Subscribe

Sign up for timely perspectives delivered to your inbox.

Elissa Johnson, Portfolio Manager and secured loans specialist within the Secured Credit Team, provides a brief analysis of the current state of US and European loan markets, finding that they signal different outlooks.

European loans have been held and traded by institutional investors for around 20 years. The market has grown in both size and number of participants in recent years and attracts the same counterparties one would expect to find in the bond markets.

Trading volumes are around €20bn a quarter. While the market is smaller than that of the US, we believe that market liquidity and tradability are very reasonable. The US market does benefit from a significantly higher proportion of jumbo loans (ie, greater than $1bn in size: 57% versus 42%) but as the growth of the European market has increased capacity, there are increasingly larger loans being issued in this market.

There is no denying the fact that the European loan market remains smaller than its US peers, in terms of size and number of issuers (see figure 1), but it also offers a very different composition; 77% of loan borrowers in Europe are not issuers in the US loan market. In addition, the European loan market was an early adopter of Libor floors — these remain for almost the whole of the market today. Indeed, only eight euro/sterling denominated loans do not have a floor, which provides protection against any further cuts in interest rates.

| CS LLI | CS WELLI | Non-USD WELLI | |

|---|---|---|---|

| US loans | European loans | European loans excl. USD denominated |

|

| Market value ($ billion equivalent) | 1,176 | 353 | 269 |

| Number of issues | 1,655 | 507 | 414 |

| Top 50 as % market cap | 14.9% | 31.8% | 34.3% |

| Average rating | B | B | B |

| BB (or higher) | 22.6% | 11.6% | 10.5% |

| CCC (incl split B/CCC) | 13.4% | 7.2% | 5.7% |

| 2nd lien | 3.1% | 1.4% | 1.0% |

| Average price | 92.3 | 94.1 | 94 |

| Average spread (bp) | 353 | 356.4 | 362.8 |

| 5-year discount margin (bp) | 511 | 488.3 | 492.6 |

| 12-month default rate | 3.9% | 0.9% | |

| Percentage priced at < 80 | 6.10% | 4.30% | 3.80% |

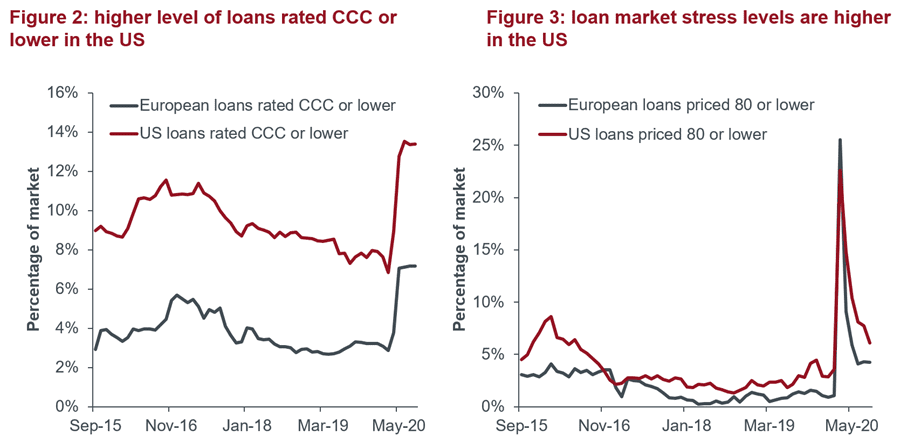

Of most interest today, in this period of uncertainty regarding future demand, unemployment and general macroeconomic conditions, is the level of distress in the two markets. The US market currently has over 13% of market value rated CCC or worse by at least one rating agency, compared with 7.2% for the European loan market and 5.7% for the non-USD European loan market (see figures 1 and 2). In addition, the level of distress in the market, defined here as the percentage of the market trading at a price of 80 or below, is also higher in the US loan market (figure 3).

European loans have been held and traded by institutional investors for around 20 years. The market has grown in both size and number of participants in recent years and attracts the same counterparties one would expect to find in the bond markets.

Trading volumes are around €20bn a quarter. While the market is smaller than that of the US, we believe that market liquidity and tradability are very reasonable. The US market does benefit from a significantly higher proportion of jumbo loans (ie, greater than $1bn in size: 57% versus 42%) but as the growth of the European market has increased capacity, there are increasingly larger loans being issued in this market.

