Knowledge. Shared Blog

September 2020

Health Care Gains an Edge

Andy Acker, CFA

Andy Acker, CFA

Global Life Sciences | Portfolio Manager

With the 2020 U.S. presidential election nearing, talk of drug pricing and health care reform is picking up. But this year, the COVID-19 pandemic has also cast the health care sector in a more positive light. In the following Q&A, Portfolio Manager Andy Acker explains how the political discourse around health care has shifted, with potential benefits for the sector.

Key Takeaways

- Health care reform continues to be a political focal point, but the COVID-19 pandemic has also underscored the importance of advanced medicine and access to care.

- Thus, while talk of drug pricing and health care reform could increase leading up to the election in November and create near-term uncertainty, we believe future policy could be more moderate than expected.

- For example, reforms that lower out-of-pocket costs for patients instead of setting drug prices could both safeguard innovation and improve access to care. In our view, such an approach could benefit consumers, as well as the sector.

Health care is typically a hot-button issue during U.S. elections, often leading to volatility for the sector. Is the same true of the 2020 election?

This year, COVID-19 and the urgent need to find treatments for the virus has helped to focus attention on the innovative prowess of the pharmaceutical and biotech industries. To that end, more than 170 vaccine candidates for the novel coronavirus are now in development, 31 of which are in clinical trials, including a handful in pivotal late-stage studies.1 Based on early positive data, we expect at least one vaccine to be approved by early 2021, with more to come in the months and years following. When you consider that vaccines have historically taken over 10 years to develop – and COVID-19 surfaced little more than eight months ago – this pace of progress has been astonishing.

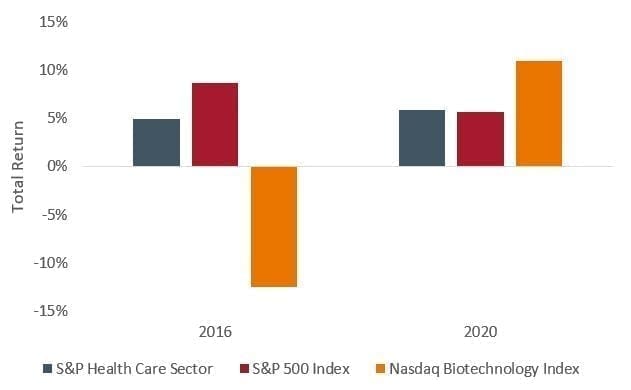

So, while health care remains a key campaign issue, sentiment toward the sector has improved. In turn, health care stocks, particularly biotech shares, have benefited. For the year through mid-August, the Nasdaq Biotechnology Index delivered gains of 11%, nearly double the return of the S&P 500® Index. By comparison, for the same period during the 2016 presidential election, biotech declined 12.5%, while the S&P 500 gained 8.6% (see chart).

Election Years: Health Care Stock Performance

[caption id=”attachment_315038″ align=”alignnone” width=”631″] Source: Bloomberg, data from 12/31/15—8/15/16 and 12/31/19—8/14/20. S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance. The S&P 500® Health Care Sector comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector. The Nasdaq Biotechnology Index contains securities of Nasdaq-listed companies classified according to the Industry Classification Benchmark as either Biotechnology or Pharmaceuticals which also meet other eligibility criteria.[/caption]

Source: Bloomberg, data from 12/31/15—8/15/16 and 12/31/19—8/14/20. S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance. The S&P 500® Health Care Sector comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector. The Nasdaq Biotechnology Index contains securities of Nasdaq-listed companies classified according to the Industry Classification Benchmark as either Biotechnology or Pharmaceuticals which also meet other eligibility criteria.[/caption]

Does that mean the political overhang for health care is gone?

Not quite. President Trump began his presidency with a promise to lower drug prices. In July, with the election looming, Trump signed four executive orders aimed at prescription drug costs. These orders include allowing medicines to be imported to the U.S. from Canada and linking certain Medicare drug prices to those charged in other countries. The Trump administration also joined a Supreme Court case brought by Texas and other states to invalidate the Affordable Care Act (ACA), the decade-old legislation that expanded health care access in the U.S. Meanwhile, Democratic nominee Joe Biden supports expanding the ACA and says that as president, he would seek to curb annual drug price increases and the launch price of novel drugs. In short, health care remains a political focal point.

But there’s usually a wide gap between what politicians say and what becomes policy. For one, it’s been widely reported that the president does not have authority to fully enact his proposals, and the pharmaceutical industry declined an invitation to discuss Trump’s policies. In our view, the executive orders are more political theater than real policy initiatives.

The fate of the ACA is harder to forecast, but the Supreme Court has ruled against two previous challenges to the law, with the same five justices who made those decisions still sitting on the bench. Furthermore, Republicans have not crafted alternative legislation for the ACA, and the optics of eliminating health care coverage for 20 million Americans during a global pandemic would be disastrous.

What would happen if the Democrats win the White House, along with a majority in the Senate and the House?

If the Democrats sweep the election, Biden could still face an uphill battle to pass his most drastic proposal: rolling out a government-run “public option.” Although the plan would be in addition to (not in place of) private insurance, there would be many details to work out, including whether managed care companies could have a role, as they do for managed Medicare and Medicaid programs.

Furthermore, the government’s ability to push reimbursement rates significantly lower could be limited by the tenuous financial state of many not-for-profit hospitals. Too much pressure could lead to hospital bankruptcies, which could create access issues for many Americans.

Even with a Democratic sweep, the Senate would likely be evenly split, and passing controversial future legislation could require changing Senate voting rules, replacing the 60-vote threshold now required to end a debate with a simple 51 majority – with serious long-term implications for governing. In our view, Biden would have an easier time getting more incremental measures achieved, such as expanding Medicaid and making the ACA’s tax credits more generous.

As for drug pricing, we believe the pandemic has given pharma some more bargaining power. Thus, while campaign pledges might sound extreme, in practice we believe a Biden administration could seek a middle ground that targets what we view as the real issue: rising out-of-pocket costs. In fact, a recent study by the IQVIA Institute for Human Data Science found that while list price growth of pharmaceuticals was 5.2% in 2019, net price growth, which accounts for discounts and other price concessions, was only 1.7%.2 The problem is patients don’t often see the benefit of these discounts – the savings tend to get pocketed by plan intermediaries – and co-pays and deductibles are climbing. In our opinion, this needs to change.

What if neither party gets a majority?

If we get the status quo, then it’s likely not much alters in the near term. So far, President Trump has been unsuccessful in achieving health care reform, even when Republicans controlled Congress. We see little evidence of the task getting easier, particularly without a governing majority. If Biden wins and Republicans keep control of the Senate, we could see modest measures, such as restoring funding for ACA programs cut under the Trump administration.

Should health care investors brace for volatility in the coming months?

We believe health care stocks could experience volatility in the near term. This fall, late-stage trials for COVID-19 vaccines will start to deliver data, and the results could have a significant impact on stocks. The market also typically trades on fear of health care reform long before any details are decided. The U.S. health care system is complex, and final legislation can vary widely from what’s initially proposed. In the end, we believe neither Republicans nor Democrats want to undermine pharmaceutical innovation. We are optimistic that we could get to a solution that will ultimately limit out-of-pocket costs, improve access to medicines, and benefit the country and the industry in the long run.

1World Health Organization, as of 8/25/20.

2“Medicine Spending and Affordability in the United States,” IQVIA Institute for Human Data Science, August 2020.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox