Subscribe

Sign up for timely perspectives delivered to your inbox.

As most UK defined benefit (DB) pension funds mature and get closer to their endgame (a buyout target, self-sufficiency or a commercial UK DB consolidation vehicle), trustees and corporate sponsors are increasingly seeking enhanced solutions as part of a low-risk, long-term investment strategy. The market risks underlying most DB pension investment strategies have become more evident during recent stressed conditions, where funding levels have fallen by up to 10%. We believe this reiterates the need for trustees to be investing in multiple, truly diversifying, return-seeking assets that add value relative to equities and credit; with the result of more resilient pension funds, particularly during volatile markets.

The Covid-19 pandemic has accentuated the key investment challenge that still needs to be addressed for most mature pension funds: how to generate strong enough returns along the journey towards the endgame, while avoiding market risks that undermine that objective.

In this paper, we explore this pensions investment challenge and put forward a diversifying skill-based strategy that could improve the performance, and reduce the underlying risks, of return-seeking portfolios for UK DB pension funds.

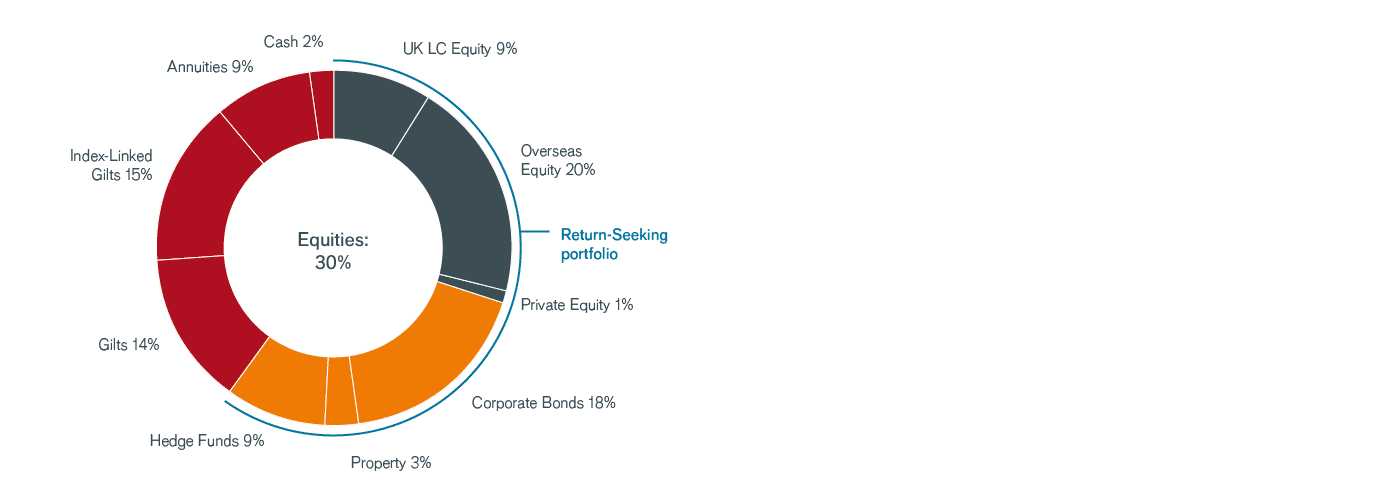

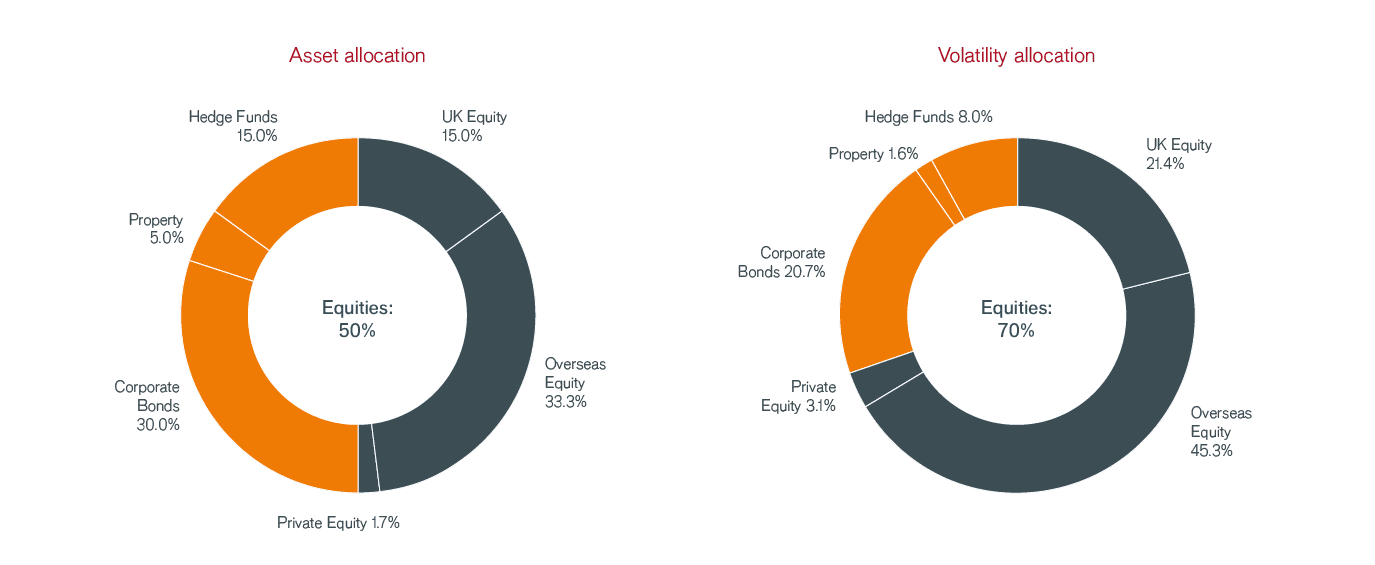

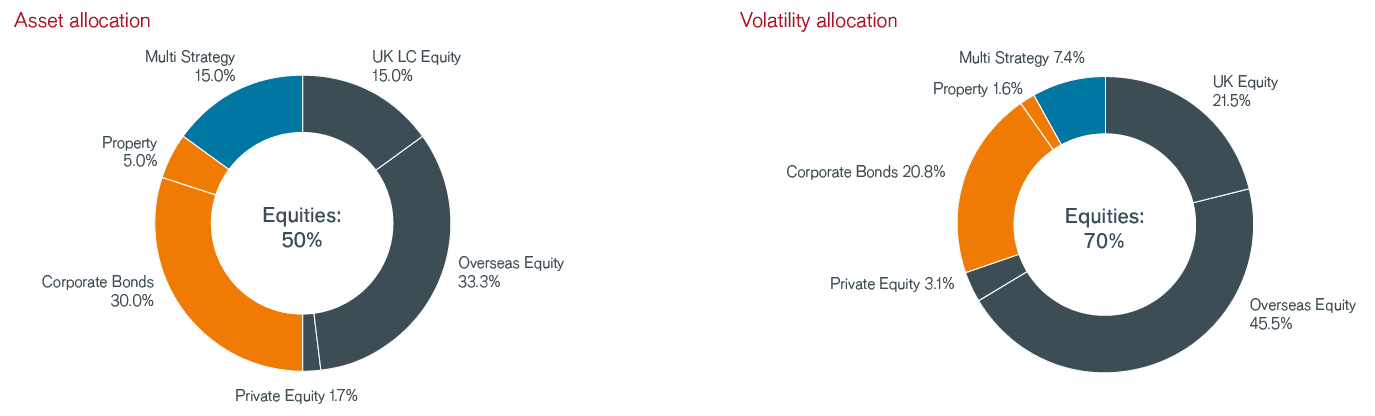

To understand the challenge faced by pension funds, it is important to assess where the risk and return potential lies based on asset allocation. Figure 1 shows that the average UK DB pension fund seems diversified with exposure to a balance of asset classes. However, when looking closer at the return seeking portfolio, equities dominate, making up 50% of the allocation and responsible for 70% of the volatility (figure 2).

Source: Janus Henderson Investors, Pension Protection Fund, Bloomberg as at 30 June 2020. Percentages shown are subject to rounding.

Source: Janus Henderson Investors, Pension Protection Fund, Bloomberg as at 30 June 2020.

Percentages shown are subject to rounding

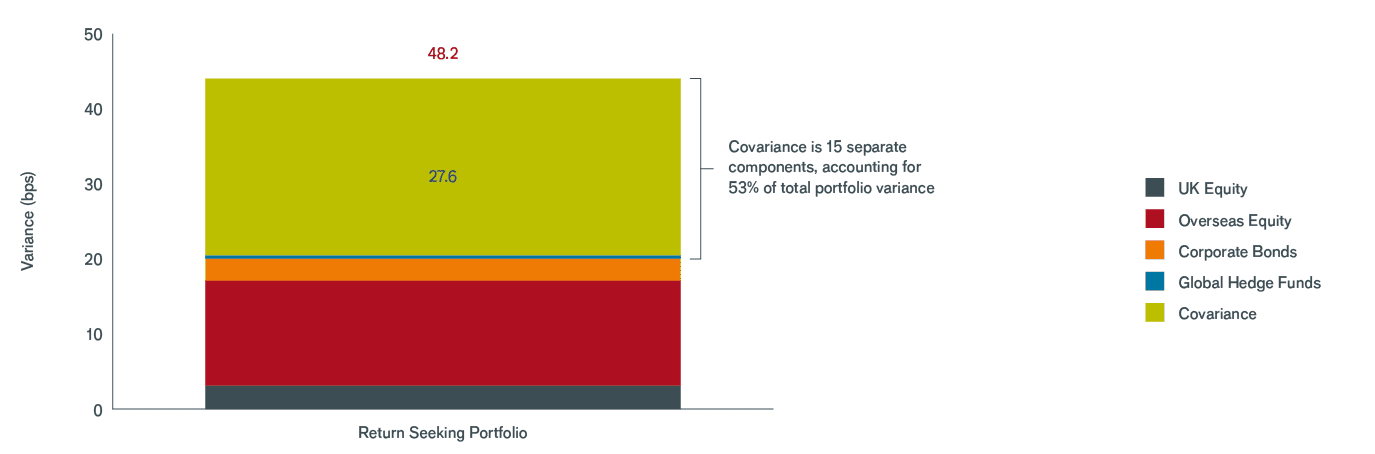

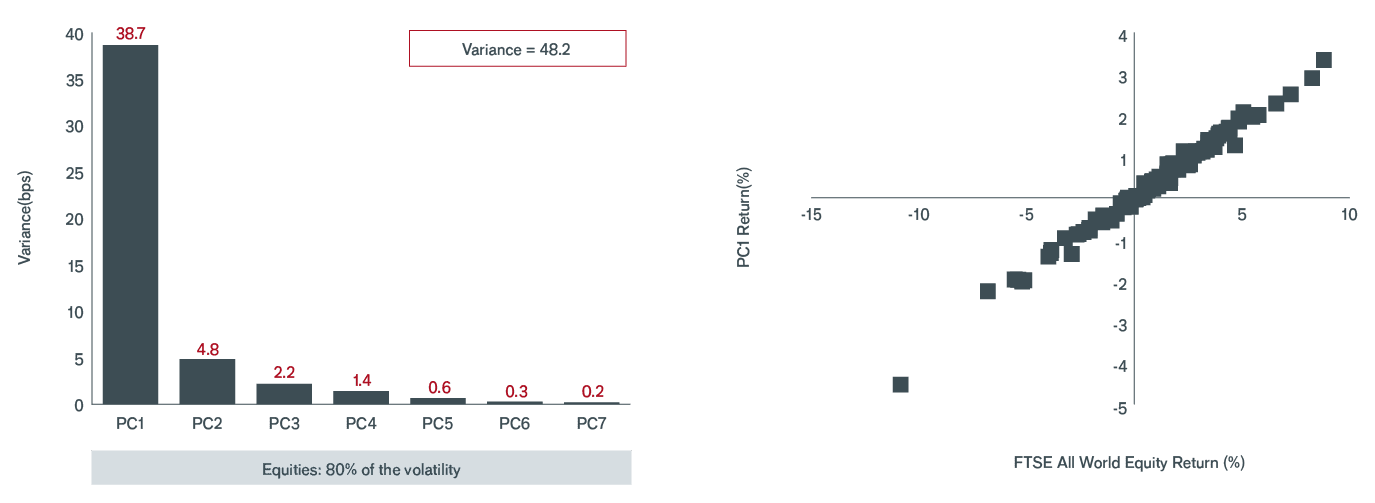

Source: Janus Henderson Investors, as at 30 June 2020.

While global equities and credit are significant contributors to the return-seeking portfolio volatility, the largest contributor is the ‘covariance.’ This covariance, i.e. the way in which the underlying assets interplay and correlate with one another, is important and is explored in more detail below.

Analysing the covariance can be complex, with multiple variance (volatility) and covariance terms. Therefore, we use a simplified ‘principal components analysis’ that highlights seven key statistical factors (figure 4). The analysis in figure 5 below shows that the first principal component is almost perfectly correlated with global equities. This first principal component explains 80% of the volatility of the portfolio, meaning that the typical return-seeking portfolio for a UK DB pension fund is even less diversified – more dependent on equity risk – than the prior analysis showed.

Source: Bloomberg, Janus Henderson Investors. as at 31 July 2020. Principal component analysis conducted on all asset classes with 8 year monthly history (UK Equity, Overseas Equity, Corporate Bonds, Private Equity, Property, and HFRI Global HF), World Equity (FTSE ALL WORLD Equity total return index).

Based on a representative account of the strategy and may vary for other accounts in the strategy due to asset size and other factors. The representative account is believed to most closely reflect the current portfolio management style.

In summary, while the larger pension funds with in-house teams tend to have a greater mix of assets, return-seeking portfolios for the average UK DB pension fund are typically diversified in appearance only. Alongside the traditional equity and credit components, a truly diversified portfolio should have exposure to multiple sources of return, such as manager skill and insurance. Each component would ideally deliver returns at different times. However, return-seeking portfolios in most UK DB pension funds are over-reliant on equities, whose returns have become increasingly correlated with other assets.

This increased correlation arises because equities (and, indeed, credit) are driven by fundamental economic activity. Since the Global Financial Crisis, we have also seen unprecedented shifts in fiscal policy and central bank monetary policies used to rescue economies from crises. Negative and near-zero interest rates in most major economies, and the substantial amount of debt issued during various market stresses, including the recent Covid-19 pandemic, are just some examples of these new, dominant market drivers.

