September 2020

Bond/equity correlation: how to hedge the free lunch

-

Natasha Sibley, CFA

Natasha Sibley, CFA

Portfolio Manager

Key takeaways

- For the best part of two decades, investors have relied on the reverse correlation between equities and bonds to build natural diversification into their portfolios.

- With bonds and equities once again moving into uncertain territory, investors may want to consider alternatives to build diversification into their strategies.

- The diversified alternatives arena offers a range of tools that can help to hedge the risks of a fundamental change in the relationship between these two major asset classes, by trading the correlation parameter itself.

Diversification is the only free lunch in investing.

– Harry Markowitz

Nothing lasts for ever, whether the subject is a financial market trend or anything else. Take the Earth’s magnetic poles, as an example. Since Earth’s magnetic field is dependent on its constantly shifting core of liquid iron, its poles are in constant motion. Every 200,000 to 300,000 years or so, they switch[1]. The last such event was around 780,000 years ago, suggesting that we are now long overdue for such a change.

While this reasonably well-known phenomenon has been a favoured subject for conspiracies over the years, the simple truth is that this pattern of magnetic pole reversal has played out many times over the planet’s history. But while we may not be teetering on the brink of a dramatic B-movie end to civilisation, the topic does act as an interesting insight into other things we take for granted, specifically when it comes to our understanding of financial markets, and the relationship between equities and bonds.

For the best part of two decades now, correlation between equity markets and interest rates has been positive, influenced by changing monetary policy from the late 1980s onwards. This monetary policy can be loosely characterised as the ‘Fed put’ – i.e. when markets face a severe sell-off central banks act to buy bonds, lowering rates.

This started with then-Chair of the US Federal Reserve, Alan Greenspan, in the 1987 crash and has continued in the decades since. Over time, this relationship became ingrained in market moves, as anticipation of central bank action had the same effect as the action itself. US Treasuries are considered ‘safe haven’ assets, and when equities fall, investors rush into bonds, continuing the negative stock/bond (or positive stock/rate) correlation. This negative correlation has given investors a very valuable free lunch, when it comes to easily achievable diversification in a portfolio.

Reversals are the rule, not the exception

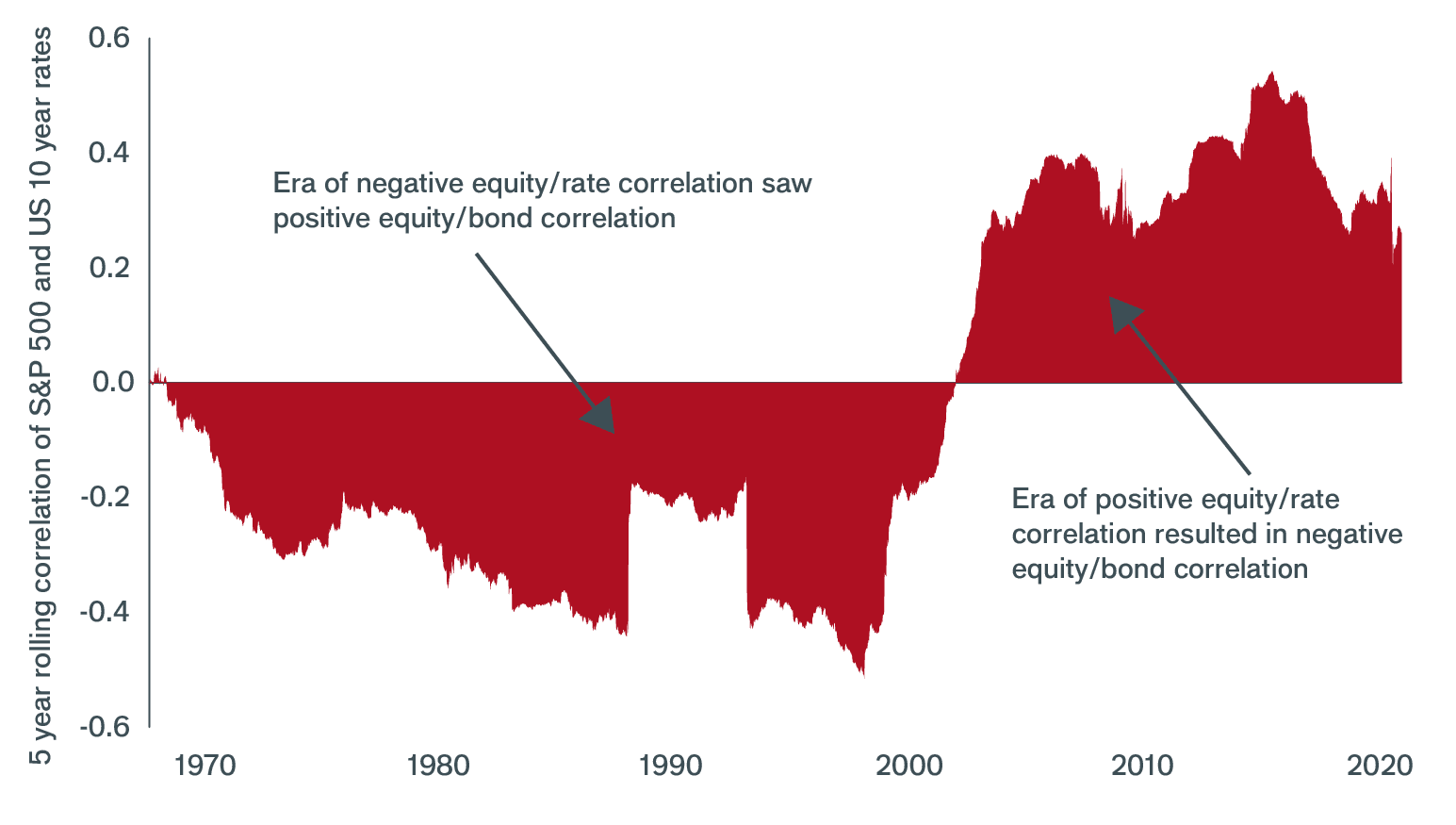

For many, a trend of such duration represents an investment lifetime – it is hard to imagine an environment where the rule of negative correlation does not hold true. However, for many decades previously, this equity/rate correlation was often significantly negative, meaning that correlations between price movements for equities and bonds were positive.

The implications of this, in terms of portfolio construction, are clear. With bond yields currently at very low levels, and the relationship between bonds and equities once again moving into uncertain territory (see exhibit 1), should investors be looking at alternative ways to build risk diversification into their portfolios?

EXHIBIT 1: ARE WE NEARING A TURNING POINT IN EQUITY / BOND PRICING CORRELATIONS?

Source: Janus Henderson Investors, Bloomberg, as at 21 August 2020. Chart shows the five-year rolling correlation of the S&P 500 Index and US 10-year rates. When negative, it implies a positive correlation between pricing movements for equities and bonds. When positive, it implies a negative correlation between these two major asset classes.

The asset pricing correlation risk

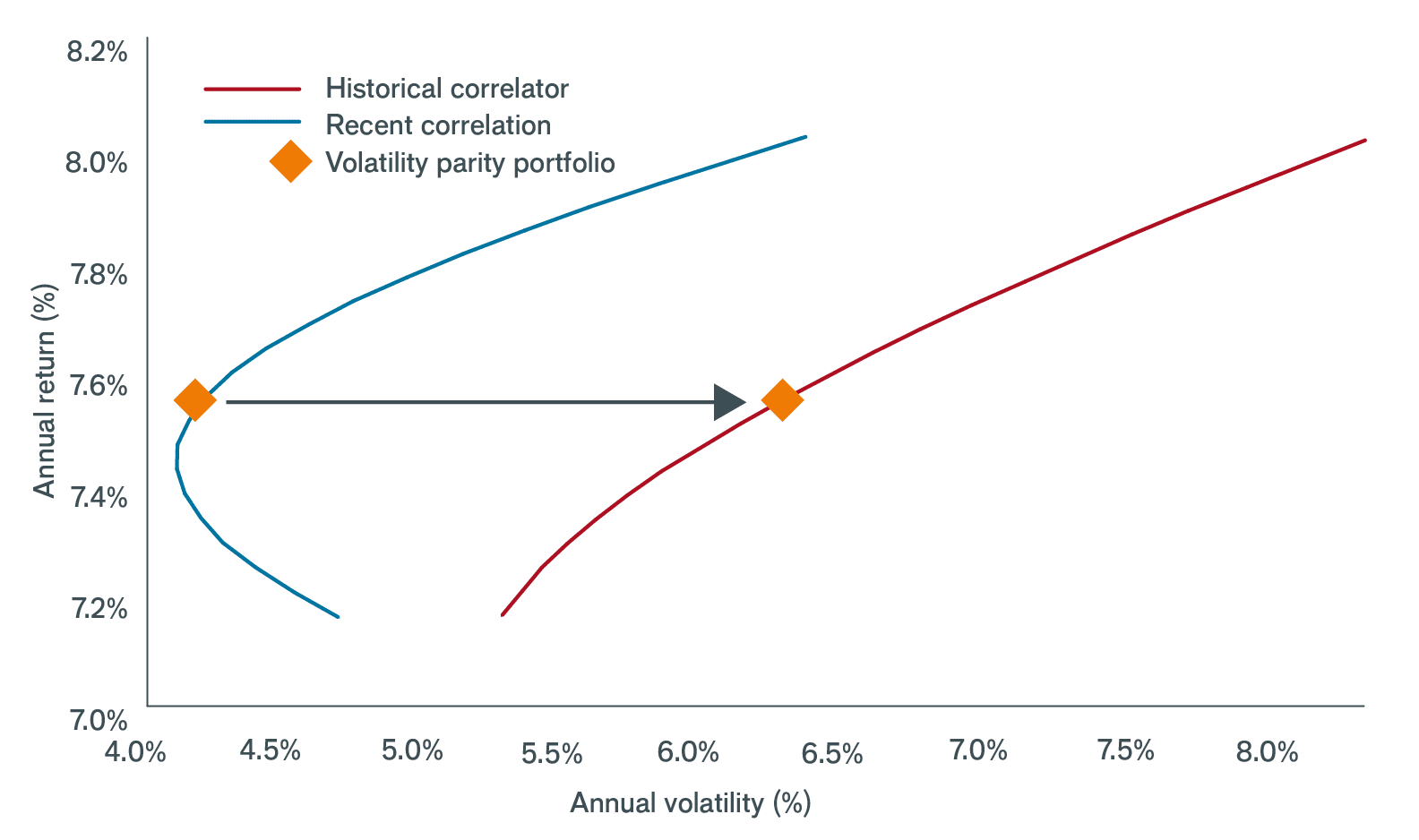

The volatility of a balanced multi asset (equities and fixed income) portfolio increases dramatically if the correlation between these primary assets moves from negative to positive, particularly for those strategies that use leverage to augment returns from fixed income (Exhibit 2). Sharpe ratios deteriorate, implying that the potential rewards no longer match the risks taken, and to maintain acceptable levels of portfolio volatility, investors are forced to de-lever, or find alternative ways to reduce risk.

EXHIBIT 2: THE EFFICIENT FRONTIER OF EQUITY AND BOND PORTFOLIOS

Source: Janus Henderson Investors, Bloomberg, as at 31 July 2020. Historical correlation: 29 April 1977 to 30 April 1997. Recent correlation: 30 April 1997 to 31 July 2020. Note: Equity and bond representations here are the S&P 500 Index and Bloomberg Barclays US Treasury Index.

In April 2020, at the height of the initial COVID-19 market collapse, correlations between the S&P 500 Index and US 10-year rates reached their lowest level since November 2001, before bouncing back. There were earlier signs of this too, back in the first quarter of 2018, when both the S&P500 and the Bloomberg Barclays US Aggregate Bond Indices fell more than 1 per cent – just the fourth time in the previous three decades[2] that this had happened. Effective diversification depends on low – or negative – correlation between investments held in a portfolio. A more fundamental shift in correlations between two primary asset classes, perhaps driven by close-to-zero interest rates (leaving little room for central banks to cut rates further), would represent a market-wide shock.

The alternatives toolbox

One way to try to protect a portfolio from this risk is to trade the correlation parameter itself. There are various ways to achieve this. Using swaps, conditional options, or a range of correlation-dependent derivatives, investors could have the opportunity to profit from a shift in the correlation regime, potentially cushioning any performance impact that such a shock might have.

Our preference from this range of tools is the correlation swap, a type of derivative that can be used to hedge the parametric risk exposure of changes in correlation. Mathematically bounded, so with a limited maximum potential loss, these securities offer a pure exposure to correlation. These securities are also sensitive to outliers, such as during Black Monday on 19 October 1987 – the biggest single-day percentage fall in the history of the Dow Jones Industrial Average – when the five-year correlation moved by almost 20 percentage points. With the prevailing positive stock/bond correlation regime, an investor could take a short position in a correlation swap, receiving the fixed, positive strike of the swap, and paying the subsequent realised correlation. This position will be profitable if stock/rate correlation drops below strike.

If diversification is the only free lunch, then investors should be wary of the risk of this benefit eroding and consider adjusting their strategy accordingly. As a broad rule, holding a portfolio of uncorrelated assets helps to reduce overall risk. If we do see a risk to the long-standing negative correlation between equities and bonds, investors may want to consider the benefits of adding alternative assets to their portfolio. Correlation trading might be one such tool to hedge against the risk of future smaller lunches.

[1] Source: National Geographic, ‘No, We’re Not All Doomed by Earth’s Magnetic Field Flip’, 31 January 2018. https://www.nationalgeographic.com/news/2018/01/earth-magnetic-field-flip-north-south-poles-science/

[2] Source: FT, ‘New Correlations Spell Concern for Bond and Equity Investors’, 1 May 2018. https://www.ft.com/content/7914a096-48a9-11e8-8ee8-cae73aab7ccb

ALTERNATIVEPERSPECTIVES Explore more

More Alternative Perspectives

PREVIOUS ARTICLE

PREVIOUS ARTICLE

The end of the free put

In this article, Portfolio Managers Aneet Chachra and Steve Cain consider to what extent the offsetting relationship between bonds and equities has held firm in 2020.

NEXT ARTICLE

Pursuing portfolio protection in a world of radical uncertainty

Should investors always be protected? If so, how can this be implemented? In this article, Portfolio Manager Mark Richardson describes the construction of a multi-faceted ‘protection’ strategy designed to mitigate a large range of unforeseeable market risks.