A letter to the Fed from a concerned friend

-

Nick Maroutsos

Nick Maroutsos

Head of Global Bonds | Portfolio Manager

Key takeaways

- The Federal Reserve (Fed) has proven it can support financial markets, but there is scant evidence of its basket of ultra-accommodative policy tools spurring economic growth.

- The Fed’s recent relaxation of its 2% inflation target is an implicit admission that inflation is of little concern and more initiatives are needed to create a pro-growth environment.

- With interest rates suppressed, bond investors have limited choices when seeking securities that offer the characteristics they have come to expect from a fixed income allocation.

Please see glossary of terms beneath article.

Dear Fed,

I’ve been meaning to write for a while but recognizing how much you’ve had on your plate during this tumultuous year, I did not want to distract you from the Herculean tasks you’ve been assigned. Over these past months you have proven your good-heartedness as you’ve made great efforts to support families, small businesses and employers – you know, the components of the real economy that underpinned your charter more than a century ago. With magnanimity to spare, you also lent a helping hand to vulnerable souls like Apple, Citigroup, AT&T, Ford, United Airlines and many other Fortune 500 stalwarts.

Yet, I believe your same propensity to give may leave you exposed to being taken advantage of. Due to this concern, I believe that I must speak up. I’m referencing your relationship with financial markets, which I fear has grown increasingly one-sided, to the point of becoming dysfunctional. The writing is – if not on the wall – at least in this year’s corporate bond issuance data. It’s the highest level on record as your programs that were initially created to thaw markets have allowed corporations to binge on low borrowing costs, sidestepping legitimate concerns about depressed earnings.

I can understand your desire to have given markets a helping hand during the Global Financial Crisis (GFC). Yet, so often these “project” relationships end badly as some partners are just incapable of change. The promise was there; I get it. A school of thought was that rock-bottom interest rates and bond purchases would lower the cost of capital, leading to an investment boom that would increase productivity and wages. It didn’t happen. Instead, companies gorged on cheap credit to fund a wave of share buybacks. Then, you hoped that rising asset prices would lead to a wealth effect as frothy equity prices spurred a consumption boom that would permeate the economy. While benefits may have been felt by electric vehicle dealers, Bay area wineries and fortuitously located realtors, this “rising tide” promise fell flat across much of the country. Forgive me for being cynical, but I have my doubts that large corporations’ recent feast on cheap funding will result in shiny new factories or large-scale job creation.

I’d like to say that you’re faultless in this situation, but the hard truth is that you’re enabling the market’s rash behavior. Now the proverbial camel’s nose is under the tent and any attempt to instill responsibility and moderation on the market inevitably is met with petulance, à la 2013’s taper tantrum and autumn 2018’s normalization convulsion.

I cannot help but think how much happier you appeared when the real economy commanded your undivided attention. That relationship seemed so much healthier. The economy would weaken, you’d lower rates and a credit impulse would spur investment and consumption. Granted, the relationship wasn’t without its missteps; often you were slow to control accelerating inflation, but that’s an error that likely won’t be repeated in the future. Both you and I know that inflation is not a clear and present danger.

While your recent relaxation of the definition of full employment is welcome as it should support job creation in underserved communities, it’s your expectation of perpetually mild inflation – if not disinflation – that’s allowed you to take this step without fearing any inflationary consequences. It’s a shame that markets seem to be calling the shots now because your updated views on employment and inflation mean that you’ve finally jettisoned the Phillips Curve, which has proven to be an ineffective tool in managing the economy during the post-GFC era.

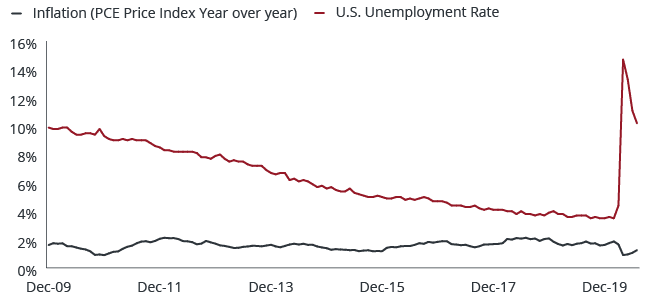

SO LONG, MR. PHILLIPS

Over the past decade, core inflation barely budged – averaging 1.6% – despite the Fed keeping interest rates low and unemployment steadily declining, all of which indicate a breakdown between the purported inflation-employment relationship espoused by the Phillips Curve that has been a central tenet of Fed policy.

[caption id=”attachment_323529″ align=”alignnone” width=”660″]

Source: Bloomberg, as of 11 September 2020. The personal consumption expenditures price index (PCE) is a measure of the prices that people living in the U.S., or those buying on their behalf, pay for goods and services. The index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.[/caption]

The neediness of markets – especially of riskier assets – has led to misplaced priorities. Healthy financial markets should be a reflection of a vibrant economy. Inventions deployed to artificially support asset prices do nothing to ignite growth on Main Street – the past dozen years have proven that.

The U.S. is endowed with robust capital markets, but the irony is that your recent decision to implicitly allow asset bubbles while seeking to shore up the real economy may actually inhibit growth in the long run. The primary function of capital markets is to steer funds toward the most attractive investment opportunities, thus facilitating growth. The current distortions caused by hyper-accommodative policy leads to the opposite: bad investment decisions that do nothing to channel funds to their most promising use. Case in point are low-quality “zombie” corporations surviving by continuously unloading new debt onto yield-starved investors.

Caught in the middle are prudent investors. Attempting to navigate markets where company fundamentals are secondary to policy means the traditional approach to asset management has been turned on its head. Riskier assets are risky for a reason. That’s why stocks typically command an equity risk premium and bond yields a spread above those on risk-free securities. If you always have the back of markets, there is little reason to account for these risk premia, and putatively risky securities are free to run exuberantly upward.

Given the primacy you’ve place on buoyant markets, there would seem to be little reason to own bonds given their miniscule yields. But while many stocks can return more in one day than the 10-year U.S. Treasury does in a year, the early-September sell-off sends a reminder that short bouts of volatility are possible.

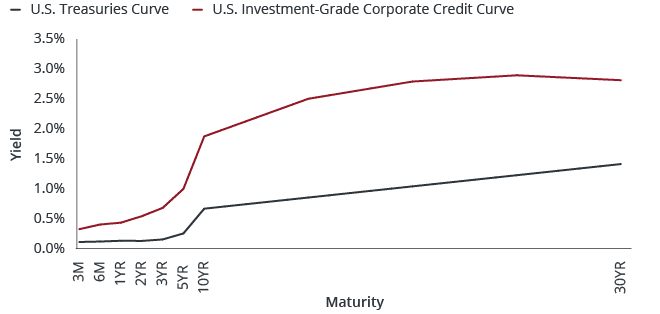

The selection of a potential hedge against this volatility has also been influenced by your unwavering support of markets. With the yield on longer-dated Treasuries barely above those on shorter maturities, the front end of the curve is one of the few segments of financial markets where logic seems to prevail. The risk/reward of these securities look to be even more like a refuge of last resort given your commitment to not raising rates.

U.S. TREASURIES AND INVESTMENT-GRADE CREDIT CURVE

With interest rates suppressed across all maturities – and likely set to stay that way – one of the few pockets of the bond market that offers an attractive term premium is shorter-dated, investment-grade credits, which have the potential to generate income as securities “roll down” toward maturity.

[caption id=”attachment_323540″ align=”alignnone” width=”660″] Source: Bloomberg, as of 11 September 2020. Investment-grade corporate bonds are those issued by companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default.[/caption]

Source: Bloomberg, as of 11 September 2020. Investment-grade corporate bonds are those issued by companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default.[/caption]

Years of flawed policy assumptions have backed you into a corner and now the market is calling the shots. The real economy is the victim here. If you are honest with yourself, you know this fealty to markets won’t give you what you truly desire – and were statutorily mandated to pursue. You pin your hopes on possible help from fiscal authorities, but we know how undependable they are.

It would take a reckoning to extricate yourself from this predicament. The market needs to be shown tough love. It must accept risk is part of life and that it cannot free ride on your largesse without having to share your attention with the real economy.

Extracting yourself from this destructive situation is easier said than done and the longer it continues, the more painful the reckoning is likely to be. A world in which never-ending dovish policy and Fed backstops keep asset valuations high may seem like one where everybody wins, but in actuality, everyone will eventually lose.

Glossary

Taper tantrum: Markets’ reaction following the U.S. Federal Reserve Chairman’s comments in May 2013, which suggested that the U.S. was considering tapering (slowing down) the rate of its bond buying program (quantitative easing).

Phillips Curve: A single-equation economic model describing an inverse relationship between rates of unemployment and corresponding rates of rises in wages that result within an economy.

Risk premium: The additional return over cash that an investor expects as compensation from holding an asset that is not risk free. The riskier an asset is deemed to be, the higher its risk premium.

Yield: The level of income on a security, typically expressed as a percentage rate.

Spread/credit spread: The difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Maturity: The maturity date is when a debt comes due and all principal and/or interest must be repaid to creditors.

Full holdings for Absolute Return Income Opportunities Fund can be found here

Full holdings for VNLA can be viewed here

Full holdings for Absolute Return Income Opportunities Fund can be found here

FIXED INCOME PERSPECTIVES

Explore MoreOvercome Uncertainty, Pursue Income

Learn MoreFeatured products

Absolute Return Income Opportunities Fund (JUCIX)Short Duration Income ETF (VNLA)

Featured products

Absolute Return Income Opportunities Fund (JUCDX)

More Fixed Income Perspectives

Previous Article

Finding floating-rate opportunities in a low-yield world

The Securitized Products team discusses potential advantages of floating-rate products in a low-yield environment given their ability to act as a hedge against rising rates.

Previous Article

Will the hump in defaults be a hill or a mountain?

Seth Meyer, Corporate Credit Portfolio Manager, and Esther Watt, Client Portfolio Manager, explore the default outlook for high yield bonds and the risks and opportunities this presents.

Next Article

The Fed’s new policy, inflation and its implications for US bonds

Head of US Fixed Income Greg Wilensky and Portfolio Manager Michael Keough discuss their outlook for US inflation after the Federal Reserve’s policy change, and its impact on US bond markets.

Janus Henderson Investors makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any portfolio. Illustrations shown are for the limited purpose of highlighting specific elements of the research process. The examples are not intended to be a recommendation to buy or sell a security, or an indication of the holdings of any portfolio or an indication of performance for the subject company.