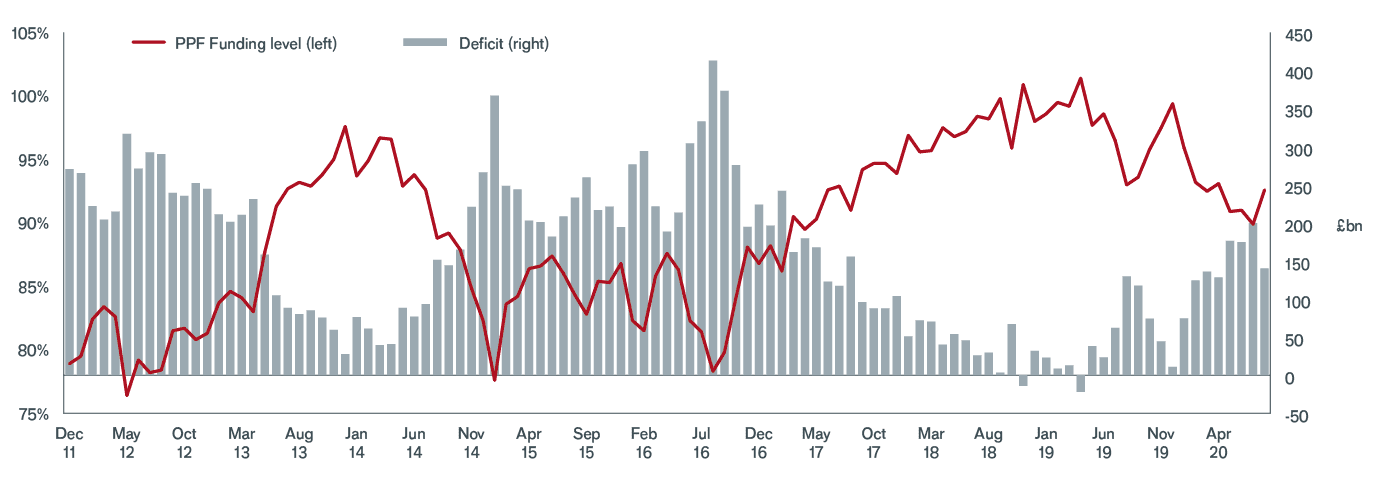

Asset values have seen sharp shifts in the last 10 years. This is illustrated by the volatility of historical aggregate funding deficits and ratios of pension funds in the Pension Protection Fund (PPF) universe (figure 6). This significant volatility, such as that experienced between the end of December 2011 and the end of August 2020, puts pension funds in real danger of failing to reach their endgame target within the desired timescales. The staggering statistics illustrate that, due to the volume invested and the volatility, equities and bonds are the biggest drivers behind the changes to asset values. This volatility puts pressure on trustees to attempt to reduce losses either by re-risking, making tactical asset allocation bets or, worse, doing nothing at all while hoping for markets to rebound.

Source: Janus Henderson Investors, internal estimates, based on representative account as at 30 June, 2020.

Notes: Contribution analysis is intended to demonstrate the impact of strategies within the portfolio using an internal classification methodology. It may differ from actual returns as it

is gross of fees and based on end-of-day holdings in the portfolio.Based on a representative account of the strategy and may vary for other accounts in the strategy due to asset size and other factors. The representative account is believed to most closely reflect the current portfolio management style.

Past performance is not a guide to future performance.

Navigating the journey towards full funding has, therefore, become even more important, particularly during times of market stress – a ‘risk-off’ environment. It is now urgent, in our view, for UK DB pension funds, and other institutional investors, to enhance the resilience of their return-seeking portfolios by considering the use of diversifying alternative strategies that include downside portfolio protection.

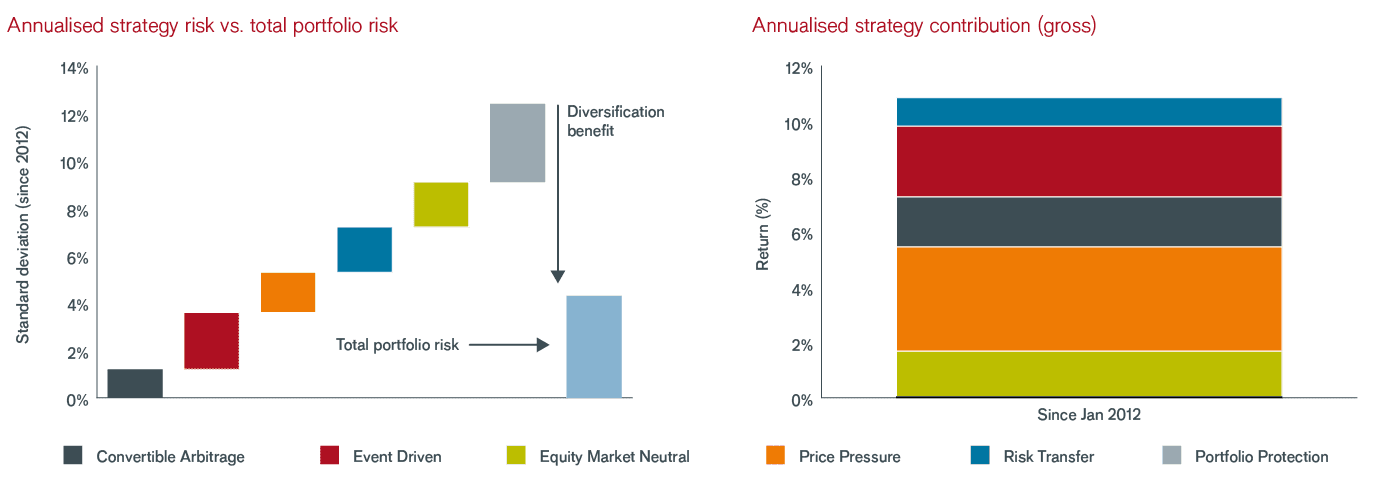

Our Multi Strategy offering seeks to provide truly diversified sources of return that exhibit a very low correlation to equity and credit risk premia (and most other return-seeking assets). It possesses a unique array of risk and return profiles due to the variety of skills employed in its underlying strategies. The underlying strategies also have low correlations with each other, which helps to further enhance diversification when added to investors’ portfolios. Figure 7 shows the six underlying skill-based strategies and their cumulative results.

Source: Janus Henderson Investors, internal estimates, based on representative account as at 30 June, 2020.

Notes: Contribution analysis is intended to demonstrate the impact of strategies within the portfolio using an internal classification methodology. It may differ from actual returns as it is gross of fees and based on end-of-day holdings in the portfolio. Based on a representative account of the strategy and may vary for other accounts in the strategy due to asset size and other factors. The representative account is believed to most closely reflect the current portfolio management style.

Past performance is not a guide to future performance.

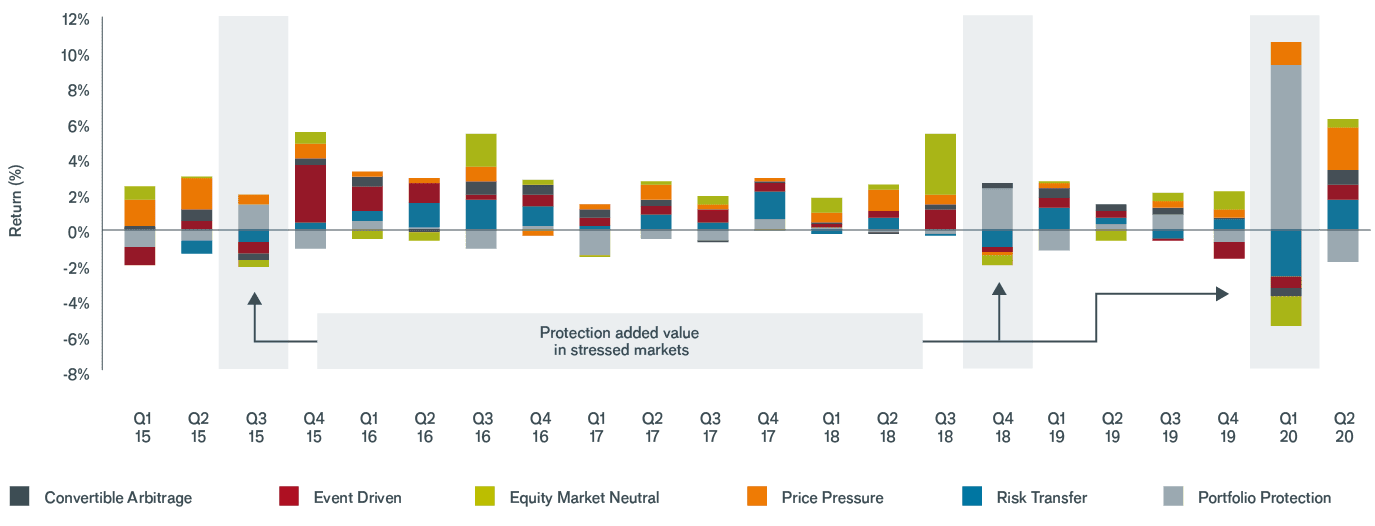

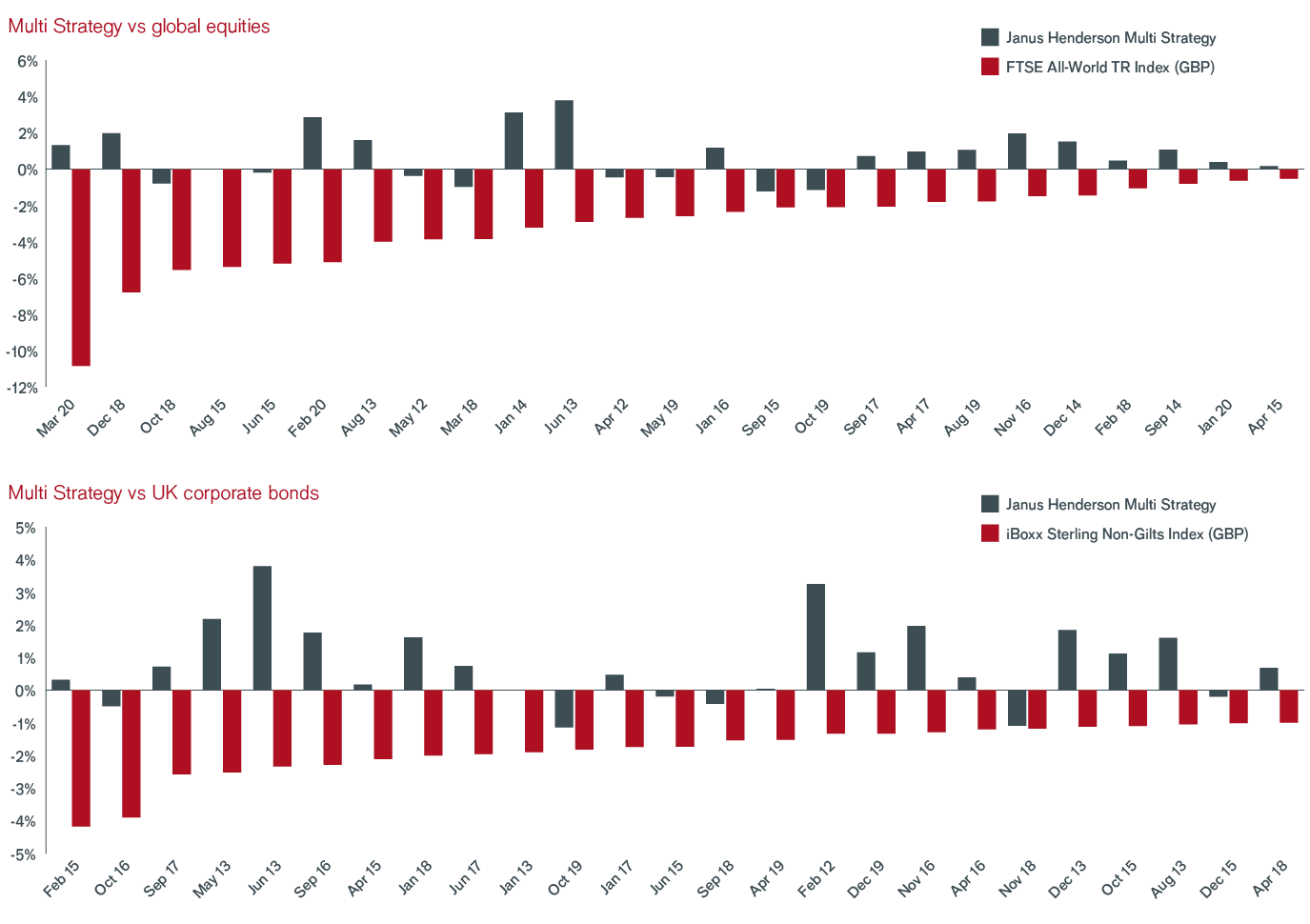

The outcome of this approach has been pleasing to see, and potentially well-suited to pension funds on their endgame journey. Figure 8 shows that the performance of Janus Henderson Multi Strategy has been consistent, with value added from underlying strategies to enhance returns at different times. Figure 9 shows this included robust portfolio protection during periods of market stress when global equities and UK corporate bonds entered negative territory.

Source: Bloomberg, Janus Henderson Investors. Period covering Jan 2012 to June 2020. Composite statistics in GBP, net of fees.

Past performance is not a guide to future performance. Investing involves risk, including the possible loss of principal and fluctuations in value.

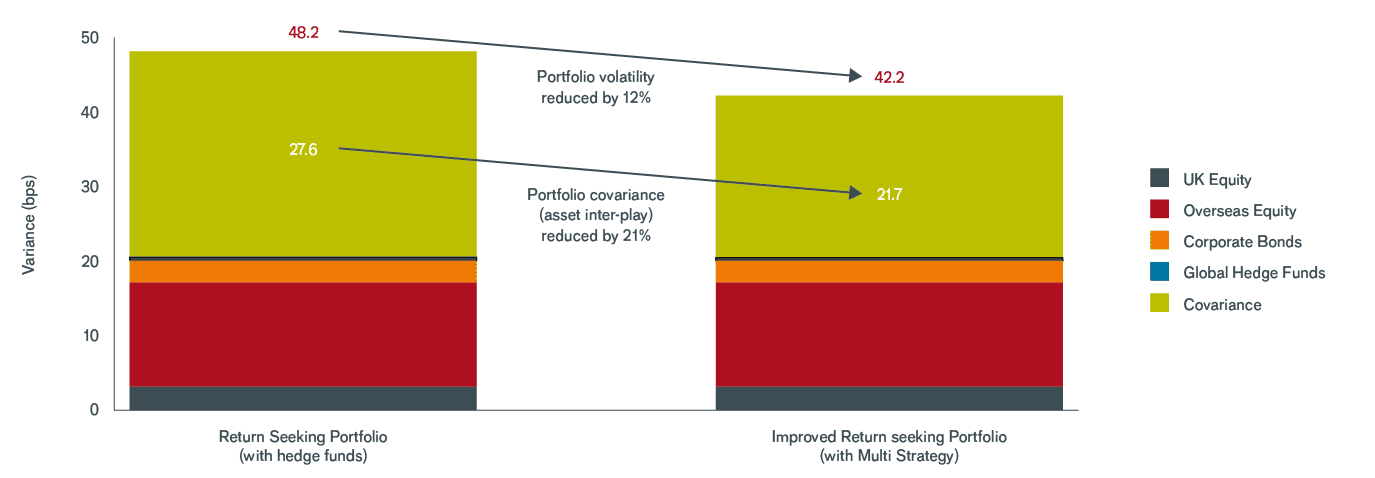

We also looked at what would happen if the Janus Henderson Multi Strategy fund had replaced the hedge fund allocation of the average UK DB pension fund (figure 10).

Source: Bloomberg, Janus Henderson Investors, as at 30 June 2020. Percentages shown are subject to rounding.

The hypothetical back-tested performance shown here is for illustrative purposes only and does not represent actual performance of any client account. No accounts were managed using the portfolio composition for the periods shown and no representation is made that the hypothetical returns would be similar to actual performance.

Figure 11 shows how introducing alternative sources of investment return could improve diversification, by meaningfully reducing the overall volatility and, more importantly, reducing the ‘inter-play’ (or the extent of interaction) between equities and the other return-seeking assets.

Source: Bloomberg, Janus Henderson Investors, as at 30 June 2020.

Overall, return-seeking portfolios for an average UK DB pension fund could have benefited from better investment outcomes – i.e. enhanced returns and lower risk. All else being equal on the valuation of liabilities and other assets, funding levels could have improved (we estimate by at least 4%) over the period since the start of 2012, when the team behind JH Multi Strategy introduced the equity protection sub-strategy. This means that, if Multi Strategy had been introduced at any point over the last eight years, the average UK DB pension fund could now be nearer their endgame.

Our Multi Strategy offering could have had a positive impact on return-seeking portfolios, particularly during recent volatile market conditions. But, of course, hindsight is a wonderful thing. Looking to the future, our Multi Strategy portfolio, with its six underlying diversified skill-based strategies, is designed to continue to deliver returns that are uncorrelated to equities, bonds and other return-seeking assets, and offer protection to UK DB pension funds and other institutional investors during periods of market stress.

Our Multi Strategy offering invests in what the team considers to be statistically independent, and economically sensible, investment opportunities that could offer enhanced risk-adjusted returns. It also incorporates explicit portfolio protection against large equity drawdowns and seeks to provide diversification to the rest of a DB pension fund’s assets by intentionally limiting exposure to equity and credit beta.

Many mature UK DB pension funds need greater resilience – i.e. consistent positive performance – to enable them to achieve their long-term endgame target within the desired timescale. Trustees and sponsors should urgently address the gap that many ‘average’ UK DB pension fund have in their return-seeking portfolios of not being sufficiently diversified across multiple risk factors.

Now, more than ever, it is difficult to predict the future with any degree of certainty. It is, however, possible to be better prepared for whatever emerges by building return-seeking portfolios with more diverse sources of return, including skill-based strategies. UK DB pension funds, and other institutional investors, could benefit from taking a Multi Strategy approach, ideally with an explicit protection strategy incorporated, within their return-seeking portfolios. This could be a prudent step to help improve diversification and navigate towards their long-term funding and investment targets with the endgame in mind.