October 2020

Global real estate – coming to the end of the abnormal?

-

Tim Gibson

Tim Gibson

Co-Head of Global Property Equities | Portfolio Manager -

Greg Kuhl, CFA

Greg Kuhl, CFA

Portfolio Manager -

Guy Barnard, CFA

Guy Barnard, CFA

Co-Head of Global Property Equities | Portfolio Manager

Key takeaways

- Common perceptions around rent collection have been wrong, with multi-year contracts providing resilience.

- Share prices for many listed companies are trading below their net asset value, with increasing evidence of a disconnect between REIT and direct property valuations emerging in many sectors.

- The team believes normality will return and, as such, this is a period to selectively capture attractive opportunities.

Real estate equities have been one of the weakest performing sectors year-to-date as investors have perceived that tenants will struggle to pay rent, and in turn, landlords will struggle to pay dividends.[1]

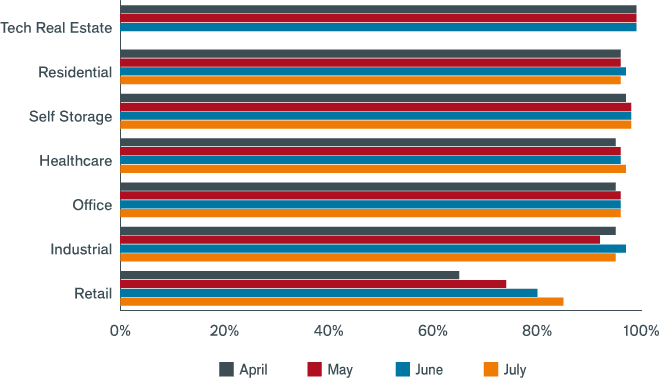

The reality however is somewhat different to this view. Rent collection and operational performance among most sectors with contractual leases has so far been incredibly resilient. There have been notable exceptions in sectors such as retail and hotels, which found themselves most impacted by COVID-19. From April through July 2020, the weighted average contractual rent collection for US-listed real estate investment trusts (REITs) was 94% excluding the retail sector. As for retail, while still weak, the sector has seen a marked improvement in rent collections as stores have been allowed to reopen. In Europe and Asia, we have seen similar trends, with rent collection numbers varying depending on local individual market conditions and the response from governments to the pandemic.

WITH THE EXCEPTION OF RETAIL, US REIT RENT COLLECTION REMAINS HIGHUS REIT April to July, rent collection by sector: weighted average ex Retail 94%

[caption id=”attachment_320826″ align=”alignnone” width=”660″]

Source: Janus Henderson Investors, company filings and commentary as of 31 August 2020. Collections reflect weighted averages based on FTSE EPRA NAREIT North America Index weights. Percentages listed within chart are average collection over the four months. Only properties with contractual leases are included.[/caption]

Why have we seen resilience in rent collections?

Many real estate companies are in an enviable position of having multi-year lease contracts, which the vast majority of tenants have honoured. We believe this provides listed real estate companies a distinct advantage over other equity sectors given the higher degree of visibility in forecasting next year’s earnings. This has also led to dividend cuts being the exception rather than the rule.

How are current valuations for real estate equities looking?

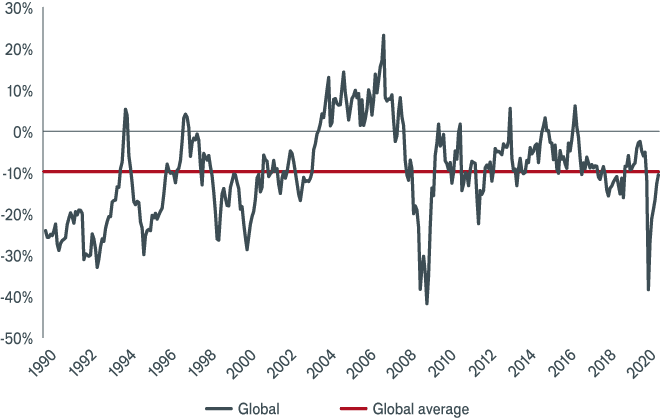

The further relaxation in monetary policy across the globe implies that the ’lower for longer’ environment may continue for some time to come, meaning the search for income among investors is expected to remain strong. We believe this will continue to support the demand for listed real estate. More interestingly, global real estate equities currently look cheap relative to many other asset classes. A key metric for the valuation of the sector is the level at which listed property companies trade relative to the private market value of underlying property owned by the companies (their net asset value or NAV).

Share prices for many listed companies are trading below their NAV (see chart below) and in some sectors, such as office, discounts of 25% already appear to reflect a significant degree of uncertainty.

It is also noteworthy that REITs continue to offer an attractive dividend yield relative to many other asset classes. Dividend growth has also typically matched or outpaced inflation over the longer term.[2]

This means in times of market weakness, investors have benefited from dividend growth while waiting for valuations in the sector to improve.

PROPERTY COMPANIES ARE TRADING AT WIDE DISCOUNTS TO NET ASSET VALUEGlobal property markets premium/(discount) to NAV

[caption id=”attachment_320782″ align=”alignnone” width=”660″]

Source: Refinitiv Datastream, UBS estimates monthly data from Jan 1990 to August 2020. Global average excludes emerging markets.

