Subscribe

Sign up for timely perspectives delivered to your inbox.

Perkins Chief Investment Officer Greg Kolb discusses the market’s changing risk-to-reward balance and why investors should proceed with caution.

The U.S. stock market has recently surpassed its all-time high set in February amid the worst global pandemic in 100 years. So-called “blank check” companies – development stage companies with no established business plan – have raised $24 billion this year globally, already eclipsing last year’s record haul by 70%, according to Refinitiv. Meanwhile, the largest 1% of stocks make up an incredible 48% of the Nasdaq, according to Strategas.

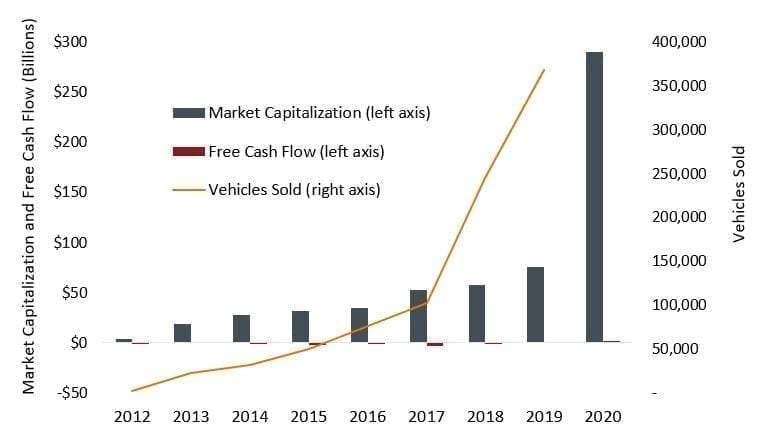

Such market extremes could be leading investors to a perilous edge. Tesla is a case in point. While there is unquestionably tremendous growth potential for electric vehicle sales in the decades ahead, the industry is extremely competitive and highly capital intensive. Thus, as Tesla’s vehicle sales have grown dramatically, the cash flows have, shall we say, not exactly kept pace. But no matter: Tesla’s stock has experienced a stunning rise, with the company now among the most richly valued (in any industry) in terms of market capitalization.

[caption id=”attachment_314469″ align=”alignnone” width=”761″] Source: Bloomberg. 2020 market capitalization and free cash flow estimate as of market close August 12, 2020. For reference, the 2019 Actual and 2020 Estimated free cash flows round to $1 billion and $2 billion, respectively.[/caption]

Source: Bloomberg. 2020 market capitalization and free cash flow estimate as of market close August 12, 2020. For reference, the 2019 Actual and 2020 Estimated free cash flows round to $1 billion and $2 billion, respectively.[/caption]

The growth/value divide, which has widened dramatically and consistently throughout 2020, is compounding the risk. The MSCI World Growth Index outperformed its value counterpart before, during and after the COVID-19 coronavirus sell-off. The result is a nearly 30% performance gap for the year-to-date through July 31, 2020. Such dramatic outperformance of growth stocks naturally leads to questions about the reward-to-risk balance looking forward from here.

The positive outlook embedded in growth stocks presents two risks: First, earnings may underwhelm. This could be a result of stay-at-home benefits for certain tech/entertainment companies proving temporary or competition/regulation heating up in unanticipated ways. Given current optimism, it may simply be that the future, while bright, isn’t bright enough to meet expectations. The second risk to consider is valuation multiples, which are high across a variety of metrics and have a long way to fall to a more normalized level. As one of Perkins’ founders likes to point out, if you are wrong twice in a stock (i.e., both the earnings and multiple move against you), you can lose a lot of money.

The long-underperforming value stocks represent another hazard in the current market. COVID-19 has had a massive impact on the general economy and high-social-contact industries in particular. Barring an unexpected medical advance, many companies will be facing weaker-than-anticipated demand for the next several years. While much cheaper than growth stocks, value equities often carry higher debt burdens (which limit staying power). Furthermore, the earnings outlook for these companies is often murky (e.g., when will travel reach 2019 levels again?) and vulnerable to any additional weakening in the economy (e.g., if recent federal fiscal stimulus payments are allowed to lapse).

Rather than focusing on the extremes, we believe the prudent approach in the current environment is to seek out more moderate stock selections. We recognize the significant disruption underway across many industries, including the remarkable competitive positions certain companies have developed. And while the most obvious beneficiaries may have been bid up too richly, we see some less-obvious winners enjoying the same tailwinds but with more reasonable valuations.

Make no mistake, the investing environment today contains many extreme elements. In our view, avoiding these sharp edges and the significant downside risk they present in favor of more moderate, yet high reward-to-risk opportunities is a sound approach.