October 2020

Looking past election volatility

-

Matt Peron

Matt Peron

Director of Research | Portfolio Manager

Key takeaways

- The 2020 U.S. election comes at a pivotal time, with the trajectory of the COVID-19 pandemic still unknown and the economic outlook uncertain.

- As such, U.S. stocks could experience increased volatility in the coming months as markets digest both a complicated macroeconomic backdrop and potential changes in Washington, D.C.

- But election-related pullbacks often have more to do with fear than actual policy and could create opportunities to invest in high-quality companies at attractive valuations.

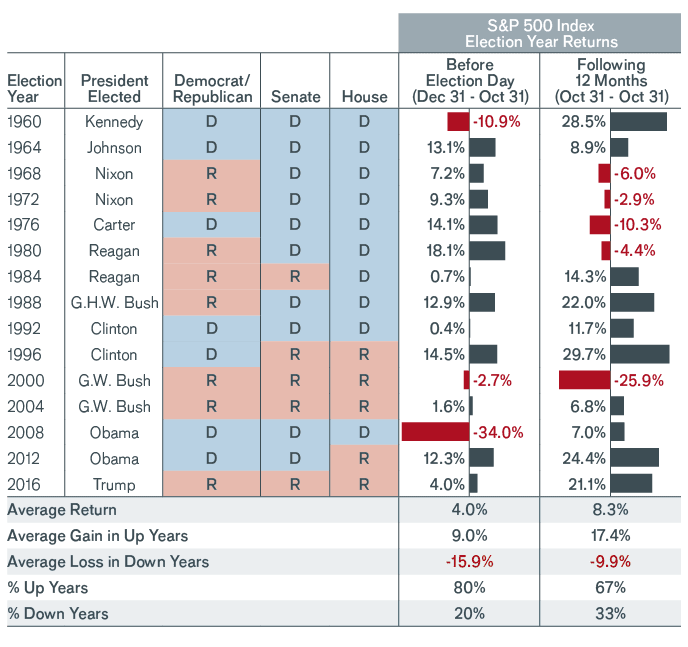

With the 2020 U.S. presidential election fast approaching, markets are weighing the probability of a Democratic or Republican win and the resulting impact on stocks. Since 1960, the S&P 500® Index has enjoyed positive returns in the months leading up to a presidential election 80% of the time and typically gone on to deliver gains in the 12 months following – with little differentiation between which party proves the victor (see table below). To no surprise, the COVID-19 pandemic has complicated matters for 2020, with U.S. stocks cratering early in the year as the outbreak spread, then rebounding as central banks unleashed massive stimulus and economic lockdowns eased. With the pandemic’s trajectory still unknown, the election comes at a pivotal time, but the policies that result in the months and years following the vote may be less disruptive than feared.

STOCK PERFORMANCE DURING U.S. PRESIDENTIAL ELECTIONS

The S&P 500 has typically delivered gains in the months leading up to an election and in the 12 months following.

[caption id=”attachment_321827″ align=”alignnone” width=”688″] Source: Bloomberg, September 2020, Janus Henderson Investors. Past performance is not a guide to future performance.[/caption]

Source: Bloomberg, September 2020, Janus Henderson Investors. Past performance is not a guide to future performance.[/caption]

A crowded macroeconomic backdrop

To be sure, we have already seen some equities trade up and down on polling data. During the summer, so-called “blue” stocks – equities of companies that might benefit should Democratic nominee Joe Biden win – rallied as the former vice president enjoyed a significant lead in polls.[1] But the global pandemic and resulting economic slump has muddied the backdrop. Take the health care sector. Both President Trump and Biden have discussed introducing significant reforms to the U.S. medical system, including policies that would curb prescription drug prices. In the past, such proposals have weighed on health care equities during election periods, as we saw in 2016.[2] But this year, the sector – specifically, biotechnology stocks – has outpaced the broader market, as the industry rises to the challenge of developing vaccines and treatments for the virus that causes COVID-19.[3]

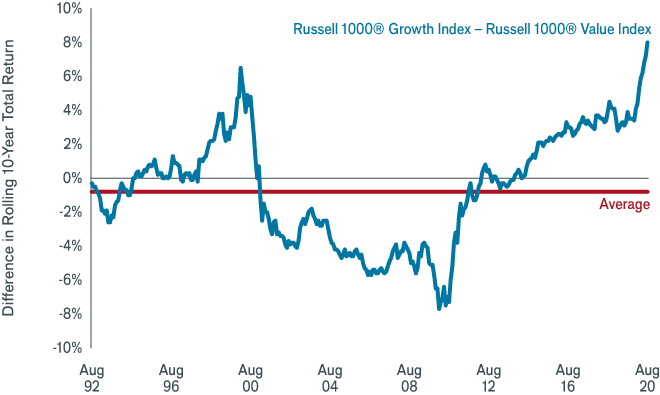

Massive stimulus unleashed by the Federal Reserve in response to the pandemic has been another dominating force. With the 10-year Treasury yield now near record lows, fast-growing companies – many of which offer digital platforms that have experienced soaring demand in a socially distanced world – have seen the value of their future earnings and cash flow rise. At the same time, the dramatic slump in the global economy has weighed on companies whose prospects are tied to the economic outlook. As such, the difference in returns between these companies has been abnormally wide and could persist until economic growth improves or rates rise, regardless of the election outcome (see chart below).

