Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Jeremiah Buckley discusses evolving investment themes as the US economy begins down the path to recovery.

As the COVID-19 economy comes into focus, new investment themes are developing and a number of existing themes are accelerating.

Consumer spending, the largest component of US gross domestic product (GDP), is driving several of the themes shaping the recovery. While overall retail sales declined in the second quarter of 2020 as the economy entered recession, e-commerce spending accelerated substantially. As seen in the chart below, e-commerce retail sales grew 16.1% in the second quarter, an increase of 31.8% from the previous quarter and 44.5% from one year prior.

[caption id=”attachment_319553″ align=”alignnone” width=”800″] Source: Retail Indicators Branch, U.S. Census Bureau, Last Revised: 18 August 2020.[/caption]

Source: Retail Indicators Branch, U.S. Census Bureau, Last Revised: 18 August 2020.[/caption]

The key question going forward will be whether increased online shopping is sustained as the economy reopens. A recent survey indicated that in the US, three-quarters of consumers have tried a new shopping method since the onset of COVID-19.3 Among those consumers, 73% to 80% intend to continue their newly adopted behavior, suggesting behavior adopted now may persist after the pandemic.3

As e-commerce is primarily transacted through a credit card, the shift from cash and check to electronic payments has also quickened. We have reason to believe this shift will also be “sticky.” In its most recent quarterly earnings call, Mastercard’s president stated, “Over 70% of consumers plan to continue or increase their online purchasing and approximately 60% believe they will use less cash even after the pandemic subsides.”

The e-commerce and e-payment boom has specifically benefited companies that have invested in direct-to-consumer distribution and marketing relationships. We think there will be a winner-take-most dynamic in market share, whereby companies that have not forged these relationships will lose share to larger companies with scale that continued to invest through the downturn. We have seen this specifically in the home improvement industry. As people are increasingly working, schooling and enjoying entertainment from their homes, home improvement spending has swelled and companies able to make digital connections with their customers have been the primary beneficiaries.

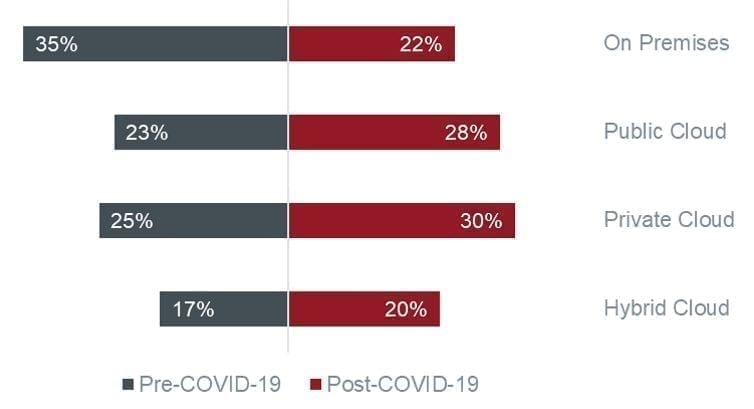

Technology companies continue to benefit from the shift to the cloud due, in part, to the flexibility that the cloud structure brings to corporate information technology (IT) budgets. Cloud-based Software as a Service (SaaS) solutions have been able to grow potential user bases due to the ease and flexibility with which they can be deployed. These technologies are aiding in the economic recovery, enabling many employees to work from home productively. A recent survey of 500 IT decision makers by LogicMonitor, an IT infrastructure monitoring platform, shows a clear increase in expected cloud utilization due to the pandemic. Nearly 90% of those surveyed believe that the pandemic will speed their migration to the cloud and only 22% think that IT resources will remain on premises by 2025.

[caption id=”attachment_319564″ align=”alignnone” width=”650″]

Source: LogicMonitor, Cloud 2025. https://www.logicmonitor.com/resource/cloud-2025, survey conducted May – June 2020.[/caption]

In the health care sector, the pandemic has highlighted the need to invest in diagnostics, treatments and vaccinations that can be brought to the market rapidly. Over the next several years, we believe the companies that have been investing in research and development will continue to benefit from these trends. We also see an ongoing recovery in elective and routine medical procedures that had previously been delayed.

Streaming, video conferencing and other transitions toward digital experiences and away from in-person experiences have driven record demand for network and data resources. As a result, we have seen opportunities in the suppliers for these trends, including equipment and hosting suppliers and cloud service providers.

We have seen several investment themes emerge and accelerate through the volatility in equity markets this year. As we progress through the ups and downs of the economic recovery, we believe it remains critical to research and identify the companies that are able to invest in these themes, widen their competitive advantages and potentially benefit. Firms with balance sheet strength and cash flow flexibility, that can survive difficult periods like we have recently seen, may present long-term opportunities for investors.

1 Estimates are adjusted for seasonal variation, but not for price changes. Total sales estimates are also adjusted for trading-day differences and moving holidays.

2 E-commerce sales are sales of goods and services where an order is placed by the buyer or price and terms of sale are negotiated over an Internet, extranet, Electronic Data Interchange (EDI) network, electronic mail, or other online system. Payment may or may not be made online.

3 Source: McKinsey & Company, COVID-19 Consumer Pulse surveys, conducted globally between June 15 and June 21, 2020.