A discount between the share price a company trades at and its Net Asset Value (assets minus liabilities) means the market is pricing in uncertainty. This discount will typically reduce if prospects are considered to improve.[/caption]

But the devil is in the detail

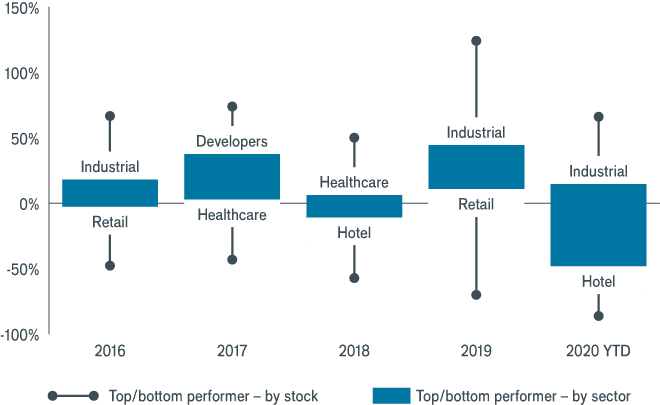

The dispersion (distribution) of returns in the real estate sector has rarely been wider, underlining the need for selectivity. Listed REITs in some sectors, particularly those which have been largely unaffected by COVID-19 such as data centres, cell towers and industrials, have posted strong absolute returns year-to-date (to 31 August), while retail, office, and hotel have suffered significantly. The chart shows the best- and worst-performing stocks in the FTSE EPRA Nareit Developed Index each year since 2016 (line with dots at each end) and the gap between the best and worst performing sector for each year (blue rectangle).

DISPERSION OF RETURNS BY SECTOR IS WIDENING

[caption id=”attachment_320793″ align=”alignnone” width=”660″]

Source: Bloomberg, Janus Henderson Investors, as of 31 August 2020. Stock and sector returns refer to the FTSE EPRA Nareit Developed Index.[/caption]

Are current valuations for listed real estate reasonable?

We think that the old adage that equity markets act like a voting system in the short term, and a weighting system in the long term probably has some truth to it. While news flow, perceptions and emotions may influence prices in the short run, prices in the long run will factor in the fundamentals of companies, e.g. earnings, cash flow and growth.

We still believe that the long-term ‘winners and losers’ in real estate – driven by changes in demographics, lifestyles and technological disruption – remain the same, and that current pricing does not fully reflect the future growth to come in areas with structural drivers of demand.

Where are the most attractive investment opportunities?

As the passing months have seen countries and populations adapt to the pandemic, many of us will increasingly long for a return to the way things used to be. The good news is that for many property companies, not much has changed with cash flows and dividends having held up much better than many expected.

While we claim no expertise in any field outside of property, we believe the unprecedented global resources being directed towards vaccines, treatments, and testing as well as the progress that is being made will mean the virus has an expiration date. When the threat of viral infection is minimised, will most people remain averse to airplane travel, sending children to school, collaborating with colleagues in the office, frequenting restaurants and bars, and attending sporting events, the theatre, museums, and cultural attractions offered by big cities? While the virus will surely bring lasting change, in our view, our existence will eventually return to something more normal rather than the abnormal we have known for the most part of 2020.

As such, when taking a longer-term view, we are beginning to see selective opportunities in cheap but not broken sectors that are looking more and more mispriced, including offices, healthcare and hotels. These sectors have borne the brunt of a lot of bad news recently, but as things slowly return to normal and outlooks improve, valuations and pricing are likely to move in tandem. We are already seeing some early signs of potential opportunistic investments in the private real estate market where the number of buy/sell agreements has improved dramatically with this figure down only 17% year-on-year for July compared with -74% in April and early May[3]. An increase in private market property transactions could be highlighting some very large discounts currently available in selected listed REIT sectors ̶ opportunities that we are actively monitoring and, where appropriate, looking to take advantage of.

Notes

[1] Source: Bloomberg, from 31 December 2019 to 23 September 2020.

[2] Source: NAREIT (National Association of Real Estate Investment Trusts). REIT dividends have outpaced inflation as measured by the consumer price index in all but two of the last twenty years to 2018.

[3] Source: CBRE Deal Flow, July 2020.

The FTSE EPRA Nareit North America Index is designed to track the performance of listed real estate companies and REITs in North American markets (US and Canada). By making the index constituents free float adjusted (where the weight of each stock in the index depends on its market value), liquidity, size and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and Exchange Traded Funds (ETFs).

The FTSE EPRA Nareit Developed Index is a free-float adjusted, market capitalisation-weighted index designed to track the performance of listed real estate companies in developed countries worldwide. Constituents of the Index are screened on liquidity, size and revenue.

Weighted average is an average resulting from the multiplication of each component by a factor reflecting its importance. eg by index weight.

Dividend yield is the income received on an investment relative to its price, expressed as a percentage.

EQUITYPERSPECTIVES Back to main

Overcome Uncertainty, Pursue Income

Learn MoreRelated products

Global Real Estate Fund (JNGSX)

Related products

Global Real Estate Fund (JERIX)

More Equity Perspectives

PREVIOUS ARTICLE

The highly rational – and sometimes slightly less rational – world of tech investing

Portfolio Manager Denny Fish argues that a long view is essential for maximising the opportunity presented by the forces driving the transition to a digital global economy.

NEXT ARTICLE

Business model investing: opportunity amid crisis

U.S. equities Portfolio Manager Nick Schommer discusses the importance of durable, competitively advantaged business models amid a disrupted economic environment.