Knowledge. Shared Blog

September 2020

Fall Harvest: Preparing Portfolios for the Next Season

-

Ted Thome, CFA

Ted Thome, CFA

Portfolio Manager | Research Analyst

Perkins Portfolio Manager Ted Thome discusses opportunities created by the current market and why now may be a good time for investors to position their portfolios for a changing environment.

Key Takeaways

- As we look at the current state of the market, now may be a good time for investors to evaluate their portfolios and prepare for the next season.

- Valuation and performance gaps that have arisen this year may provide opportunity in select segments of both equities and fixed income.

- In our view, defensive value dividend equities and differentiated multi-sector fixed income could both play a role in harvesting income in a potentially volatile and persistently low-rate environment.

Fall is approaching, and with it will come the season when farmers reap and protect the rewards of seeds sown over the past several months. So, too, may be the case for investors as they look to reap the rewards of what has been a bumper crop for equities. The U.S. stock market recently surpassed its all-time high despite an extremely challenging economic backdrop. Now may be a good time to harvest some of those gains and prepare for the next season.

Valuation and Performance Gaps Provide Opportunity

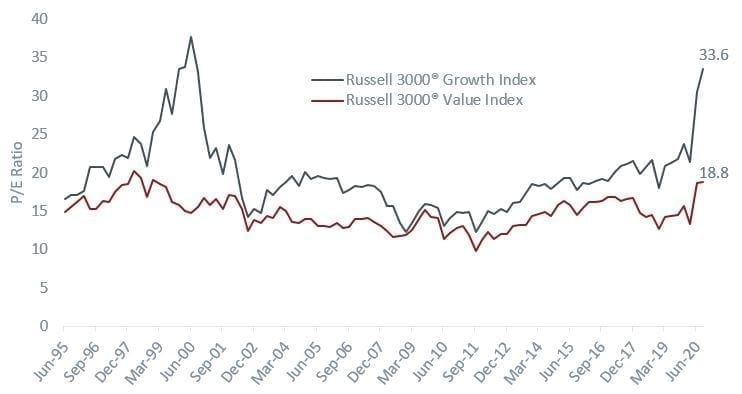

This may be especially true for growth equities, which have significantly outperformed value equities for the better part of the last 13 years. In 2020 alone, the Russell 3000® Growth Index has outperformed the Russell 3000® Value Index by a stunning 40.3% (through 9/1/20). However, while the current outperformance has been particularly persistent, value and growth investing tend to be cyclical, alternating leadership over extended periods of time. Moreover, the valuation spread between growth and value has expanded to near all-time highs, approaching levels last seen during the late ’90s tech bubble, as seen in the chart below. While this trend could certainly continue, history indicates that valuation spreads typically compress. For these reasons, it may make sense for some investors to consider a move toward value and away from growth.

Forward P/E Ratio: Russell 3000® Growth and Russell 3000® Value Indices

[caption id=”attachment_316741″ align=”alignnone” width=”742″] Source: Bloomberg. BEst P/E Ratio, blended 12 months, 6/30/95 – 9/2/20, quarterly data.[/caption]

Source: Bloomberg. BEst P/E Ratio, blended 12 months, 6/30/95 – 9/2/20, quarterly data.[/caption]

Similarly, in the bond market, the U.S. Aggregate Bond Index, which is largely composed of U.S. Treasury (UST) and investment-grade bonds and Agency Mortgage Backed Securities (MBS), has outperformed some of the lower-quality, higher-yielding areas of the market this year. The Federal Reserve’s (Fed) open market purchases of high-yield securities and its willingness to let inflation run higher than the 2% target create a potential opportunity to capture more income and relatively attractive returns in higher-yield fixed income versus the lower-yielding sectors of the bond market, due to the Aggregate Index’s longer duration and the rally in UST securities.

Income Harvesting: Preparing for the Next Season

Just as each new season brings change, the natural progression toward retirement gives rise to evolving needs and goals. Thus, now may also be a good time for those approaching or in retirement to consider positioning their portfolios to a longer-term harvesting phase by increasing allocations to income-producing investments. However, with the current ultra-low interest rate environment, finding attractive yields is not necessarily an easy task.

With global central banks expected to keep policy rates at or near zero for the foreseeable future, we believe rotating a portion of one’s portfolio into defensive value dividend equities and differentiated multi-sector fixed income could be part of the solution. With high-quality value equities, investors have the potential to collect steady and stable dividends while they wait for a possible rotation to value from growth, thereby receiving the benefits of both current income and potential capital appreciation.

In our view, defensive value equities combined with lower-risk high-yielding fixed income may be a prudent strategy for investors seeking to store gains, generate income and potentially be better protected from some of the harsher weather that could arise in the markets.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe