Knowledge. Shared Blog

September 2020

Abenomics: More Arrows in the Quiver?

-

Junichi Inoue

Junichi Inoue

Head of Japanese Equities | Portfolio Manager

On August 28, 2020, Japanese Prime Minister Shinzo Abe announced his resignation due to health reasons. The move also signified an end to almost eight years of “Abenomics,” economic policies based on the “three arrows” of monetary easing, fiscal stimulus and structural reforms.

In this Q&A, Junichi Inoue, Head of Japanese Equities and Portfolio Manager for the Japanese Opportunities Strategy, discusses the impact of Abenomics and the possibility of its continuation, as well as the implications of COVID-19 for Japanese stocks.

Key Takeaways

- Abenomics has benefited Japanese stocks, created jobs and resulted in a more-stable economy.

- Should Chief Cabinet Secretary Yoshihide Suga become Abe’s successor, Abenomics is likely to continue and could even be enhanced.

- In our view, valuations of Japanese equities are currently attractive, and we believe a focus on managing cyclicality and identifying unique opportunities that are less likely to be influenced by macroeconomic forces is a prudent approach.

What has been Abenomics’ impact on Japanese companies?

Abenomics began as a political accord with the Bank of Japan to ease monetary as well as fiscal policy with the aim of ending deflation and stimulating economic activity. While these efforts worked initially, it was the government’s persistence in using market forces to resolve the country’s structural issues (chronic deflation, low productivity, economic stagnation, underemployment and large government deficit) that resulted in a revival of the economy.

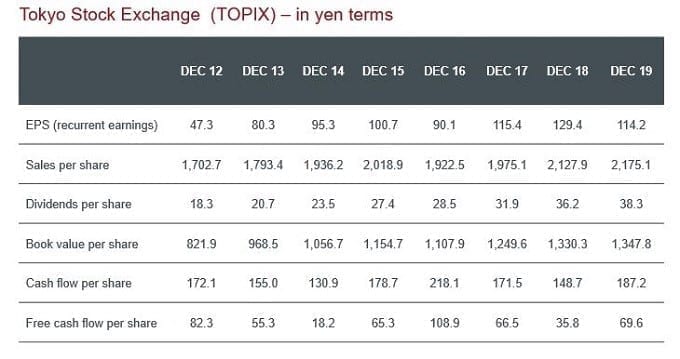

During Abe’s term, profits, as measured by earnings per share (EPS), of Tokyo Stock Exchange-listed companies more than doubled (see chart below) while the market has delivered an annualized total return in yen terms of 11% since Abe’s appointment to the end of August 2020 (a span of seven years and eight months).1

Japanese Stocks Overall have Benefited from Abenomics

[caption id=”attachment_317909″ align=”alignnone” width=”680″] Source: FactSet, Janus Henderson Investors, end of calendar year comparisons as of 31 December 2019. Shinzo Abe was appointed prime minister on 26 December 2012. Past performance is not a guide to future performance. Earnings per Share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. Book value is the total value of a business’ assets found on its balance sheet and represents the value of all assets if liquidated. Free cash flow represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.[/caption]

Source: FactSet, Janus Henderson Investors, end of calendar year comparisons as of 31 December 2019. Shinzo Abe was appointed prime minister on 26 December 2012. Past performance is not a guide to future performance. Earnings per Share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. Book value is the total value of a business’ assets found on its balance sheet and represents the value of all assets if liquidated. Free cash flow represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.[/caption]

Businesses were boosted by policy support through lower financing rates as well as more stable exchange rates. Improvements in corporate governance and capital efficiency also played a key role. Listed companies were advised to improve return-on-equity (ROE) by more than 8%, and investors to play a greater role through engagement. These policies led to higher transparency of the board, clearer business strategies, higher dividend payout ratios and share buybacks – all of which benefited investors and, in many cases, led to improved company valuations.

Abenomics has helped to create 4.5 million jobs (between 2013-2019), while a stable currency has helped improve the competitiveness of manufacturers; other sectors have also benefited, improving the stability of the economy.2

A longtime Abe aide, Chief Cabinet Secretary Yoshihide Suga, is the frontrunner to succeed as prime minister. Can we expect a continuation of Abenomics-style policies under Suga?

In our view, Suga-san will likely win the support of the Liberal Democratic Party by focusing on his support for Abe’s policies, making him the natural successor. Like Abe, he is known as being pro-market and pro-reform. If elected as prime minister, it is likely that the policies enacted in Abe’s administration will not simply continue but could be enhanced as well.

What are best-case and worst-case scenarios that may result from the PM’s resignation?

In our view, the best-case scenario is that markets will recognize that Abenomics has largely worked, and the probability of this continuing through the appointment of Suga should strengthen investor sentiment, supporting an argument for higher stocks valuations. Our worst-case scenario would be that the transition of power is interrupted by an external shock event that brings fiscal and monetary policy regime changes, although we would think this is unlikely.

Which sectors have suffered as a result of COVID-19 and which have fared better?

The market has been polarized. Travel and natural resources stocks have been hit hard. The manufacturing sector also experienced severe setbacks due to collapses in supply chains. In a tougher market environment, with a shrinking market size, weak and capital-inefficient companies could face closure. Those with strong business models with high capital efficiency are more resilient; examples include Z Holdings, an Internet service provider, and Nitori, the home fashion retailer, which both saw increased demand during the pandemic. Computer gaming, software and certain retailers have also seen their stocks gain. Those stocks that have idiosyncratic risk characteristics are capable of performing well regardless of the macro environment, an example being Daiichi Sankyo, which recently launched a blockbuster drug for breast cancer.

What do you see as a key concern for investors?

A key risk is that no COVID-19 vaccine is approved and the threat of the global pandemic continues to loom over markets. So far, the global recovery has been K-shaped, meaning an unequal rebound with some markets rising and some falling. We think investors should look for companies that are competitive, capital efficient and have the ability to create shareholder value through strong free-cash-flow generation. At the same time, it may be prudent to selectively allocate to competitive businesses that are under pressure amid the pandemic, but where risk and reward is asymmetrical. In our view, these companies are more likely to be able to deliver strong returns when the economy normalizes.

Why should investors consider Japanese stocks right now?

We think valuations of Japanese equities currently seem attractive. As long-term investors, we remain focused on managing cyclicality and identifying unique opportunities that are likely to be influenced by macroeconomic forces.

1Source: FactSet. Annualized total return in yen terms for the TOPIX between 31 December 2012 and 31 August 2020. Past performance is not a guide to future performance

2Source: e-Stat, Japan government statistics portal, as of 31 December 2019. Refers to the period from 2012 when Abe entered office to 2019.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe