October 2020

Will the hump in defaults be a hill or a mountain?

Esther Watt, CFA

Esther Watt, CFA

Client Portfolio Manager Seth Meyer, CFA

Seth Meyer, CFA

Multi Sector Income | Portfolio Manager

Key takeaways

- Current expectations are that the default rate will be less severe than in the Global Financial Crisis, thanks to monetary and fiscal stimulus permitting refinancing and an economic rebound.

- Differences in the composition of high yield markets mean the default outlook is not uniform and at the sector level investors may be surprised by the areas that are outperforming.

- How economies navigate a rise in COVID-19 infection rates will ultimately drive the default outlook but selectivity by investors can help mitigate risks and extract value.

Please see glossary of terms beneath article

Considering the global economy has faced one of the most disruptive economic events in its history, asset markets have staged a remarkable recovery. Equity markets have rallied and corporate bond spreads have tightened on prospects that the global economy can bounce back quickly from the coronavirus-induced downturn. Within the high yield corporate bond market, expectations are that the default rate will rise but be less severe than that experienced after the 2008 Global Financial Crisis (GFC). Monetary and fiscal stimulus, combined with supportive technicals, frame this outlook but are markets right to be sanguine about defaults?

The distressed ratio measures the level of bonds with elevated spreads. It provides a useful barometer of stress within the high yield market. If the distressed ratio is high it is suggestive of an increased likelihood of defaults. While the spike in the distressed ratio back in March heralds a rise in defaults, it was significantly below the levels of the GFC and the fallout from the dot-com bubble.

DISTRESSED RATIOS HAVE DECLINED TO ALMOST PRE-COVID-19 LEVELS

Distressed ratio = % of bonds trading with spreads above 1,000 basis points

Source: Deutsche Bank, ICE Indices, Markit, 31 January 2000 to 8 September 2020. Spreads reflect the additional yield of a corporate bond over an equivalent government bond. In general, widening spreads indicate deteriorating creditworthiness of corporate borrowers, tightening spreads are a sign of improving creditworthiness. Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.[/caption]

A default by any other name

What constitutes a default? This might sound like an inane question – surely when a bond issuer fails to meet their obligations to bondholders – but definitions can be tricky. For holders of credit derivatives in Novo Banco, the Portuguese bank, in 2016 it was a very real question. A decision not to classify a retransfer of assets as a ‘governmental intervention’, which would have triggered protection payments to holders of credit derivatives, meant that creditors were on the hook for losses.

Filing for bankruptcy, defaulting on a payment and restructuring debt are the most common credit events defined by the International Swaps and Derivatives Association (ISDA), the trade organisation of participants in the market for over-the-counter (bespoke) derivatives. However, legal definitions and bankruptcy processes vary considerably from country to country, which can make direct comparisons difficult. Furthermore, differences in regional constituents and index weights further complicate the picture.

For example, bankruptcy in the US is a relatively straightforward and more timely process than in Europe where state aid and loan guarantees typically play a bigger part in the credit markets, sometimes postponing the inevitable. The US can also be seen to be the riskier market with a greater exposure to the energy market and high proportions in the ‘single B’ and ‘CCC’ ratings buckets.

DIFFERENT COMPOSITION OF REGIONAL INDICES

| % weight in index | US | Europe |

|---|---|---|

| BB weighting | 56.2 | 71.1 |

| B weighting | 32.3 | 21.8 |

| CCC weighting | 11.5 | 7.1 |

| Energy sector | 12.9 | 5.0 |

Source: Bloomberg, ICE BofA US High Yield Index, ICE BofA European Currency High Yield Index, as at 9 September 2020. ICE BofA US High Yield Index (H0A0) tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. ICE BofA European Currency High Yield Index (HP00) tracks the performance of EUR and GBP denominated below investment grade corporate debt publicly issued in the eurobond, sterling domestic or euro domestic markets. Ratings agencies assign a credit rating to high yield borrowers based on the borrower’s creditworthiness. The credit rating progresses down through the alphabet such that a BB rated borrower is deemed better quality than B, which in turn is better quality than CCC. A CCC rating indicates the borrower is deemed higher risk and more vulnerable to default.

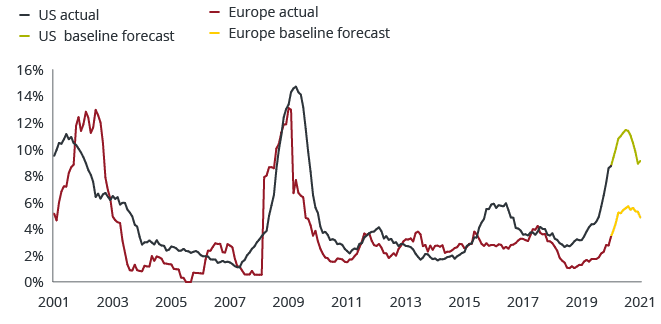

As such, it comes as no surprise that the US has seen a higher number of defaults relative to Europe this year and over recent years, in both cash bonds and derivatives. As the following chart shows, the high yield trailing 12-month default rate, compiled by Moody’s, the credit rating agency, has risen to 8.7% in the US, more than double Europe’s 3.4% as at the end of August.1

SPECULATIVE GRADE (HIGH YIELD) DEFAULT RATES

High yield default rates expected to peak lower than during the Global Financial Crisis

Source: Moody’s default report, Trailing 12-month default rate, issuer weighted, 31 August 2000 to 31 August 2020. Baseline forecast as at 9 September 2020. Baseline is the most likely outcome between optimistic and pessimistic scenarios. The forecast is an estimate only, may vary and is not guaranteed.[/caption]

Given the equal weightings applied to credit default swap (CDS) indices a direct comparison does not make sense, but the latest iteration of the Markit CDX NA HY Index (North America high yield) provisionally sees eight companies leaving the index due to defaults versus only two in the Markit iTraxx Crossover Index (Europe).2

Bridging the divide

Despite the unprecedented cessation of activity in some areas of the economy, default expectations have not rocketed. This is because many companies have been able to refinance at increasingly attractive levels thanks to the quick and unprecedented level of fiscal and monetary response that followed the coronavirus-related sell-off in March. To put this into context, in August, Ball Corp., an aluminium container maker rated BB+, set a record for the lowest coupon on 10-year bonds issued by a US junk-rated company – at 2.875%3.

Investors should therefore not be overly alarmed by a near term deterioration in credit metrics. It is this successful ‘bridging’ of the revenue gap with temporary borrowing that will broadly see corporate credit metrics weaken over the next year or so before balance sheet repairs begin to take place. Investors, however, need to be discriminatory. Amid the high levels of issuance, good money will be thrown after bad and it is important to identify those issuers for whom structural changes have permanently impaired the business model.

Sector distinction

Unlike a more typical credit cycle, both companies with strong business models and those more fundamentally challenged are having to adapt to the COVID-19 environment. The nature of this crisis, with its restrictions on social activities, means retail, travel, and leisure are suffering alongside energy. We also need to be cognisant that these sectors are more likely to be exposed to the economic fallout from a second wave of COVID-19 infections. Some will already have used unencumbered assets to raise senior secured financing. A prolonged period of low revenues means this may have to be restructured further out.

Healthcare and technology are among the top performing sectors within high yield year to date4 but investors may be surprised to learn that media, consumer goods, and autos are too, which highlights idiosyncrasies specific to credit and the composition of the high yield market. COVID-19 has accelerated usage of home entertainment, bringing a boost to the subscriber base of Netflix, the media group and significant high yield borrower. In autos, Ford became a so-called ‘fallen angel’ after it was downgraded from investment grade to high yield. Yet the high yield market was able to comfortably absorb the US$36 billion of debt and the spread on Ford’s bonds subsequently tightened, illustrating that fallen angels can offer potential return opportunities for high yield investors.

The view from the top

The outlook remains uncertain in the absence of a proven COVID-19 vaccine. The ability to navigate a second wave in the northern hemisphere through winter without a marked pickup in hospital admittance will be crucial to keeping economies open and the recovery sustained. With announced fiscal support programmes coming to an end over the next couple of months on both sides of the Atlantic, the level of unemployment will be a key metric to watch as we go into the US election at the beginning of November and a potential ‘no deal’ Brexit at year end.