There is no denying the fact that the European loan market remains smaller than its US peers, in terms of size and number of issuers (see figure 1), but it also offers a very different composition; 77% of loan borrowers in Europe are not issuers in the US loan market. In addition, the European loan market was an early adopter of Libor floors — these remain for almost the whole of the market today. Indeed, only eight euro/sterling denominated loans do not have a floor, which provides protection against any further cuts in interest rates.

| CS LLI | CS WELLI | Non-USD WELLI | |

|---|---|---|---|

| US loans | European loans | European loans excl. US$ denominated |

|

| Market value (US$ billion equivalent) | 1,176 | 353 | 269 |

| Number of issues | 1,655 | 507 | 414 |

| Top 50 as % market cap | 14.9% | 31.8% | 34.3% |

| Average rating | B | B | B |

| BB (or higher) | 22.6% | 11.6% | 10.5% |

| CCC (incl split B/CCC) | 13.4% | 7.2% | 5.7% |

| 2nd lien | 3.1% | 1.4% | 1.0% |

| Average price | 92.3 | 94.1 | 94 |

| Average spread (bp) | 353 | 356.4 | 362.8 |

| 5-year discount margin (bp) | 511 | 488.3 | 492.6 |

| 12-month default rate | 3.9% | 0.9% | |

| Percentage priced at < 80 | 6.10% | 4.30% | 3.80% |

Of most interest today, in this period of uncertainty regarding future demand, unemployment and general macroeconomic conditions, is the level of distress in the two markets. The US market currently has over 13% of market value rated CCC or worse by at least one rating agency, compared with 7.2% for the European loan market and 5.7% for the non-USD European loan market (see figures 1 and 2). In addition, the level of distress in the market, defined here as the percentage of the market trading at a price of 80 or below, is also higher in the US loan market (figure 3).

Source: Credit Suisse, Janus Henderson as at 31 August 2020.

Source: Credit Suisse, Janus Henderson as at 31 August 2020.While the average rating in the US loan market is single B, it also has a slightly higher proportion of second lien (second ranking) debt. Combined with the higher level of risk discussed above, it is no surprise that the US loan market yields slightly more than the European loan market. The 5-year discount margin (the spread plus discount to par, which closes over five years, ie, assuming the loan is prepaid in five years) is 5.1% in the US versus 4.9% in Europe. Note that the average margin in each market is similar, at just over 3.5%, although European loans do benefit from the zero Libor floor (which is worth approximately 40 basis points per annum based on current swap rates assuming a 5-year average life for loans).

Different levels of distress could be attributable to the sectoral differences in the market. The US market, while having a higher weighting to energy (2.8% versus 0.6%) has a lower weighting to retail (3.1% versus 5.3%) and similar exposure to gaming/leisure (5.4% versus 5.2%). Indeed, the more cyclical sectors (chemicals, manufacturing, consumer durables) have a higher weighting in the European market. This though, is offset by European loans having a higher weighting to healthcare and food compared with the US market (23.0% versus 16.8%) and, our analysis shows that on average, US healthcare loans are more volatile than those in Europe.

Idiosyncratic risk means that looking at sector performance alone does not provide an ‘apples to apples’ comparison. For example, leisure in Europe has significantly underperformed leisure in the US loan market, whereas US retail has underperformed European retail; which is no surprise, given the high profile bankruptcies in the US since the Covid crisis began.

| Sectors | European index sector weight |

European index ytd total returns ($) |

US index sector weight |

US index ytd total returns |

|---|---|---|---|---|

| Aerospace | 1.3% | -0.6% | 2.3% | -8.0% |

| Chemicals | 8.5% | -0.3% | 3.8% | 1.1% |

| Consumer durables | 0.8% | -0.9% | 0.7% | -6.1% |

| Consumer non-durables | 1.9% | -2.4% | 1.9% | -6.5% |

| Energy | 0.6% | -11.1% | 2.8% | -14.0% |

| Financial | 2.6% | 1.9% | 7.3% | 1.3% |

| Food/drug (retailers) | 0.0% | -2.7% | 0.3% | 13.6% |

| Food/tobacco (manufacturers) | 7.5% | 0.1% | 4.2% | -0.8% |

| Forest product/containers | 2.7% | 0.9% | 2.8% | 1.4% |

| Gaming/leisure | 5.2% | -6.9% | 5.4% | -4.9% |

| Healthcare | 15.5% | 0.6% | 12.6% | 1.2% |

| Housing | 3.8% | -0.2% | 2.9% | -0.4% |

| Information technology | 10.1% | 1.1% | 12.8% | 1.6% |

| Manufacturing | 4.3% | -3.0% | 4.4% | -1.3% |

| Media/telecoms | 14.5% | -2.5% | 14.3% | -2.2% |

| Metals/minerals | 0.3% | -0.1% | 0.8% | -5.4% |

| Retail | 5.3% | 1.7% | 3.1% | -6.2% |

| Service | 12.0% | -1.2% | 11.4% | -1.7% |

| Transportation | 3.3% | 0.6% | 3.4% | -1.1% |

| Utility | 0.0% | 0.0% | 2.7% | -0.9% |

Past performance is not a guide to future performance.

