asset class, but rates won’t stay low forever and a day of reckoning will eventually arrive.

The results of EM countries successfully increasing national wealth in a durable manner are mixed. The ones that have achieved the most share certain characteristics. Foremost, they tend to be led by reformist governments. Countries where leaders recognize the power of harnessing the private sector to ignite prosperity, in our view, will have a decisive edge going forward. This entails deregulation, a sound legal system that respects shareholder rights and contracts, and not enlisting companies (through coercion or other measures) in “national service.” This latter point has come to the fore in the era of COVID as many EM countries have insinuated that institutions such as banks should play a role in national recovery. Historically such endeavors lead to corporate decisions not based on sound economics. Perhaps the most susceptible to national service are large, state-owned enterprises that often act as mechanism to implement government policy.

Emerging markets have been major beneficiaries of expanding global trade – as have developed market consumers and corporations. But the recent groundswell of opposition to further globalization darkens the future for what has largely been a successful economic paradigm. Ironically, much of the opposition to globalization emanates from the developed world. Many see November’s U.S. election as a proxy for this debate. But opposition is also occurring in Europe and other regions that seek to protect their domestic jobs and “national champions.” We view differences in U.S. trade policy between President Trump and Democrat nominee Joe Biden as a matter of nuance. While Mr. Biden may be more multilateralist, we expect the protection of American jobs, IP and national security, especially with respect to technology infrastructure, to be high priorities for whoever emerges victorious.

Although the removal of the tailwinds of globalization creates a more challenging environment for EM equities, it can be argued that future winners may be stronger than any export-dependent company or country of yore ever could. Going forward, reformist countries will be rewarded, as will companies and countries that cultivate value-added technologies, businesses and brands. Taking advantage of low interest rates to improve a country’s fiscal position should help dampen external macro shocks. Together, the development of more sustainable and sophisticated economic models along with creative private companies should help insulate disciplined countries from the ebbs and flows of global growth, interest rates and commodities prices and allow them to become masters of their own destiny.