GROWTH OUTPERFORMS VALUE

In another sign of the year’s trends, fast-growing companies (growth equities) have outperformed more economically cyclical firms (value stocks) by an unprecedented margin.

[caption id=”attachment_320815″ align=”alignnone” width=”660″]

Source: Bloomberg, data are monthly from 31/12/1990 to 31/8/2020. Past performance is not a guide to future performance.[/caption]

Campaign promises vs. legislation

Restoring economic growth is likely to be a White House priority no matter who wins the election. But the two candidates would take different approaches to that goal. Trump, for one, has proposed deferring payroll taxes, lowering the top capital gains tax rate and maintaining the corporate tax rate at 21% (lowered from as much as 35% under the Tax Cuts and Jobs Act of 2017). Biden, on the other hand, says he would increase spending on infrastructure, funded by a higher corporate tax rate (28%) and bigger tax bills for wealthy households. Trump is also expected to continue pursuing industry-friendly regulations for fossil fuels and banks, while Biden has proposed making big investments in green energy and expanding government-run health care.

At first blush, these proposals might suggest that certain sectors, such as energy and finance, would do well under a Trump administration, while renewables and select industrials would thrive under a Biden presidency. But long term, the impact could be more nuanced and will certainly depend on policy details. Consider energy: Biden has a goal of eliminating carbon emissions from electric power generation by 2035, part of a roughly US$2 trillion clean energy plan that would also speed adoption of electric vehicles and improve the energy efficiency of buildings. Overall, such initiatives could be seen as a negative for oil and gas companies. But in our view, it wouldn’t spell the end of these industries. On the contrary, we think oil and gas would remain key players in a decades-long energy transition and that the value of pipelines, refineries and other existing carbon assets could actually increase if investment in fossil fuels slows.

It’s also important to remember that whoever wins the White House will need the support of Congress to turn campaign proposals into reality. Even if Democrats achieve a so-called “blue wave” – winning the presidency and gaining a majority in Congress – significant changes to Senate voting rules may have to be made in order to pass transformative legislation. Thus, while incremental reform could be achieved quickly, bigger overhauls would be slower to come, if at all.

Short-term volatility, long-term opportunity

Nevertheless, markets fear the unknown and could become more unsettled as Election Day draws near. An unclear – or contested – outcome on November 3 could also roil stocks. But investors should bear in mind that these swings usually are short-lived. On the night of Trump’s 2016 victory, futures contracts for the S&P 500 plunged 5%, hitting a daily downside limit. The next day, the index finished the trading session with gains.[4] When the Affordable Care Act (ACA) was being debated in 2009, stocks of some of the largest managed care companies in the U.S. traded at less than 6x forward earnings (an estimate of a company’s earnings for upcoming periods) on worries that profitability and revenues would suffer.[5] But the ACA ended up being a growth opportunity for the industry, as more than 20 million new individuals gained coverage under the legislation, with 100% covered by private sector plans. Today, the group’s average valuation is 15x forward earnings.[6]

This type of fear trade – one divorced from fundamentals – can create attractive opportunities to invest in companies with strong balance sheets and innovative products and services. Such firms could thrive long after an election is decided and potentially benefit investors who look past the volatility and stay focused on bottom-up analysis.

[1] https://www.cnn.com/2020/09/02/investing/joe-biden-stock-market-donald-trump/index.html

[2] Bloomberg. Data reflect returns for S&P 500 Health Care sector from 31/12/2015 to 31/10/2016.

[3] Bloomberg. Data reflect year-to-date total return for Nasdaq Biotechnology Index and S&P 500 Index as of 10 September 2020.

[4] https://www.reuters.com/article/usa-stocks/us-stocks-futures-slide-as-trump-wins-u-s-presidential-election-idUSL1N1DA10L, Bloomberg. Data as of 9/11/2016.

[5] Bloomberg, data for UnitedHealth Group and Anthem as of 31 March 2009.

[6] Bloomberg, data for S&P 500 Managed Health Care sub-sector as of 10 September 2020.

EQUITYPERSPECTIVES Back to main

Related products

More Equity Perspectives

PREVIOUS ARTICLE

Is now the time for defensive value?

Portfolio Manager Justin Tugman discusses factors that may point to a leadership change from growth to value stocks. He also explores the potential a defensive value-based approach offers investors concerned with ongoing market volatility and lofty stock valuations.

NEXT ARTICLE

The highly rational – and sometimes slightly sess rational – world of tech investing

Portfolio Manager Denny Fish argues that a long view is essential for maximising the opportunity presented by the forces driving the transition to a digital global economy.