Subscribe

Sign up for timely perspectives delivered to your inbox.

With the Supreme Court set to hear arguments about the constitutionality of the Affordable Care Act (ACA) on Nov. 10, the death of Justice Ruth Bader Ginsburg has raised doubts about the law’s future and led stocks of hospitals and insurance providers to sell off. But Portfolio Manager Andy Acker and Research Analyst Rich Carney say the reaction may be overdone.

Following the death of Supreme Court Justice Ruth Bader Ginsburg, the future of the Affordable Care Act (ACA) – the decade-old legislation that expanded health care access in the U.S. – has become less certain. That’s because the Supreme Court is set to hear a case challenging the validity of the law on Nov. 10, one week after the U.S. election. The suit, led by a coalition of Republican state attorneys general and joined by the Trump administration, argues that the law became unconstitutional after a 2017 federal tax cut removed the tax penalty associated with the ACA’s mandate that all Americans obtain health insurance (known as the “individual mandate”). The Supreme Court has twice upheld the ACA in previous legal challenges, but Justice Ginsburg had been a key part of the 5-4 rulings.

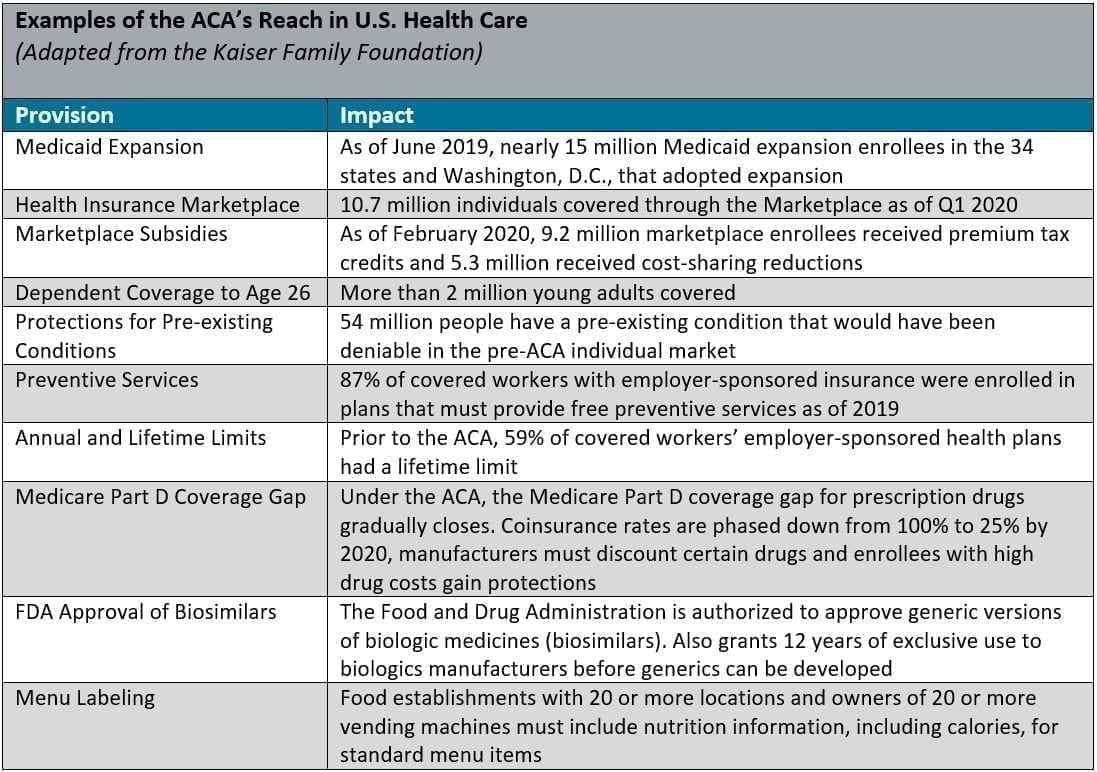

The ACA has become an integral part of the U.S. health care system, not just in terms of expanding access to care but other key policies, such as banning insurers from rejecting patients with pre-existing conditions. With the ACA’s future now more tenuous, health care stocks have come under pressure, particularly those of insurance companies and service providers (i.e., hospitals), both of which could be directly impacted by changes to the law.

[caption id=”attachment_320483″ align=”alignnone” width=”1097″] Source: Kaiser Family Foundation, as of 22 September 2020.[/caption]

Source: Kaiser Family Foundation, as of 22 September 2020.[/caption]We recognize that the ACA’s future is more at risk, potentially leading to significant disruption for the health care system. But as dire as some headlines cast the turn of events (“Ginsburg’s death leaves Obamacare in greater danger than ever”1), we’d point out that the range of potential outcomes is much wider than might first appear and depends on several unknowns:

Given the wide range of variables, the tail risk of the ACA being invalidated has grown. But even then, it’s important to remember that remedies exist should parts of the law be rolled back. For example, if the Supreme Court determines that the individual mandate is unconstitutional and thereby pre-existing condition protections and guaranteed issue are invalid, states or Congress could legislate to replace these protections. (Guaranteed issue requires that insurers furnish policies to individuals regardless of health status.) Furthermore, invalidating the entire law would effectively throw the U.S. medical system into chaos given the ACA’s wide reach and longevity. And the optics of undoing the law during a global pandemic would be horrible. Thus, as Mark Twain once quipped about rumors of his death, we think reports of the ACA’s demise “are greatly exaggerated.”

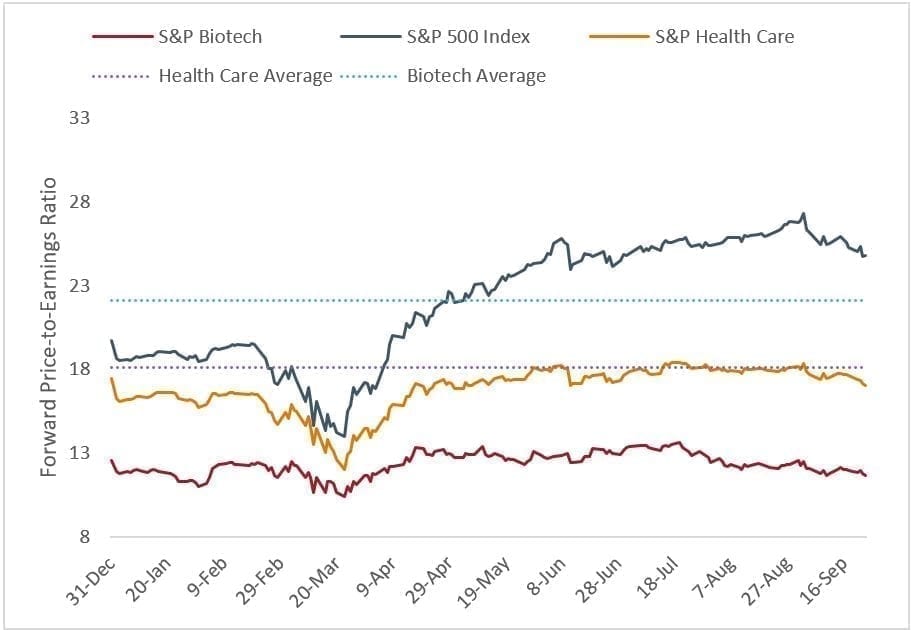

Sentiment could weigh on health care stocks in the near term, particularly for hospitals and providers that have benefited from ACA provisions like Medicaid expansion. But we’d also point out that negative sentiment could cause valuations to dislocate from fundamentals, as happened a decade ago when the ACA was first being legislated. Today, the health care sector trades at a large discount to the broader markets, even as many companies develop breakthrough therapies – including vaccines for COVID-19. In our view, these types of dislocations create opportunities for investors and can make a significant difference to long-term returns.

[caption id=”attachment_320546″ align=”alignnone” width=”911″] Source: Bloomberg. Index and sector data from 31 December 2019 to 24 September 2020. Averages reflect quarterly data from 31 March 1992 to 30 June 2020. S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance. S&P sector indices comprise those companies included in the S&P 500 that are classified as members of the respective GICS® sector.[/caption]

Source: Bloomberg. Index and sector data from 31 December 2019 to 24 September 2020. Averages reflect quarterly data from 31 March 1992 to 30 June 2020. S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance. S&P sector indices comprise those companies included in the S&P 500 that are classified as members of the respective GICS® sector.[/caption]

1Politico, 19 September 2020