Continued high levels of new issuance, fallen angels (previously investment grade names that have been downgraded), identifying potential rising stars and ‘avoiding the losers’ are all areas where an active manager can add value. Alongside defaults, zombie companies (those which can service interest payment on their debt but lack sufficient funds to repay the capital or grow the business) are another area of concern for investors, but while we recognise the long-term impact of a misallocation of capital on productivity and growth, at the right price these too can be a source of returns for high yield investors while they remain creditworthy.

Ongoing nervousness means average spreads on high yield bonds remain above their three and five-year averages5 and an effective yield of 5.5% for the ICE Global High Yield Bond Index (at 9 September 2020) means the asset class is likely to continue to attract investors prepared to accept some risk in the search for income. The default rate over the coming year may lack the height of previous episodes but we are mindful that the strength of the economy will determine whether the hump in defaults has a rapid descent or a more prolonged period of corporate challenge, underscoring the need for careful credit analysis.

1Source: Moody’s default report (August 2020), 9 September 2020.

2Source: Morgan Stanley, CDX/iTraxx Roll Update, 11 September 2020, Markit news 16 September 2020. IHS Markit CDX NA HY Index is a tradeable credit default swap index comprising the most liquid North American high yield (sub-investment grade) entities. IHS Markit iTraxx Crossover Index is a tradeable credit default swap index that comprises the 75 most liquid sub-investment grade entities.

3Source: Bloomberg, 10 August 2020.

4Source: Bloomberg, ICE BofA Global High Yield Index, total return in US dollars, 31 December 2019 to 31 August 2020. ICE BofA Global High Yield Index (HW00) tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or eurobond markets.

5Source: Bloomberg, ICE BofA Global High Yield Index, Govt option-adjusted spread (OAS), 3-year and 5-year periods to 9 September 2020 inclusive. Option-Adjusted Spread (OAS) measures the spread between a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option.

Glossary

High yield bond: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk. High yield credit quality ratings are measured on a scale that generally ranges from BB (highest) to D (lowest).

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

Spread/Credit Spread: The difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Credit derivative: A financial asset in the form of a privately held bilateral contract between parties in a creditor/debtor relationship, which allows the creditor to transfer the risk of the debtor’s default to a third party, paying it a fee to do so.

Credit default swap (CDS): A form of derivative between two parties, designed to transfer the credit risk of a bond. The buyer of the swap makes regular payments to the seller. In return, the seller agrees to pay off the underlying debt if there is a default on the bond. A CDS is considered insurance against non-payment and is also a tradable security. This allows a fund manager to take positions on a particular issuer or index, without owning the underlying security or securities.

Fallen angel: A bond that has been downgraded from an investment-grade rating to sub-investment-grade status, due to a deterioration in the financial condition of the issuer.

Rising Star: A bond that has potential to be upgraded once the company establishes an outstanding track record of paying back its debt.

Yield: The level of income on a security, typically expressed as a percentage rate.

Senior Secured Debt: Senior debt is borrowed money that a company must repay first if it goes out of business. The “secured” classification means the issuer is backing it with collateral.

FIXED INCOME PERSPECTIVES

Overcome Uncertainty, Pursue Income

Related Products

Multi-Sector Income Fund (JMUDX)

High-Yield Fund (JNHYX)

Related Products

Multi-Sector Income Fund (JMUIX)

High-Yield Fund (JHYFX)

More Fixed Income Perspectives

Previous Article

Strategic Fixed Income: the predictable Japanification of US corporates

Jenna Barnard, Co-Head of Strategic Fixed Income, discusses how the suppression of volatility in interest rates by major central banks has spread the Japanification phenomenon to the US.

Next Article

A letter to the Fed from a concerned friend

Head of Global Bonds Nick Maroutsos expresses concern that monetary policy focused on financial markets will do little to ignite the growth needed for the economy to recover from recent weakness.

Next Article

Finding floating-rate opportunities in a low-yield world

The Securitized Products team discusses potential advantages of floating-rate products in a low-yield environment given their ability to act as a hedge against rising rates.

Janus Henderson Investors makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any portfolio. Illustrations shown are for the limited purpose of highlighting specific elements of the research process. The examples are not intended to be a recommendation to buy or sell a security, or an indication of the holdings of any portfolio or an indication of performance for the subject company.

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security. Janus Henderson Investors, one of its affiliated advisors, or its employees, may have a position in the securities mentioned in the report.