Subscribe

Sign up for timely perspectives delivered to your inbox.

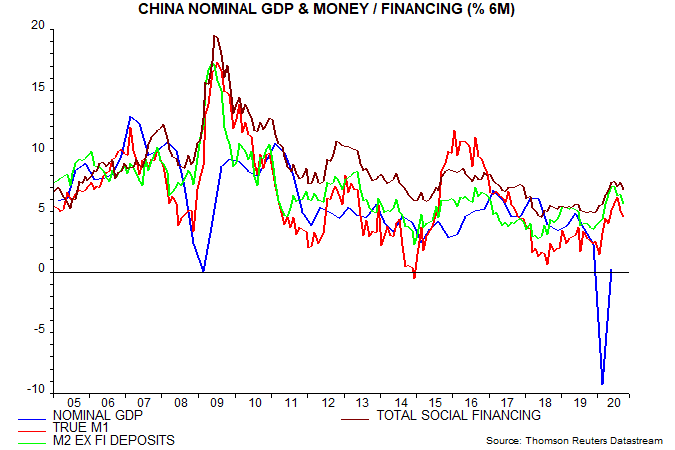

Chinese money and credit trends appear to be cooling following a reduction in PBoC policy support, reflected in a significant rise in interbank rates since June.

The consensus interpretation of today’s September numbers is likely to be bullish. Monthly flows of broad credit (total social financing) and bank lending topped expectations, while annual growth of M2 rebounded to 10.9%.

The focus here is on six-month rates of change (seasonally adjusted) of outstanding stocks of money and credit. These peaked over the summer, moderating further in September – see chart.

Growth rates remain well above last year’s lows. The PBoC is probably aiming for stability rather than a slowdown. Business survey evidence of easier credit conditions suggests that lending and money flows will hold up.

The message is that economic momentum may cool from early 2021 but there are no monetary grounds for concern yet. Equally, though, there is no monetary case for additional policy restraint and a further rise in rates.