October 2020

Finding floating-rate opportunities in a low-yield world

Jessica Shill

Jessica Shill

Securitized Products Analyst | Assistant Portfolio Manager Nick Childs, CFA

Nick Childs, CFA

Portfolio Manager | Securitised Products Analyst John Kerschner, CFA

John Kerschner, CFA

Head of US Securitised Products | Portfolio Manager

Key takeaways

- Low government bond yields make finding appropriate risk-adjusted returns challenging. While some investors may feel comfortable adding credit risk, it may be prudent for investors to consider their overall interest-rate exposure.

- Floating-rate products with high-credit ratings could be an attractive option in a diversified portfolio given their ability to act as a hedge against potentially rising rates.

- The floating-rate CLO market, which has nearly doubled in size in the last five years and where spreads remain attractive versus similarly rated corporate bonds, may deserve a closer look.

U.S. interest rates are near historic lows, but investors still want their bond portfolios to offer income in addition to the stability, and potential price appreciation, they have come to expect from bonds. U.S. Treasuries, given their AA+/Aaa credit rating, still offer more security and, despite low yields, diversity from equities. AAA rated corporate credit offers some additional yield over U.S. government bonds, but with similarly low absolute yields and increased interest-rate risk as borrowers issue bonds with longer maturities: The average maturity of the Bloomberg Barclays U.S. Corporate Bond Index has been steadily growing, with the current duration (a measure of interest-rate sensitivity) above 8.5 years.1 While we remain broadly positive on the outlook for corporate bonds, investors may be well served diversifying some of their credit exposure into securities with less duration.

Floating-rate securities may offer a hedge against rising rates

As more investors get comfortable thinking the worst of the current recession could be behind us, they may start to wonder if interest rates will rise as the economy recovers. The U.S. Federal Reserve’s (Fed) recent statements about allowing inflation to rise, in the short term, above their 2% target adds to the fear that at some point U.S. interest rates could be significantly higher. We do not share the concern but recognize the risk. Given the low level of rates today, there is more asymmetric risk in U.S. Treasuries – rates can rise more than they can fall without turning negative, which we think is highly unlikely. One option for diversification could lie with floating-rate securities, where the coupon paid rises and falls with the prevailing interest rate, making their prices less sensitive to changes in rates.

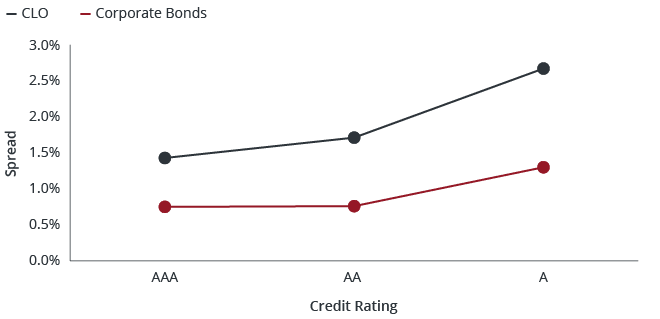

Securitized products have been a growing market since the mortgage market was established in the 1970s. Over the decades new offerings have been introduced such as commercial mortgage-backed securities (CMBS) and, more recently, collateralized loan obligations (CLOs) – the latter of which is the largest (and fastest-growing) segment of the securitized market offering floating-rate exposure. The collateral on these securities are pools of floating-rate bank loans issued to corporations that normally have a below investment-grade credit rating, but the pooled offerings span the ratings spectrum. Relative to the investment-grade corporate credit market, investment-grade CLOs at the AAA rating currently offer 0.67% of extra yield, while single A rated CLOs offer over two times the spread, as can be seen in the chart below.

CLO VERSUS U.S. CORPORATE BOND SPREADS

Relative to the investment-grade corporate credit market, investment-grade CLOs currently offer attractive spread over U.S. Treasuries.

Source: Bloomberg, as of 31 August 2020, J.P. Morgan CLO AAA Post-Crisis Discount Margin, Bloomberg Barclays Aaa Corporate Average Option-Adjusted Spread. Option-Adjusted Spread (OAS) measures the spread between a fixed income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option.[/caption]

Source: Bloomberg, as of 31 August 2020, J.P. Morgan CLO AAA Post-Crisis Discount Margin, Bloomberg Barclays Aaa Corporate Average Option-Adjusted Spread. Option-Adjusted Spread (OAS) measures the spread between a fixed income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option.[/caption]

Dissecting the yield on floating-rate CLOs

CLOs have offered a premium over both corporate bonds and many securitized products since the market began, over a decade ago.2 One explanation is the relative newness of the market, including many investors’ lack of familiarity with it. But this may be changing. The market has caught investors’ attention, nearly doubling in size in just the last five years3.

Concerns over a lack of liquidity could also be contributing to the yield premium, but we would argue the growth of the CLO market has been accompanied by increased trading volumes and improving liquidity. In March of this year, when bond market volatility was peaking and volumes in many fixed income markets fell, trading volume in CLOs surged, setting a new monthly record for the asset class.4 Meanwhile, the number of CLO managers has grown steadily, more than tripling over the last decade5, increasing both liquidity in the secondary market and more willingness on the part of broker-dealers to transact and hold the products.

Another, timely explanation for CLOs to pay comparatively higher yields could be the typical lack of demand for floating-rate securities during a period of falling interest rates. As floating-rate securities offer less capital appreciation potential in a falling rate environment, it would have been rational for investors to favor fixed-rate securities, like U.S. Treasuries and most corporate bonds and securitized product as the Fed cut interest rates. Particularly over the last few years, as CLO issuance has risen, lower demand for floating-rate products would contribute to higher yields. However, with the Fed’s policy rate now at zero, and Treasuries out to the 10-year note paying less than 1%6, perhaps floating-rate exposure warrants a closer look.

FIXED INCOME PERSPECTIVES

Related products

Multi-Sector Income Fund (JMUDX)

Related products

Multi-Sector Income Fund (JMUIX)

The value of structure

While the underlying collateral for the different segments of the securitized market varies, a few core ideas underlie them all.

- Different individual loans are pooled together in an attempt to create a more diverse offering.

- The product is structured into different classes (usually called tranches) to create higher-quality and lower-quality investment options across the ratings spectrum.

In the case of CLOs, which are collateralized by pools of loans, if there is a deterioration in the underlying collateral, the structure diverts cash flows to the higher-rated notes, which means that investors in a AAA tranche could be repaid sooner than expected, as opposed to later or less.

While no security is without some risk of loss, the amount of protection provided to the highest-rated tranches of a typical CLO has increased dramatically since the Global Financial Crisis, and today the protections are as stringent as any part of the securitized market. Indeed, through the COVID-19 crisis to date, the most severe liquidity crisis in over a decade, CLOs structures generally operated as expected, and in many cases better than the market expected.

Careful portfolio construction includes security selection

In an environment where interest rates are low, real yields (the yield paid after taking into account expected inflation) are negative, and the risk of higher Treasury yields has risen (while corporate bond durations have risen), we encourage investors to consider their portfolio construction carefully. To earn the yield they seek, investors can take additional interest-rate risk through buying ever-longer-term bonds. They could also take additional credit risk by extending into the investment-grade corporate bond market or even the high-yield market. Or, they can add additional exposure to securitized products, where yields often exceed the average for corporate bonds, durations are lower, and – in the case of CLOs – the coupons are floating rate, offering a natural hedge against potentially rising interest rates. But sector selection is only part of the process. Ultimately, we believe the value in active bond asset management comes from security selection within sectors that are identified as offering attractive risk/reward. Characteristics of individual securities can vary widely, and it is the role of the manager – ideally armed with decades of experience – to pick securities that offer better risk/reward and combine them into a portfolio with yield and risk targets that investors seek.

1Source: Bloomberg, as of 10 September 2020.

2Source: Bloomberg, as of September 2020.

3Source: Bloomberg, as of September 2020.

4Source: Bank of America Merrill Lynch, as of September 2020.

5Source: Wells Fargo Securities, as of September 2020.

6Source: Bloomberg, as of 10 September 2020.

Glossary

Yield: The level of income on a security, typically expressed as a percentage rate.

Floating-rate bonds: Debt instruments with a variable coupon, where the interest paid equals a reference rate, such as the fed funds rate, plus a determined spread.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans.

Spread: A measure of how much additional yield an issuer offers over comparable “risk-free” U.S. Treasuries. In general, widening spreads indicate deteriorating creditworthiness of corporate borrowers, tightening spreads are a sign of improving creditworthiness.

Bloomberg Barclays U.S. Corporate Bond Index measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

Duration: Duration is a measure a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa

Securitized Sectors: Refers to fixed income securities that pool financial assets together to create new securities that can be marketed and sold to investors.

Commercial mortgage-backed securities (CMBS): These are fixed income investment products backed by mortgages on commercial properties rather than residential real estate.

Investment-grade corporate bond: A bond typically issued by companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

Premium: When the market price of a security is thought to be more than its underlying value, it is said to be ‘trading at a premium’. Within investment trusts, this is the amount by which the price per share of an investment trust is higher than the value of its underlying net asset value. The opposite of discoun

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

More Fixed Income Perspectives

Previous Article

Will the hump in defaults be a hill or a mountain?

Seth Meyer, Corporate Credit Portfolio Manager, and Esther Watt, Client Portfolio Manager, explore the default outlook for high yield bonds and the risks and opportunities this presents.

Next Article

A letter to the Fed from a concerned friend

Head of Global Bonds Nick Maroutsos expresses concern that monetary policy focused on financial markets will do little to ignite the growth needed for the economy to recover from recent weakness.