Leveraged loan markets on both sides of the Atlantic are actively traded and have investors who invest in both markets. Cross-border loans, those with US dollar and euro tranches, are priced at similar levels in both markets, certainly within the bid-offer spread, accounting for underlying interest rate curves, foreign currency hedging costs and trading costs (figure 5).

| Loan borrower | Margin (bp) |

Price (mid) |

Maturity | Yield to maturity |

Discount margin (bp) |

|---|---|---|---|---|---|

| EG Group – USD | 0+400 | 98.75 | Feb-25 | 4.6% | 431 |

| EG Group – EUR | 0+400 | 98.00 | Feb-25 | 4.5% | 500 |

| McAfee – USD | 0+375 | 99.625 | Sep-24 | 4.1% | 385 |

| McAfee – EUR | 0+350 | 99.75 | Sep-24 | 3.2% | 373 |

| SFR – USD | 0+275 | 96.75 | Jul-25 | 3.7% | 349 |

| SFR – EUR | 0+300 | 97.875 | Jul-25 | 3.5% | 397 |

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

As a consequence, arbitrage between the markets does not present a significant opportunity. However, each loan market offers diversification benefits and idiosyncratic risks, as well as individual technical benefits and risks such as collateralised loan obligation (CLO) arbitrage, which could influence demand and supply dynamics and the overall pricing environment.

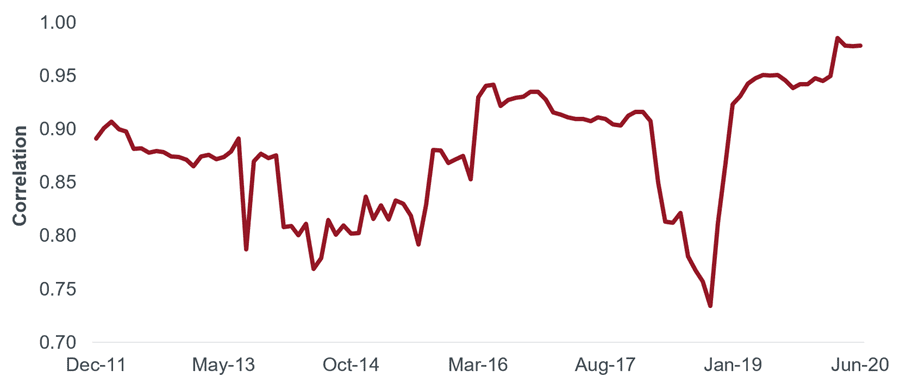

Through the pandemic, the correlation between the US and European loans markets has been extremely high. This reflects the high level of uncertainty facing all corporates and the risk to business models, no matter where the company is based. However, historically, the markets show divergence of performance suggesting a diversified loans portfolio could prove more attractive (figure 6).

Source: Credit Suisse, Janus Henderson as at 31 August 2020.

Source: Credit Suisse, Janus Henderson as at 31 August 2020.Past performance is not a guide to future performance.

Looking forward, there remains significant uncertainty given the Covid-19 pandemic. Structural shifts in demand appear to be occurring in some industries (eg, commercial office space, retail) and the consumption of leisure and services over the medium term remains unknown — will streaming change our view of cinemas and theatres forever? Will we choose different holidays? Or will a vaccine return our purchasing habits, suggesting significant value in some Covid affected loans?

However, Covid-19 also saw an unprecedented monetary and fiscal response, much of which was directly aimed at corporates and preserving jobs, thereby protecting the level of consumption demand. In addition, there is the recovery fund in Europe, which may add 5-6% of gross domestic product (GDP) to countries such as Spain and Italy.

As a consequence of this corporate and consumer income support, a V-shaped recovery from the lockdown appears to be forming. However, it is early days and with unemployment rising in many countries in the Western world it is clear that demand is likely to be lower for many businesses over the next couple of years, but not in our view, at levels that would indicate significant market distress.

In June, we wrote that default forecasts for European loans from the rating agencies and investment banks (approximately 8% and 10% respectively) were too high for 2020 given the liquidity and corporate support available in Europe, as well as the availability or revolving credit facility (RCF) and owner support (mainly from private equity). Trailing twelve-month default rates in European loans are currently just 0.9% versus over 4% in the US loan market.

Our core view centres around an elongated period over which corporate concerns may come to pass, with some companies ultimately finding their debt burdens too high for the ‘new normal’ level of demand. As the maturity profile of the predominantly covenant lite US and the European loan markets averages around 2024-25, it seems likely that we could see low defaults per annum until nearer this time. Indeed, both JP Morgan and Deutsche Bank have expressed in recent conference calls that they expect European leveraged finance to see 3-4% default rates per annum now, rather than any sharp spike.

However, that is not to say that markets would not price refinancing risk for the debt ahead of time. Clearly, they will. While we continue to see some idiosyncratic risk, which we do not think is fully reflected in loan prices, we note that many affected companies such as those in the leisure space, are already trading at distressed levels while those with limited exposure to Covid-19 continue to offer yields of 3-4% plus. Figure 7 shows a selection of yields for credits generally perceived as having limited impact from Covid-19.

| Credit | YTM % | Maturity | Mid Price | Coupon | Sub-sector |

|---|---|---|---|---|---|

| VERISURE HOLDING AB | 3.12 | 21/10/2022 | 99.75 | 3 | Commercial services |

| LOIRE FINCO LUXEMBOURG | 3.5 | 20/04/2027 | 98.5 | 3.25 | Healthcare services |

| HENSOLDT HOLDING GMBH | 3.67 | 28/02/2024 | 98.63 | 3.25 | Aerospace/defense |

| SURF HOLDINGS SARL | 3.85 | 05/03/2027 | 98 | 3.5 | Computers |

| TECHEM VERWALTUNGSGESELL | 3.07 | 15/07/2025 | 99.13 | 2.875 | Commercial services |

| JACOBS DOUWE EGBERTS INT | 2.45 | 01/11/2025 | 100.25 | 2.5 | Beverages |

| REFRESCO HOLDING BV | 3.49 | 28/03/2025 | 99 | 3.25 | Beverages |

| ZIGGO BV | 3.2 | 31/01/2029 | 98.5 | 3 | Media |

| VIRGIN MEDIA SFA FINANCE | 2.71 | 31/01/2029 | 98.38 | 2.5 | Media |

| EIRCOM FINCO SARL | 3.35 | 15/05/2026 | 99.5 | 3.25 | Telecommunications |

| ALTICE FRANCE SA | 3.58 | 31/07/2025 | 97.5 | 3 | Telecommunications |

| NOMAD FOODS EUROPE MIDCO | 2.71 | 15/05/2024 | 100.13 | 2.75 | Food |

| GAMMA INFRASTRUCTURE III | 4.47 | 09/01/2025 | 96.18 | 3.5 | Media |

| FINANCIERE MENDEL SASU | 4.67 | 12/04/2026 | 100.38 | 4.75 | Pharmaceuticals |

| MCAFEE LLC | 3.67 | 29/09/2024 | 99.38 | 3.5 | Computers |

| CERBA HEALTHCARE SASU | 3.87 | 20/04/2024 | 98.75 | 3.5 | Healthcare services |

| MARNIX SAS | 3.72 | 19/11/2026 | 98.75 | 3.5 | Computers |

| NIDDA HEALTHCARE HOLDING | 3.9 | 21/08/2026 | 97.88 | 3.5 | Pharmaceuticals |

| GREENEDEN US HOLDINGS II | 3.96 | 01/12/2023 | 98.63 | 3.5 | Software |

| OVH GROUPE SAS | 3.47 | 29/11/2026 | 98 | 3.25 | Computers |

| Average rating: B category | 3.5 | 98.81 | 3.24 |

Source: Bloomberg, Janus Henderson Investors, as at 7 September 2020.

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.Past performance is not a guide to future performance.

Looking forward, there remains significant uncertainty given the Covid-19 pandemic. Structural shifts in demand appear to be occurring in some industries (eg, commercial office space, retail) and the consumption of leisure and services over the medium term remains unknown — will streaming change our view of cinemas and theatres forever? Will we choose different holidays? Or will a vaccine return our purchasing habits, suggesting significant value in some Covid affected loans?

However, Covid-19 also saw an unprecedented monetary and fiscal response, much of which was directly aimed at corporates and preserving jobs, thereby protecting the level of consumption demand. In addition, there is the recovery fund in Europe, which may add 5-6% of gross domestic product (GDP) to countries such as Spain and Italy.

As a consequence of this corporate and consumer income support, a V-shaped recovery from the lockdown appears to be forming. However, it is early days and with unemployment rising in many countries in the Western world it is clear that demand is likely to be lower for many businesses over the next couple of years, but not in our view, at levels that would indicate significant market distress.

In June, we wrote that default forecasts for European loans from the rating agencies and investment banks (approximately 8% and 10% respectively) were too high for 2020 given the liquidity and corporate support available in Europe, as well as the availability or revolving credit facility (RCF) and owner support (mainly from private equity). Trailing twelve-month default rates in European loans are currently just 0.9% versus over 4% in the US loan market.

Our core view centres around an elongated period over which corporate concerns may come to pass, with some companies ultimately finding their debt burdens too high for the ‘new normal’ level of demand. As the maturity profile of the predominantly covenant lite US and the European loan markets averages around 2024-25, it seems likely that we could see low defaults per annum until nearer this time. Indeed, both JP Morgan and Deutsche Bank have expressed in recent conference calls that they expect European leveraged finance to see 3-4% default rates per annum now, rather than any sharp spike.

However, that is not to say that markets would not price refinancing risk for the debt ahead of time. Clearly, they will. While we continue to see some idiosyncratic risk, which we do not think is fully reflected in loan prices, we note that many affected companies such as those in the leisure space, are already trading at distressed levels while those with limited exposure to Covid-19 continue to offer yields of 3-4% plus. Figure 7 shows a selection of yields for credits generally perceived as having limited impact from Covid-19.

| Credit | YTM % | Maturity | Mid Price | Coupon | Sub-sector |

|---|---|---|---|---|---|

| VERISURE HOLDING AB | 3.12 | 21/10/2022 | 99.75 | 3 | Commercial services |

| LOIRE FINCO LUXEMBOURG | 3.5 | 20/04/2027 | 98.5 | 3.25 | Healthcare services |

| HENSOLDT HOLDING GMBH | 3.67 | 28/02/2024 | 98.63 | 3.25 | Aerospace/defense |

| SURF HOLDINGS SARL | 3.85 | 05/03/2027 | 98 | 3.5 | Computers |

| TECHEM VERWALTUNGSGESELL | 3.07 | 15/07/2025 | 99.13 | 2.875 | Commercial services |

| JACOBS DOUWE EGBERTS INT | 2.45 | 01/11/2025 | 100.25 | 2.5 | Beverages |

| REFRESCO HOLDING BV | 3.49 | 28/03/2025 | 99 | 3.25 | Beverages |

| ZIGGO BV | 3.2 | 31/01/2029 | 98.5 | 3 | Media |

| VIRGIN MEDIA SFA FINANCE | 2.71 | 31/01/2029 | 98.38 | 2.5 | Media |

| EIRCOM FINCO SARL | 3.35 | 15/05/2026 | 99.5 | 3.25 | Telecommunications |

| ALTICE FRANCE SA | 3.58 | 31/07/2025 | 97.5 | 3 | Telecommunications |

| NOMAD FOODS EUROPE MIDCO | 2.71 | 15/05/2024 | 100.13 | 2.75 | Food |

| GAMMA INFRASTRUCTURE III | 4.47 | 09/01/2025 | 96.18 | 3.5 | Media |

| FINANCIERE MENDEL SASU | 4.67 | 12/04/2026 | 100.38 | 4.75 | Pharmaceuticals |

| MCAFEE LLC | 3.67 | 29/09/2024 | 99.38 | 3.5 | Computers |

| CERBA HEALTHCARE SASU | 3.87 | 20/04/2024 | 98.75 | 3.5 | Healthcare services |

| MARNIX SAS | 3.72 | 19/11/2026 | 98.75 | 3.5 | Computers |

| NIDDA HEALTHCARE HOLDING | 3.9 | 21/08/2026 | 97.88 | 3.5 | Pharmaceuticals |

| GREENEDEN US HOLDINGS II | 3.96 | 01/12/2023 | 98.63 | 3.5 | Software |

| OVH GROUPE SAS | 3.47 | 29/11/2026 | 98 | 3.25 | Computers |

| Average rating: B category | 3.5 | 98.81 | 3.24 |

Source: Bloomberg, Janus Henderson Investors, as at 7 September 2020.

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.Past performance is not a guide to future performance.

Income is hard to find these days and the headline yield offered on loans looks attractive in a low yield world; more so, given the seemingly medium-term commitment to low interest rates by central banks such as the US Federal Reserve.

US and European loan markets price pari passu loans equivalently on a foreign currency hedged basis. We see limited upward interest rate pressure for the foreseeable future but Libor floors (prevalent in European loans) should continue to offer protection for lenders should interest rates be cut again.

The level of risk in each market is different. In this period of uncertainty we prefer a lower risk approach, seeking core income returns. For clients only exposed to the US loan market, we believe that an allocation to European loans could help reduce risk and increase diversification, while also helping to maintain income.

Note: