Knowledge. Shared Blog

September 2020

What “Equalizing” Retirement Contributions Could Mean for Investors

-

Matt Sommer, CFA, CFP®, CPWA®

Matt Sommer, CFA, CFP®, CPWA®

Sr. Managing Director

Retirement and wealth strategies expert Matt Sommer digs deeper into the Joe Biden tax plan with a synopsis of the plan’s proposal to equalize tax treatment for retirement plan contributions. In addition to outlining the key implications of the proposal, he also offers three strategies investors can consider to enhance their retirement savings and potentially reduce their tax liability – regardless of what the future holds.

Over the summer, Joe Biden introduced a proposal as part of his broader tax plan that would change the deductibility rules of retirement plan contributions. Although many investors are hearing about this proposal for the first time, the concept it is based on – known as tax equalization – is not new. In fact, the approach was floated in 2011 when the Senate Finance Committee held hearings on new approaches to retirement security.

While we cannot predict whether these policies may be implemented, investors should be aware of potential changes on the horizon and understand how this proposal – if enacted – could impact their retirement savings.

Under current law, most individual contributions to employer-sponsored retirement plans such as 401(k)s and 403(b)s, as well as traditional IRAs, are made with pre-tax dollars. An individual who earns $60,000 a year and is in the 20.5% tax bracket would receive a $205 tax deduction for every $1,000 pre-tax contribution to his or her retirement plan. However, someone who earns $600,000 and is in the 37% tax bracket would receive a $370 deduction for every $1,000 contribution. This hypothetical scenario illustrates the fact that the present system provides greater tax benefits to savers in higher-income tax brackets.

The Biden proposal seeks to equalize this treatment by eliminating tax deductible traditional contributions entirely. Instead, all individuals – regardless of income – would be entitled to a refundable tax credit (estimated to be 26%) for each dollar contributed to a plan.

A 26% credit is equal to a deduction at a 20.5% marginal tax rate. (As a reminder, credits reduce the amount of tax you owe, while a deduction lowers your taxable income). For higher-income taxpayers, the tax benefit of contributing to a retirement plan would be diminished with the proposed flat credit. For example, under the Biden proposal, individuals in the 37% marginal rate would only effectively receive a deduction at the 20.5% marginal rate, rather than the current full deduction. Of course, the proposal would benefit lower- and middle-income earners in marginal tax brackets below 20.5% and – in theory – encourage additional savings among those taxpayers.1

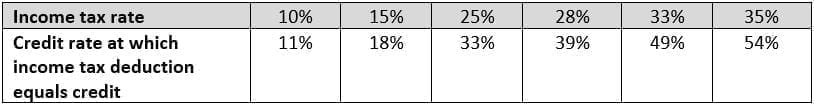

To further illustrate how the flat credit would benefit lower-income earners while reducing the benefit to higher-income earners, we can refer to a 2012 AARP Public Policy Institute paper titled “New Ways to Promote Retirement Saving.” The table below, which is taken from the paper, calculates the tax credit that would be necessary to provide the same benefit as a deduction. As you can see, the higher an individual’s income tax rate, the larger the credit required to equal a deduction. (Note: The figures in the table below are based on tax rates at the time the paper was published).

[caption id=”attachment_318564″ align=”alignnone” width=”814″] Source: AARP Public Policy Institute, October 2012.[/caption]

Source: AARP Public Policy Institute, October 2012.[/caption]

According to the nonpartisan Tax Foundation, one of the implications of equalization is that Roth savings vehicles would become more popular for higher-income investors. This is because, over the long term, the tax-free growth that is unique to Roths is likely to outweigh the reduced upfront tax benefit proposed under the Biden plan. As a result, savings could shift away from traditional retirement accounts if the equalization proposal is implemented. On the other hand, the matching tax credit would reward lower-income earners for saving more, which could help encourage these individuals to keep adding to their retirement nest eggs.2

Evergreen Retirement Savings Strategies

As I mentioned in my previous post on the Biden tax plan, while it may still be too early to make changes to your plan when we don’t yet know which proposals will be implemented (or who will win the election), there are strategies investors can consider to help maximize their retirement savings – regardless of what the future brings.

- Consider supplementing your 401(k) with a Roth IRA. I discussed this in my previous post as well. There is a common misconception that if you participate in a 401(k) through your employer, there is no need to fund any other type of savings vehicle. But as long as you don’t exceed the 2020 contributions maximum, you can mix and match your contributions to a traditional pre-tax plan and a Roth. While the Roth contributions won’t be tax deductible, the earnings still accumulate in the plan tax deferred. So regardless of how tax laws change in the future, funding a Roth IRA allows investors to capture tax-deferred growth, which can help provide diversification from a tax perspective.

- Consolidate your retirement account balances. According to the Bureau of Labor Statistics, the average person changes jobs every four years. As people move from one employer to another, they often leave multiple 401(k) balances behind. For many reasons, this is not ideal. In addition to simply being difficult to manage multiple disparate accounts, there are potential benefits to consolidating your balances into one account: You may be able to save money on fees and having more of your assets pooled together may also help you qualify for professional financial advice. Furthermore, rebalancing your portfolio tends to be simpler if you’re focused on one overall asset allocation, and it’s generally easier to remember to take required minimum distributions when you’re only dealing with one plan.

- Look into Pooled Employer Plans (PEP). This is one for small business owners to keep their eye on. The SECURE Act of 2019 introduced this new retirement vehicle, which allows two or more unrelated employers (they need not even be in the same location or industry) to participate in a single, shared 401(k) plan. By forming a larger plan with more participants, employers can get more competitive pricing and better services. It’s also worth noting that the SECURE Act eliminated the so-called “one bad apple rule” that had previously made some business owners reluctant to participate in multiple-employer plans. (Under that rule, a regulatory violation by one employer could jeopardize the entire plan’s tax-qualified status.)

I would encourage financial professionals to carefully monitor these events and be prepared to discuss their potential implications with clients. Proposals such as tax equalization may have a significant impact on today’s retirement savings system and would likely require a full review of existing financial plans. But until we know whether the proposed changes will be implemented, consider whether there are steps you can take now to enhance your retirement savings, reduce tax liabilities and be better prepared for whatever the future holds.

1Tax Foundation. “Biden’s Proposal Would Shift the Distribution of Retirement Tax Benefits.” August 26, 2020.

2Tax Foundation. “Biden’s Proposal Would Shift the Distribution of Retirement Tax Benefits.” August 26, 2020.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe