Knowledge. Shared Blog

October 2020

Building Bond Portfolios on a Strong Housing Market

-

Nick Childs, CFA

Nick Childs, CFA

Portfolio Manager | Securitised Products Analyst -

John Kerschner, CFA

John Kerschner, CFA

Head of US Securitised Products | Portfolio Manager

Conventional wisdom would suggest that rising unemployment would have discouraged consumers from making large contractual obligations like buying a new home, but the pandemic has affected the way many Americans think about housing. Portfolio Managers John Kerschner and Nick Childs discuss why this is happening and what it could mean for bond investors.

Key Takeaways

- The pandemic has affected the way many Americans think about housing. As a result, demand for housing – and with it, home price appreciation – is on the rise, despite the U.S. experiencing the deepest recession since the Great Depression.

- Meanwhile, the Federal Reserve (Fed) and U.S. banks are both buying mortgage-backed securities (MBS), and the combined purchases could end up being as much as twice the net new issuance. We do not expect this demand to wane quickly.

- These trends bode well for MBS, an asset class that has historically been less sensitive to changes in interest rates and offers a yield premium over U.S. Treasuries. For investors seeking income – and who also want to manage volatility – we think MBS deserves a closer look.

As we enter the final quarter of 2020, we appreciate how difficult it may be for investors to build a bond portfolio that meets their needs. U.S. Treasury rates are near historic lows, real yields (the yield after accounting for expected inflation) are negative, and the Bloomberg Barclays U.S. Aggregate Bond Index today yields just around 1.2%.1 In this environment, there is no simple solution for fixed income investors to find the income they expect with the risk they are comfortable with.

Diversity helps. U.S. Treasury bonds have historically offered a hedge against broader market weakness, and while low rates make their upside potential less obvious, they will likely retain this benefit. Similarly, corporate credit markets are likely to remain in demand, particularly among the lower credit ratings, as they offer higher absolute yields in a time of low rates. We believe both Treasuries and corporate bonds deserve a place in a diverse portfolio. We also think allocations to mortgage-backed securities (MBS) may also help provide additional diversification.

The Fundamental Foundations of MBS Are Strong

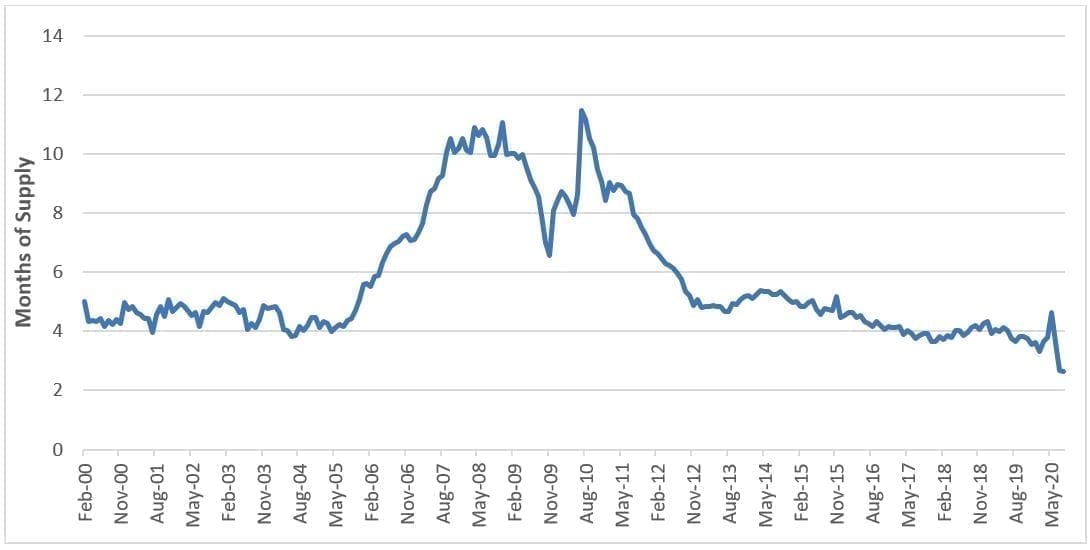

Not all financial market crises are created equal. The collapse in equity markets and bond market liquidity as a result of the COVID-19 shock is not only different from the Global Financial Crisis (GFC) a decade ago, it has had the opposite effect in some respects. In part this is because the environment going into the current crisis is also markedly different from the GFC in some important ways. In 2007-08, the supply of homes in America was at multi-decade highs. In 2020, it is near historic lows, as shown in the chart below. As a rule of thumb, around a six month’s supply of homes puts the market at an equilibrium. Today, we are closer to 2.5 months; today, demand exceeds supply.

Months’ Supply of Existing U.S. Homes for Sale (Seasonally Adjusted)

[caption id=”attachment_323170″ align=”alignnone” width=”1090″] Source: Bloomberg, as of 31 August 2020.[/caption]

Source: Bloomberg, as of 31 August 2020.[/caption]

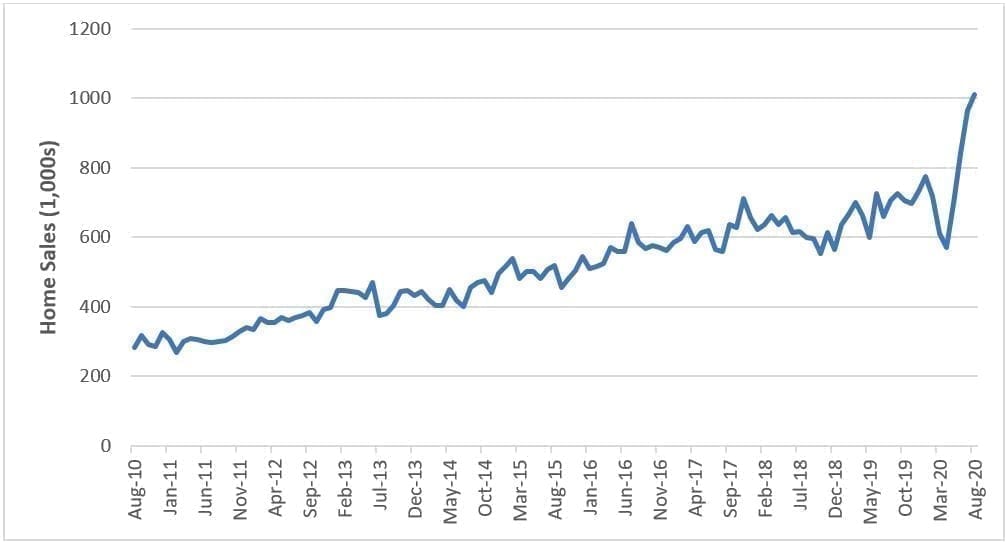

While the supply of homes has been trending lower since the GFC, the COVID-19 crisis may have created an unexpected (positive) shock to demand. Mortgage applications in August were 28% higher than a year ago and are now at the highest levels in more than 10 years.2 Conventional wisdom would suggest that rising unemployment would have discouraged consumers from making large contractual obligations such as buying a new home, but the pandemic has affected the way many Americans think about housing.

The Security of Home Ownership amid COVID-19

There is nothing like staying at home for real comfort” – Jane Austen

The trend to urban living has reversed, which means a dip in rental demand as interest in single-family home ownership has grown. Families may be looking for larger (and more expensive) homes in the suburbs to allow for a more productive work-from-home and home-schooling environment. Like the old joke that there is never extra closet space in a home (because people will always buy enough stuff to fill it), we do not think demand for more personal space will reverse anytime soon. It has been a year of uncertainty for Americans and, to paraphrase Jane Austen, there is nothing like owning a home for real security.

New Single-Family Home Sales

[caption id=”attachment_323182″ align=”alignnone” width=”1007″] Source: U.S. Census Bureau, Bloomberg, as of 30 September 2020.[/caption]

Source: U.S. Census Bureau, Bloomberg, as of 30 September 2020.[/caption]

Home Prices Are Surging … In a Recession

All of this demand has raised prices. Despite the U.S. experiencing the deepest recession since the Great Depression, home price appreciation is up this year: Nationally, home prices are up just under 3% year-to-date, and 4.8% year-on-year.3

Demand for housing is driven, in part, by the affordability of housing. The primary factors in affordability are income and the cost of the mortgage. Low mortgage rates – thanks to the Federal Reserve (Fed) – justify a rise in average home prices. High unemployment, or the fear of becoming unemployed, could affect the income side of the affordability equation, but so far this year it has not, perhaps because affordability is somewhat subjective. Some people may value owning a home more than contributing to savings, or other discretionary spending. Put differently, has the premium Americans place on additional space, and perhaps the security of owning the roof over their heads, changed?

We think the average price of homes across the United States can rise further. This is due in part to changes in affordability, and historically low levels of supply, but also the fact that home prices are not materially higher than they were before the GFC.4 Given the surge in prices preceding the GFC, a period of consolidation makes sense. But today’s supply and demand imbalance suggest that period has come to an end.

The Fed – and the U.S. Banks – Are Buying MBS

The supply of mortgages is currently high and 2020 may see a record year of issuance.5 While that would normally be a headwind for MBS, demand is also setting records. Of the expected net supply for the year (around $430 billion)6, the Fed was buying about $5 billion a day in early March and quickly ramped up to $50 billion a day as the COVID-19 crisis intensified.7 While the rate of buying has since tapered off, we estimate the Fed is currently targeting around $40 billion per month in MBS purchases.

Meanwhile, U.S. banks are buying at in unprecedented size as a result of a surge in deposits. Consumer savings spiked after the COVID-19 crisis, pushing bank deposits up over $1.5 trillion dollars.8 Since the deposit surge comes during a time when banks are reluctant to loan, they have opted to invest some of the deposits in high-quality bonds with higher yields than U.S. Governments – that is, MBS.

The combined buying from the Fed and the banks is more than the entire expected net issuance of MBS for the year and could end up being as much as two times the net new issuance. We do not expect this demand to wane quickly and expect the market will see net negative supply for the foreseeable future. The Fed is purchasing MBS in part to keep mortgage rates low, and in part to encourage bond investors to take additional credit risk in higher-yielding asset classes, in order to boost the amount of credit provided across the economy. And while banks may not see the sustained deposit growth they have year-to-date, they are likely to hold onto the MBS they have bought and are unlikely to pivot new deposits back to lending until the economy has more fully recovered.

MBS Offers High-Quality Income with Low Sensitivity to Changes in Interest Rates

MBS have historically had the highest Sharpe ratio of the major fixed income asset classes, which means that relative to their historical volatility, they have generated the highest returns. This positive ratio was maintained through the peak of the bond liquidity crisis in the first half of the year: MBS had roughly one-third the volatility of the Bloomberg Barclays U.S. Corporate Bond Index and nearly half that of the more diversified Bloomberg Barclays U.S. Aggregate Bond Index.9 And yet, despite offering the same credit rating as U.S. Treasuries (given their implicit government backing), MBS offers a yield premium over U.S. Treasuries.

Furthermore, the duration (a measure of sensitivity to changes in interest rates) of MBS is low compared to other fixed income asset classes, offering some protection should interest rates rise meaningfully as the U.S. economy recovers, inflation rises sharply, or both. The Bloomberg Barclays U.S. MBS Index currently has a duration around 2.2, which means that a 1% rise in Treasury rates would result in a -2.2% loss. The Bloomberg Barclays U.S. Aggregate Bond Index has a duration near 6, meaning it would lose 6% in the same 1% rate rise, while the Bloomberg Barclays Corporate Bond Index has a duration over 8.5.10 While the Aggregate index offers more diverse exposure to bonds, and corporate bonds offer higher yields, MBS may play a helpful role for investors looking to reduce their risk in the event of higher interest rates.

MBS Has a Place in a Diversified Portfolio

Bond investors today face an unusual challenge: Constructing a portfolio that offers income, and potential for capital appreciation while offering diversity, security and protection from rising interest rates. With the Fed’s policy rate at zero – and not expected to rise anytime soon – Treasury yields are near historic lows and the risks look very asymmetric. Assuming the Fed will remain reluctant to let yields go negative, the price appreciation available from falling yields is limited, while signs of an economic recovery could cause yields to rise.

We believe the greatest potential for capital appreciation looks most likely to occur in the corporate bond markets, particularly the high-yield corporate market and the lower-rated segments within securitized products such as asset-backed securities, commercial mortgage-backed securities and collateralized loan obligations. However, in addition to potential return, these instruments also contain potential risks. In our view, diversity – a balanced portfolio – remains the best solution. For investors seeking income, but lower volatility, in today’s environment, we think MBS deserves a closer look.

1Bloomberg, as of 5 October 2020.

2Mortgage Bankers Association, Bloomberg as of 30 September 2020.

3S&P Case-Shiller index, Bloomberg, as of 30 September 2020.

4S&P Case-Shiller 20-City Composite Index, Bloomberg, as of 30 September 2020.

5Citibank, 25 September 2020.

6Citibank, 25 September 2020.

7U.S. Federal Reserve, as of 30 September 2020.

8U.S. Federal Reserve, as of 30 September 2020.

9Bloomberg, as of 30 September 2020.

10Bloomberg, as of 30 September 2020.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe